Here are ten awesome Bitcoin facts, success or disasters that you may not be aware of, enjoy!

Bitcoin Studies

You suddenly wish you could go back to university, but you only have bitcoins left because of your forward-thinking state of mind? Do not panic: you are now able to pay your tuition fees with Bitcoins for the famous New-Yorker university of The King’s College!

However, if you are not living on the American soil, be aware that it exists the same kind of initiative, for example by the University of Cumbria in the United Kingdom, or also by the University of Nicosia, in Cyprus. The latter also features a degree in « Digital Currencies » for its student that highlights Bitcoin.

Bitcoin Boulevard

Are you visiting the Netherlands? Do not miss the Bitcoin Boulevard located in the Hague, which offers a unique feature: A high majority of shopkeepers who are located on the two streets that go alongside the channel – Bierkade and Groenewegje – now accept Bitcoin, following an initiative submitted by Hendrik Jan Hilbolling and Peter Klasen.

You can therefore have dinner in one of the nine restaurants that participate to the operation, or you can go shopping in the art gallery also located there, thanks to your favorite cryptocurrency. Some other streets seem to follow the same move, in particular in the United States: for example, the North-American Bitcoin Boulevard located in Cleveland Heights, in Ohio.

The first transaction

Bitcoin has enabled 43 472 379 transactions since its creation through its network. However, you will be certainly interested by knowing who initiated the first transaction.

It is no one else but Satoshi Nakamoto, the fantastic Bitcoin and underlying technology creator, who sent 100 bitcoins to Hal Finney on January 12th, 2009.

Hal Finney has been involved for a long time in the cryptography community. For years, he has been working with PGP Corporation, developing one of the most famous encryption system (The company was holding the rights for the PGP system, developed at the origin by Phil Zimmermann). He launched then the first anonymous remailer used to encode his emails, and was also implicated in the cypher-punks’ movement.

On a Bitcointalks post, Hal explained how it happened:

When Satoshi announced the first release of the software, I grabbed it right away. I think I was the first person besides Satoshi to run Bitcoin [client]. I mined block 70-something, and I was the recipient of the first Bitcoin transaction, when Satoshi sent ten coins to me as a test. I carried on an email conversation with Satoshi over the next few days, mostly me reporting bugs and him fixing them.

After a few days, Bitcoin [client] was running pretty stably, so I left it running. Those were the days when difficulty was 1, and you could find blocks with a CPU, not even a GPU. I mined several blocks over the next days. But I turned it off because it made my computer run hot, and the fan noise bothered me. In retrospect, I wish I had kept it up longer, but on the other hand I was extraordinarily lucky to be there, at the beginning. It’s one of those glass half full half empty things.

The million dollar Bitcoin pizza

On May 22nd, 2010, a Bitcoiner named Laszlo Hanyecz paid to a Bitcointalks forum user not less than 10 000 BTC for two Papa John’s pizzas. What can be considered as an incredible amount (5 619 700$ worth of BTC nowadays) was equivalent to 30$, according to the exchange rate applied at this time, estimated to 0,003 cents per Bitcoin. Mr. Hanyecz said he had acquired these bitcoins by mining on his computer.

“It wasn’t like bitcoins had any value back then, so the idea of trading them for pizza was incredibly cool,” said Mr. Hanyecz. But when asked about the current value of the cryptocurrency, he adds: “No one knew it was going to get so big.”

Questioned about possible regrets, he adds:

“No, not really,” Mr. Hanyecz said. Then he sold his bitcoins when the price was around 1$, getting 4000$ “That was enough to get a new computer and a couple of new video cards, so I’d say I ended up on top.”

A Bitcoin master swindle

On November 4th, 2011, a BitcoinTalks forum user named pirateat40 has announced the creation of a Bitcoin investment fund, promising to the investors a return on investment of 7% per week.

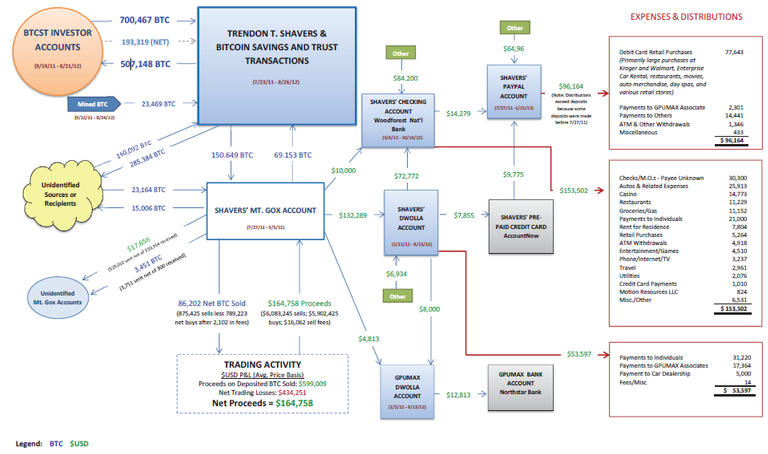

Despite numerous suspicious elements and ridiculous incentives to invest such as “It’s growing, it’s growing!”, “I have yet to come close to taking a loss on any deal,” and even “risk is almost 0”, the fund encountered a fast and great success: according to the SEC report, more than 700 467 BTC, the equivalent of 411,7 million dollars, have been collected by Trendon Shavers, a.k.a pirateat40.

Here is an infographic explaining the whole swindle scheme

More Bitcoin users in Poland than in France

While France is way ahead in terms of GDP (2,737,361 Millions of USD, FMI, 2013) at the 5th position, and Poland is at the 22nd position (516,128 Millions of USD, FMI, 2013), it seems that there are more Bitcoin users in Poland than in France!

This is the stunning fact that the download statistics of the most-downloaded Bitcoin client (Bitcoin-Core, totalizing 5M+ downloads) seem to indicate since January 2009: it has been downloaded 124,748 times by users having an IP located in Poland since January 2009, against 106,780 in France.

A first sketch of the explanation can be found in the progressive state of mind adopted by the Polish government:

Everything that is not forbidden is allowed. However, in light of EU legislation, we can’t recognize Bitcoin as legal tender or electronic money. Bitcoin capital gains are taxed as ordinary income. […] We don’t stand in the way of bitcoin’s development, but we need a declaration from its users whether they expect any regulations to be introduced or rather prefer the government to stand aside.

Krzysztof Piech, Ph.D. from Warsaw School of Economics, said that Poland is in the top 10 in the number of bitcoins mined, and Polish bitcoin trading volume is one of the biggest in the world. He also emphasized bitcoin’s potential for the Polish economy.

However, to reassure our French readers, we want to add that in terms of Bitcoin nodes, one has to admit that France keeps a clear advantage.

64% is the estimated part of present « ghost » Bitcoins on the Blockchain

..According to a study made by the California University

The history of Bitcoin is regularly studded by stories of users who have lost their private keys and who are not still able to use their bitcoins. See two examples of bitcoins who have not been spent for a very (very!) long while:

• 1FeexV6bAHb8ybZjqQMjJrcCrHGW9sb6uF : 75,957 bitcoins which have never been spent. Address created on March 1st 2011.

• 12tkqA9xSoowkzoERHMWNKsTey55YEBqkv : 28,150 bitcoins which have never been spent. Address created on April 5th, 2010.

The computing power of the Bitcoin network is 7468 times higher than the one of the cumulative 500 world supercomputers

Indeed, the computing power of the whole Bitcoin network is estimated to 2 046 364 Pflop/s, against 274 Pflop/s for the cumulative 500 most powerful world supercomputers.

First of all, it is important to note that Bitcoin miners are not performing any floating point operations (FLOP) but only integer calculus. How have we then been able to proceed? It’s very easy, in fact:

1 hash = 6.35K integer operations

1 integer operation = 2 floating point operations

1 hash = 12.7K floating point operations

Then, using this rate of one hash = 12,7K flop, and by analyzing the current hashrate of the Bitcoin network which peaks to 161 131 086 gh/s on July 31st 2014, we get an estimation of 10^9*161131086 H/s * 12700 = 2 046 364,7922 Petaflops.

So much computing power that could have been possibly used in modelization purposes, for medicine, astronomy, physics. Damn bitcoiners!

The largest transaction ever made on the network: 194 993 BTC

https://blockchain.info/tx/1c12443203a48f42cdf7b1acee5b4b1c1fedc144cb909a3bf5edbffafb0cd204

It represents more than 114 million of dollars, according to the effective rate on 07/31/2014. « A shitload of money » is the comment submitted by the recipient of the funds about the transaction. We can only agree!

Some reddit users, such as gen_gen, had fun by trying to identify the author of this colossal transaction :

Interesting findings:

Going further down the tree from that tx shows that these two addresses are extremely likely Bitstamp cold wallets:

17ewBhK712mY2E4uPAbinThibdY2LRyabd (85,993 btc)

1DKH2oZtrcAAoZXsNJQnKBwKYaYdx5KrVV (39,200 btc)

Also based on https://blockchain.info/tx/5d8a61b66c003743ba782b0b3931a782d8e0f1cdd8e4c2551faf15fc9334bdb5, it looks like 1Drt3c8pSdrkyjuBiwVcSSixZwQtMZ3Tew is a Bitstamp hot wallet.

And gen_gen was right!

Bitcoin’s Tiger Woods

In October 2009, so more than 10 months after the launch of the cryptocurrency, the bitcoins was traded at an extremely competitive rate: 1$ for 1,309BTC which is equivalent to less than 0,00076$ per Bitcoin.

Assuming you had spent 308 dollars in order to acquire your first 403,712 bitcoins, and that you would have sold them in December 2013 at the famous peak of $1240 / BTC, you would have a fortune of $501,556,440, which is the personal wealth of Tiger Woods added of one million of dollars ($500 000 000)!

Not a golf fan? No problem, let’s focus on soccer. You would have had to spend 80$ in bitcoins (104,720 BTC) in order to overtake the fortune of the international star Christiano Ronaldo, namely $130 000 000.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.cryptocoinsnews.com/top-10-awesome-facts-bitcoin/