So, the question that comes to many people’s mind “Is this it? Have we seen the top in crypto assets already? Is it worth still getting involved?” To people really believing in the idea behind it, the answer can only be YES. For all others let me try it this way...

To answer this AND with regards to emerging projects like Dcorp (you will understand why this project at the end of the post), I want to share a piece of the macro report I presented to my colleagues at work.

EVERYTHING DEPENDS ON THE PERSPECTIVE - UNTIL YOU REACH ABSOLUTENESS.

We will later see what I mean by this statement.

So, for this post please keep in mind that this square

represents $100bn in market cap!

With that being said, here's Bitcoin at the moment:

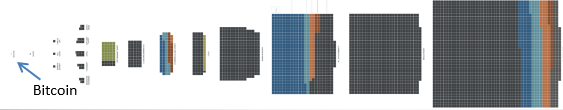

In contrast these are the wealthiest persons on the planet

and some of the most valuable companies by market cap

The market cap of all coins and banknotes, also called M0 in the US, is roughly 5 trillion.

The next big market would be gold, to which Bitcoin is frequently compared to because of it's scarcity. It's roughly $8 trillion and a large portion (see the gold) is held by the IMF and central banks. Maybe an indication of them not fully trusting their own monetary system. Other major players in the Gold market are banks like JP Morgan & HSBC and the LME.

It gets even bigger when we look at the M1 money supply, or narrow money, which includes M0 + checking accounts and demand deposits. Globally this measure amounts to approximately $29 trillion and, due to the fractional reserve banking system, is ever increasing.

Now, we get to the really interesting part. Below is the value of global stock markets which translates to roughly $72 trillion. The BLUE part represents the US, with more than 52% of the total market cap. 2/3 of this have been created since 2009 thanks to the FED. The runner up is the Eurozone (light blue) with 8% followed by Japan (orange) with 7%. China (red) only stands at 2%, while the rest of the world accounts to 31% of global stock markets. Even though valuations are at an all time high, the DOW frequently closes at new ATHs.

Even bigger is the total global money supply, called M3 or broad money, which not only includes M2, and with it M0 & M1, but also less liquid money market instruments. This market is estimated to stand at approximately $81 trillion.

However, this number looks rather small when we look at the single most important bellwether for modern economies, the debt market, which stands at a combined $202 trillion. Additionally, 32% of global debt has been accumulated since 2008, made possible through unconventional monetary policy. 1/3 of the debt is sovereign debt where the US tops the charts again.

NOW, WE GET TO THE PURPOSE OF THIS POST AND WHERE WE ACHIEVE ABSOLUTENESS IN THIS CONTEXT.

The biggest financial market globally is the global DERIVATIVES MARKET, including products like forwards, swaps and structured products. Since no one knows just how big this market really is, the estimations reach from the lower end of $640 trillion all the way up to $1.21 quadrillion, including the shadow banking system. That's more than 10x global GDP!!!

And this is how it looks like:

And to put it into perspective, here are all of the different markets mentioned before:

So, I am not a fan of derivatives at all. Just like Warren Buffet, I think they are toxic to the real economy. But this is not the point of the post. If companies like DCORP begin to offer derivatives markets for cryptographic assets and regulations being established in developed countries, the price of Bitcoin and with it other currencies may very well multiply in the next years.

If this development is healthy for the environment and still follows the idea of Satoshi's whitepaper is... (cough) highly questionable to say the least!

Let me know your thoughts and challenge my post. Only this way we can learn from each other.

Many thanks to Sue Chang for catching up on this topic back in 2015.

Nice work Marizouchi!

I like bitcoin ,,,, By keeping Bitcoin primarily as a store of value and / or currency, we store it simply and theoretically at least reduce the bloat on the main blockchain.

It can also help reduce arguments and subdivisions in the future because of protocol changes, as there will be little incentive to add new features to try to compete with new projects.

So in short, I think keeping Bitcoin in focus and working well because its currency form is quite difficult so it should be the only focus. In some cases simplicity is the best.

I listen ,,,, thanks