It seems like every day, there is some Talking Head getting on the MainStreamMegaphone to announce that Bitcoin is in a bubble (Ray Dalio), or in the case of Jamie Dimon, that Bitcoin is a fraud. My personal opinion is that Bitcoin in not in a bubble, not by a long shot, for the reasons I’ll get into below.

But first, what constitutes a financial bubble? According to Investopedia:

"A bubble is an economic cycle characterized by rapid escalation of asset prices followed by a contraction. It is created by a surge in asset prices unwarranted by the fundamentals of the asset and driven by exuberant market behavior. When no more investors are willing to buy at the elevated price, a massive selloff occurs, causing the bubble to deflate.”

Based on this definition, the 3 Key Elements of a bubble are:

- Rapid escalation of asset prices followed by a contraction, and

- The price surge is unwarranted by the fundamentals, and

- No more investors are willing to buy at the elevated price, which leads to a crash.

So let’s take these one at a time.

HAS THE PRICE OF BITCOIN RAPIDLY ESCALATED?

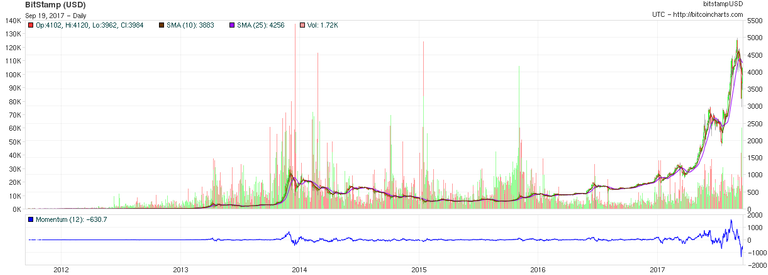

To answer this question, let’s look at a long term BTC price chart.

In this 8-Year chart, we can see that Bitcoin has experienced a rapid price escalation in 2017. Now look at the price rise in 2014, at that time, that rise was very steep and quick, and given it low grinding price that followed 2014 for 3 years, the rise in 2014 was bubbly. In 2014, there were about 12 million Bitcoins and probably not that many users, but the rise was steep. In comparison to the rise in 2017, the rise in 2014 is but a blip on the radar. Does the rapid rise of BTC in 2017 mean there is a bubble right here right now? Only time will tell; however, the user base of Bitcoin is leaving the gradually-sloping foothills and, IMHO, will be approaching a much steeper part of the user base growth curve, and we’ll visit this again in more detail. This leads us to the next Key Element of a bubble.

IS THE PRICE SURGE UNWARRANTED?

Several factors that come to mind that contribute to a rising price include:

- Speculation and Growth

- Value transfer

- Convenience

- Desire to escape the ever inflating fiat currency system (Gresham’s Law)

Speculation and Growth. I admit, I am guilty of this, and I presume that many other Bitcoiners are as well. The question of whether the speculation has run its course is answered below in the next section, but suffice it to say, the supply demand fundamentals point to much higher future prices, IMHO.

Value Transfer. Bitcoin has been a value transfer vehicle for capital flight from countries with capital controls, and probably will continue to serve this function. China, until their announced prohibition of ICOs seemed to be responsible for a fair chunk of the rise. But more recently, China’s announcement for the complete closure of BTC exchanges have had little noticeable adverse effect on the price of BTC. In addition, BTC in Zimabawe has recently been selling for $7200 USD do to their Country’s rampant printing. I tend to think that most of the BTC adopters thus far are generally from developed countries; although BTC adoption in emerging market countries will probably accelerate in the not too distant future due to a general SNAFU and FUBAR state of their respective monetary systems (Venezuela?). In looking at the relatively low transaction costs for Bitcoin, I imaging that the remittance market will begin a shift and companies that handle wire transfers will increasingly feel the pain of displacement (adios Western Union). In addition, transaction fees that are less than Visa/MC/Amex/Paypal, etc. means future BTC growth, so the market for using Bitcoin to transfer value seems wide open.

Convenience. Convenience of use is a function of the user base, the more people that use Bitcoin, the more convenient it is to use. I would say that right now, Bitcoin transfers are not yet convenient due to limited depth of acceptance by businesses and individuals. However, the potential convenience market is huge. For example, folks that need to regularly send money, can do so anywhere in the world using a universally accepted unit that doesn’t need to go through a currency exchange process, with the click of a mouse or a press of a virtual button on a smart phone. Granted, there is a learning curve with the wallets, exchanges and security protocols, but as with everything, that will get better in the future as the user base increases.

Fiat Inflation and Gresham’s Law. Let’s face it, in a world where fractional reserve systems across the major financial powers result in the creation of vast quantities of debt-based fiat by central banks, even to the point of negative interest rates (talk about FUBAR), the debasement of fiat currencies is at hand and seems to be along a steep part of the debasement curve. That’s not to say the debasement can’t get worse, it probably will, especially when some systemic event requires another major conjuring session. So what is Gresham’s Law? It is a monetary principle stating that "bad money drives out good." In this context, a debased currency is considered “bad” money, and a currency that holds its value or increases in value is considered “good” money. In a practical sense, people keep or save the good money, and spend the bad money. The rise in the price of Bitcoin could be a reflection, at some level, of Gresham’s Law in that people are spending their bad money (debased fiat) to obtain good money (bitcoin). Historically, Gold and silver were the desired good money; however, in this day and age of fractional reserve precious metals (COMEX and LBMA) whose contract quantities can be exponentially increased at the click of a button, other non-fractional assets such as Bitcoin are proving to be the Go-To “good” money.

So, has the Bitcoin price rise been unwarranted? Hmmm….let’s see…

- Is there still potential for speculation and further price growth? YES.

- Does Bitcoin offer value transfer utility and will it continue to do so at higher prices? YES.

- Is Bitcoin convenient to use and will its user base increase over time? NOT QUITE YET & YES.

- Will Central Banks & Nations across the Globe continue to debase their fiat currencies? YES.

Based on the answers to the 4 bulleted Q’s above, it does not appear that the price rise of Bitcoin has been “unwarranted.”

ARE THERE MORE INVESTORS WILLING TO BUY BITCOIN AT HIGHER PRICES?

This is a hard question to answer accurately, as who really knows? John Maynard Keynes said “Markets can remain irrational for longer than you can remain solvent." But what can we consider in trying to answer this question? How about supply and demand?

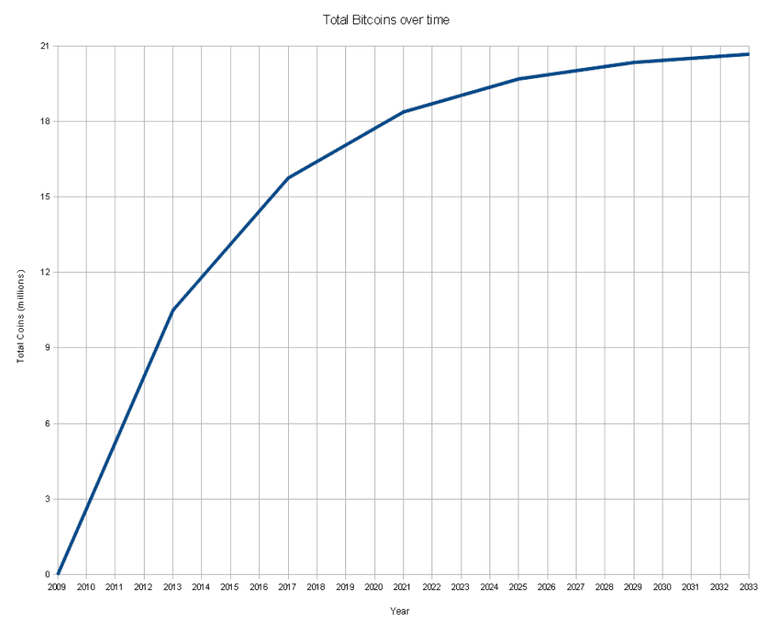

What is the supply of Bitcoins? We can see in the chart below that the number of Bitcoins is capped at 21 million, and that in 2017, the current number is over 16 million. We can also see that the rate of Bitcoin creation will be slowing down in the future and the slope will flatten considerably. As described in the Bitcoin wiki, starting in 2009, the Bitcoin supply is created at a rate of approximately 50 bitcoins every 10 minutes. Every 210,000 generations (about every four years), the creation rate is cut in half (i.e. 50, 25, 12.5, 6.25, etc.) and tends to zero, such that there will never be more than 21 million total coins created.

So what about demand? There is no way to accurately calculate the demand, but we can use logic to get a sense of whether demand is increasing. In the beginning, Bitcoin was dirt cheap (less than $1), and only the lucky innovating fringe had bought in. Clif High was an early adopter and promoter of Bitcoin, and has been following and evaluating Bitcoin ever since. He estimates that less than 3% of the global population is a Bitcoin user. Clif also points out that once 3% acceptance is reached, it quickly moves to 10%, and then all hell breaks loose. With 7.4 billion people in the world today, 3% seems high to me, as it would mean that means that 222 Million people are Bitcoin purchasers, and I don’t get the sense that there are currently this many BTC users.

Clif High Interview (about the 20+ minute mark).

Doug Casey, a widely known hard asset guy, estimates that there are 25 million Bitcoin users in the World today (Doug Casey Interview, time=10:45). 25 Million users represents 0.33% of the current global population of 7.4 billion.

Using a percentage somewhere between Clif High’s and Doug Casey’s BTC user percentages means that the current Bitcoin user base is between 25 and 220 million people holding approximately 16 million Bitcoins. At a 10% acceptance level, there would be 740 million people vying for up to 21 million Bitcoins. At a 20% acceptance level, there would be 1,500 million people demanding 21 million Bitcoins. Is there room for demand growth for Bitcoin at prices that are higher than today’s prices? The supply demand fundamentals points to YES.

CONCLUSIONS

Is Bitcoin in a bubble? Although today’s price is elevated relative to its past prices, that in itself does not define a bubble. The price increases could have just been a result of demand that reached a steeper part of the growth curve. Bitcoin is not too widely held, and has a long long way to go up the curve before it is even moderately held. Demand should continue to grow due to its utility, transactional convenience, and limited supply. Because of these factors, I have concluded that Bitcoin is not in a bubble at this time.

However, if you are of the opinion that Bitcoin is indeed in a bubble, please post your reasons...I would like to understand them.

I largely agree with you @metalbone - I don't think that bitcoin is a bubble in the traditional sense, I think the only thing that will bring about it's downfall is if there are huge advances in competition from other cryptocurrencies...

I still think that Bitcoin is leading the race by some way.

Good post - upvoted.

Be sure to check out my post about Jordan Belfort's comments that is about to go live.

Alex

I agree, all the new Crypto's can muddy the water, however, there are a lot that will never gain traction...in the same way that crappy currencies like the Zim Dollar and Venezuelan whatever are being rejected by their own people. Anything that results in volatility on the way up such as other cryptos just means that increasing your number of BTC and ETH via trading is easier. I read about Jordan's comments...funny how these guys think that only govt-backed fiat (full faith and credit decree) can be a currency...never mind that gold as a currency has been co-opted by govts throughout history and that they add Gold-colored ink to their pretty paper to try to maintain the public's confidence in their fiat. But alas, this is the system we reside within...

Congratulations @metalbone! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP