Over the past several weeks it seems that the anti-cryptocurrency rhetoric being unleashed on the uninformed has hit a fever pitch.

When Bitcoin broke $2700 and then pulled back around $300, there was talk all over the place about how the Bitcoin bubble had burst, what total nonsense. In fact I said publicly that any pullback in Bitcoin should be used as a buying opportunity.

At the time I am writing this article, Bitcoin is now nearing $2600 again, and I have no doubt whatsoever that it is going much much higher, (along with many other cryptocurrencies including Steem)

What we have seen, and a trend that will remain in my opinion, is a loss in the value and thus purchasing power of the US dollar, but the anti-cryptocurrency crowd seems to be oblivious to this.

Another way to look at the anti-cryptocurrency crowd is this: there always has to be two sides of a trade, one will lose and one will win. I have no doubt whatsoever that those of us who recognize what I feel is unprecedented opportunity with regard to holding and owning cryptocurrency will not only win, but will win big time.

Gregory Mannarino

Jump on the Steem Train!!! Steem headed to $2!!! @marketreport

It will be over 1000$ in 2020

For that to be true steemit's market cap would have to be 234 billion... or BTC would have to be really up there itself and/or by the USD having lost much of its value. But I'd love to see $1000 steem :P

I'd love to see it but I think that's highly unlikely. I'd be happy with $10 a token in 2020.

Yeah! maybe!

Oh my, I'm starting to feel giddy!

Totally agree! IMO, there are not a lot of great places for people to park their money anymore.. with the exception of metals, cryptos. Especially when the Index bubble finally pops

More and more these days what is driving my investment decisions is third party risk. Physical metals and cryptos held off-exchange are the only two that I've found that meet this criteria. I thought about real estate, but with property taxes, liability issues, mortgage market manipulation, and the need to get a 3rd party tenant, I've decided there's too much risk there. I agree with you, metals and cryptos are where to park your money.

Smart thinking. I used to think RE was the place to be but property taxes are the razors edge for me.

Real Estate is problematic. Foreign investors have seriously impacted the price in a lot of the major markets helping those areas re-bubble. Also the goverment is having money problems an increase in property taxes is not completely out of the question. Crypto and precious metals (metals depending on quantity) can be moved where as real estate cannot. So crypto and precious metals is probably where to go now.

Also precious metals mining companies... The profit made from the increase in price of metals will increase yet mining costs will remain same... $$$$

The thing about Bitcoin is that with no derivative market, no way to short or trade HFT it is very hard for the mainstream to manipulate Bitcoin's price. Bitcoin is trading in a real market meaning fear and greed are the real drivers. As Greg said, the trend is up.

Is it physically impossible to have a derivatives market because of the way Bitcoin is designed, or have they just not gotten there yet? I have heard of ways to short Bitcoin (can't remember where though), and have always assumed it is just a matter of time.

The banks won't create BTC derivatives because they can't control the price and they can't control the price because BTC doesn't have derivatives. Positive feedback loop for us ;-).

I so agree and the pullbacks are the perfect buying opportunities.

Me too!

I believe you are right Greg, I know you don't like the paper metals but I don't think JPM would try to steal from themselves. In any event the technical may help those who are buying the physical

Thank you Greg for letting me know about steemit

Cryptocurrency will be the future... which coin will win or bust? Only time will tell. Steem is very promising! Investing more soon!

Greg, this post just encouraged me to buy some more bitcoin! And I recently joined steemit through you, thanks!

@marketreport, Gregory could you please share your thoughts about what other crypto's you like a.t.m.?

How true Greg. The only problem is, every time there's a price dip, I have no reserves. I need to start holding my reserves back until there is a dip, and not invest on the way up. You're like that little guy on my shoulder telling me to wait and have patience!

I do not care if I win big! I hope to find stability without debt. The dollar seems poised to fall. Pride comes before a fall and there are many who feel pride in the number of dollars they control.

You have always said how undervalued silver is Greg and seeing how you embrace crypto currencies, I am excited to see what's going to unfold in the next few years.

Hoping steemit will last, it's fun to use!

Me too!

I think anything the mainstream media trash talks is a threat to Wall Street and a good place for my money.

Yep. Today they brought out the old Bitcoin is dangerous because criminals use it on the Wall Street Journal Website. Youll be happy to note the comments were laughing at the article. I myself said then maybe we should outlaw dollar bills because criminals use them too.

Yes this is my mindset as well Gregory, thanks for posting I've watched your stuff on youtube for years!

The more I study cryptos, the more I agree with you, Greg. Started an account at a leading crypto exchange, just been dipping my toe a bit so far. Think I may divest a little of my Goldmoney holdings and shift them into cryptos. Wifey and I are deep in metals, don't care to invest in stocks or bonds, but PM's infuriating 'sideways one week, smacked down the next' market pattern is discouraging. I know central bank manipulation in PMs has to end someday, but when? Meanwhile the bull market of the decade is just starting to warm up for the big parabolic move. Time to diversify.

Acxcording to the web bot report the market manipulation ends this year. Hyper inflation starts this month.

In my opinion, we are not out of the woods yet. If cryptos gain more and more importance, the powers will intervene. They will not watch idle how the control over the money is slipping out of their hands.

And they are the ones who make the rules (laws), giving them all options to harrass crypto owner in every way they want. I see trouble ahead...

They already do harass us. This is why they made it subject to capital gains tax. But people will ignore it until they give up and declare it a currency like Russia did.

Hey Greg..Great to see you on here will be viewing and voting on here!

The dollar is almost dead. No fiat currency has lasted this long. Crypto is here to stay and is in its beginning stages. It is digital, it is global, it is safe! Three key characteristics of its future longevity. The anit crypto currency talk is only a small distraction and will have no long term impact. it is only a conversation piece. Thanks for sharing.

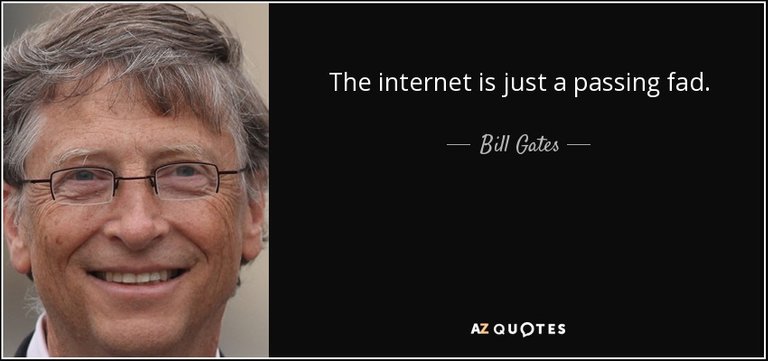

Bitcoin is just a fad....

Image source

....Bill Gates is a passing fad.......he's so 1990's!!!!

Thanks for sharing this. I tell people this story all of the time. I was a web designer in 1991 before the profession even had a name and the internet was available to the public. I saw that article and brought it in to show my boss. We laughed. I had the article framed over my desk for years.

Do you not believe this is a bubble my man?

Keep on doing what you're doing @marketreport. I'm super thankful you introduced Steemit to me via your ytube channel. I'm slowly getting others to sign up as well, and to take advantage of this awesome opportunity.

I just wonder if the pull back is over or will there be another dip (buying opportunity)

Hopefully. I converted alot of BTC to ETH and making yuge gains. I think BTC will climb higher but ETH has more potential.

Rock On / STEEM On! So glad Greg @marketreport got me on the Steem train when he did, congrats to those of you who have the know how to capitalize on Bitcoin and trade crypto to double up. I aspire to reach such heights and continue to educate myself at the direction of smart and good people like Brother Greg! Thank you & keep STEEM'in!

Outside of legislation tampering with the cryptos, it would appear they have tremendous room for growth.

The elites are panicking and don't know how to deal with this and are trying to talk it down the way the federal reserve talks up the stock market. The crypto's are like a match that has been lit which is about to become a raging fire. They are trying to put water on the flame but it won't go out. Things are changing fast.

I think they've planted some of their own cryptos within the mix. Trouble for them is that we know which one's they are!

I am new to cryto...have done my homework and understand alot more now, have brought a few cryto's but am now wondering if i have brought the right ones? Any chance you can tell me what ones the elites have planted or can you tell me how to figure this out, sorry to sound dumb....thanks in advance.

Ripple is a prime example of a bankster led crypto.

However, I'm not saying that you shouldn't buy at this moment in time (we appear to be in a strong bull market). However, there is zero chance that all the current 700 cryptos will still exist in a years time.

Another thing to look out for is cryptos that aren't mineable, this suggests that cryptos can be printed 'out of thin air'!

Thank you for reply and advice, still a learning curve...but doing my research and hopefully make a little.

Thanks and agreed re the learning curve! Still so much I don't know / understand!!

You don't sound dumb at all, your enquiring about crypto's and that's smart. I'm no expert but I would recommend investing in Bitcoin and Ethereum ( safest bets ). Educate yourself here on steemit and youtube, lots of video's available. Good luck !

I just sold to bitcoin to a 63 year old grandmother type I work with (I'm 60). I lost $40.00 on the transaction because the price went up at the time. She couldn't figure out how to get her coinbase account to work. Her bank also shut off her card because the transaction looked fradulant.

Just published this today Gregory... over in Japan Bitcoin mania is now causing stock prices to soar for any business or company that has a cryptocurrency presence - http://www.thedailyeconomist.com/2017/06/bitcoin-now-affecting-company-stock.html

I have a simple question. How do some of you in here turn FRN i to BC? To me, it looks like a two or three step process. What is the easiest west to be able to go back and forth between FRN and BC?

Hey Greg, great post.

Thanks for putting me on to steemit,i normally only stay in ordinary shares and ETF's, But this could be another of a few alternatives to keep me diversified.

I was a bit surprised to see how many crypto currencies there actually are, but i can see a future in steemit mainly because of the community backing it up. Its an interesting concept.

Thanks again.

Cliff High's ALTA report. He has never been wrong on the future of alt coins so far. I bought at $400. bitcoin and own 200 ether at $10.00 because of his recommendations.

Thank you Gregory, for for input and output..

Up voted! Excellent words and very true! The funny thing to me is at least BTC got a correction on it's quick and speedy incline unlike the stock market over the last decade................. ain't we due?

"Will win big time" indeed....I'd have to strongly agree with you Greg! The massive allocations of capital going into cryptocurrencies and block chain tech is definitely a reflection of the instability we're seeing throughout the geopolitical as well as financial landscapes. This trend will indeed remain strong for the same reasons $GOLD will eventullly breakout of it's current apex pattern despite the manipulation. It also reflects the progress being made with the "war on cash" where the consumer is being herded into the digital world left and right which actually jives seemlessly with the direction the current tech renaissance is going in, especially as governments are now looking at ways to adopt block chain tech into there systems ...and considering the IMF's disposition, it will definitely be interesting to watch theses arbitrary transitions play out over the years as there are fortunes to be made and lost off fiat devaluation and value appreciation in cryptocurrencies which coincide exactly with the continuing infestation of technology innovation.....that said, $GOLD in spite of the manipulation will no doubt win in the end simply because of its physical properties, but with respect to tech innovation and the digitization of well everything, we are looking at a modern day race between the tortoise(gold) and the hare(crypto) which again will likely take years to play out imho

ditto that.

Well like I said before I came to Steemit under your advice and I plan on taking total advantage of it! Thanks Greg The Lion Mannarino! DR

Rip the face off the blockchain!!!

Excellent advice on going against the fear norm.

Bitcoin stocks on a tear last few days a something new and exciting to consider. Here is the latest one I did a quick write up about, up 100% just today. Links in the article to the other ones as well.

https://steemit.com/cryptocurrency/@motowngold/1-more-bitcoin-stock-coin-citadel-cctl-0003-share-at-time-of-writing

This post has been ranked within the top 10 most undervalued posts in the second half of Jun 05. We estimate that this post is undervalued by $45.24 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Jun 05 - Part II. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Lets see just how high it goes this year for starters.

Can someone debunk this. I have owned Bitcoin since 2014.