Bitcoin burst into our financial consciousness like a fiery comet, setting the internet ablaze with visions of upending the existing global money system. Yet, by its nature as a cybercurrency, whose legitimacy only exists in the ether, its credibility leaves much room for debate.

HowMuch.net on Wednesday put things into perspective and demonstrated that for all the buzz and excitement bitcoin has generated, it still has a long way to go to be even remotely relevant.

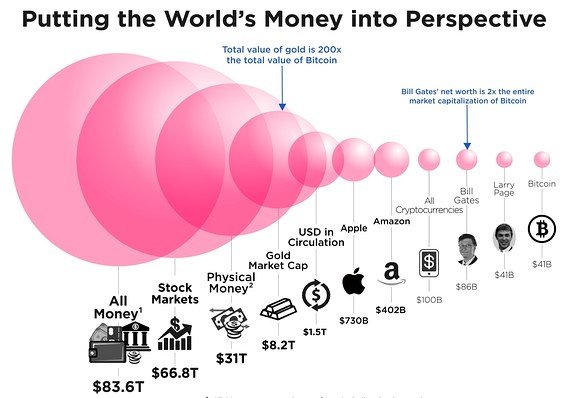

The current value of all the bitcoin BTCUSD+1.63% in the world is worth about $41 billion, according to the cost-estimating website.

That is undoubtedly more money than most Americans will ever see in their lifetime. But when it comes to bragging rights, bitcoin really is the poor relation.

As the HowMuch chart shows, the fattest bubble is for all the money in the world — including bank deposits — which comes out to $83.6 trillion.

The second biggest is for all the stocks trading across the globe, totaling $66.8 trillion, and more than double all the physical money in the world.

“A run towards or away from stocks would thoroughly deregulate the global economy, and nothing more dramatic than a minus sign in front of that amount would lead to the collapse of global civilization,” said Raul Amoros at HowMuch.net.

For all its glitter, the total value of gold is a distant fourth, at only about $8.2 trillion, while U.S. dollars in circulation add up to $1.5 trillion.

The next bubble is for Apple Inc. AAPL-0.16% valued at about $730 billion, followed by Amazon.com Inc. AMZN-0.09% at $402 billion.

Meanwhile, the value of all the cryptocurrencies in existence, such as Litecoin and Monero, checks in at $100 billion, slightly ahead of Bill Gates MSFT-0.01% who claims a net worth of $86 billion as the richest man in the world.

Larry Page, co-founder of tech giant Google GOOGL-0.2% and the 12th-richest on Forbes’ billionaires list, alone is worth all the bitcoin floating around in cyberspace, with a net worth of $41 billion.

Money is about trust. Hence, the U.S. dollar DXY0% as the monetary representation of the biggest economy in the world, is also the reserve currency of choice for many foreign governments.

As of yet, bitcoin does not command that level of respect given its wild swings recently. Nonetheless, the rise of cryptocurrencies in of itself suggests that people may be slowly losing faith in money and other traditional measures of wealth, according to Amoros.

Perfectly!

Good perspective and it really helped me understand and visualize. When you show the gold market cap is that paper/futures included or is that physical gold? Because if is not only physical and the physical gold market is smaller that actually then leads me to believe bitcoin is way under valued.

Wow this was a very interesting read, thanks for sharing :)

Why is Apple a bubble?