Bitcoin, the most popular virtual currency in the market today. The Bitcoin technology behind the currency is genuinely revolutionary. It is at the forefront of a new world for payment systems around the world. However, despite the excitement and hype surrounding its introduction to the marketplace, Bitcoin suffers from some significant and legitimate drawbacks that may permanently limit its adoption in the mainstream economy. While some see potential for Bitcoin to form the foundation for a robust and secure electronic fiat currency, adjustments will need to be made for the currency to gain widespread usage.

The Marketplace Opportunity for Cryptocurrencies

Bitcoin and other cryptocurrencies face a marketplace that is ripe for disruption. The payment systems in the U.S. and the rest of the world are in dire need of overhaul. Many of today’s payment systems are considered slow, error-prone

and expensive relative to performance in other high-tech industries. In January, 2015, the Federal Reserve released

a paper1 outlining their goal to “improve the speed and efficiency of the U.S. payment system from end-to-end over

the next decade.”

Desired outcomes include:

Speed: A ubiquitous, safe, faster electronic solution(s) for making a broad variety of business and personal payments, supported by a flexible and cost-effective means for payment clearing and settlement groups to settle their positions rapidly and with finality.

Security: U.S payment system security that remains very strong, with public confidence that remains high,

and protections and incident response that keeps pace with the rapidly evolving and expanding threat environment.Efficiency: Greater proportion of payments originated and received electronically to reduce the average end-to-end (societal) cost of payment transactions and enable innovative payment services that deliver improved value to consumers and businesses.

International: Better choices for U.S. consumers and businesses to send and receive convenient, costeffective,

and timely cross-border payments.Collaboration: Needed payment system improvements are collectively identified and embraced by a broad

array of payment participants, with material progress in implementing them.

Cryptocurrencies are a strong option to help deliver these outcomes while doing so cheaply and conveniently, but there

are some challenges to overcome first.

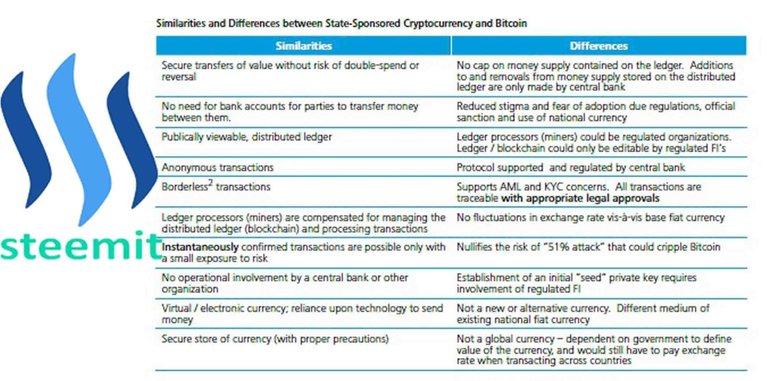

Extending the Reach of Cryptocurrencies

Bitcoin suffers from some notable shortcomings inherent in its design that have constrained its expansion into the mainstream payments system. Wide-spread adoption will require Bitcoin to address governmental requirements around anti-money laundering and illicit trade, as well as other key concerns such as volatility of value, ease of use challenges, and a general lack of endorsement by “trusted” bodies. The result very well may just be a new method of handling payments that would revolutionize the current system. With the potential to reduce costs, reduce errors, speed the transfer of money, balance privacy with anonymity, and do it without the day-to-day operational need for a centralized organization, whether commercial or federal, the result could truly be transformational.

Making It Work

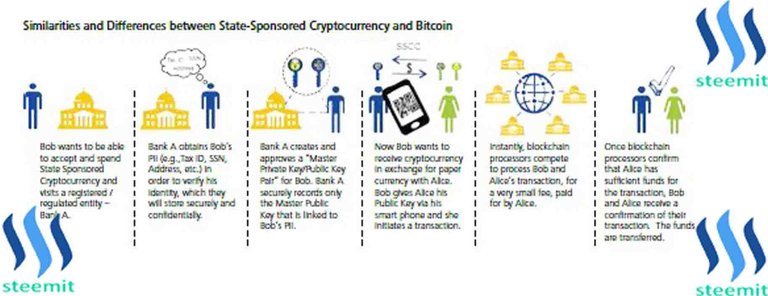

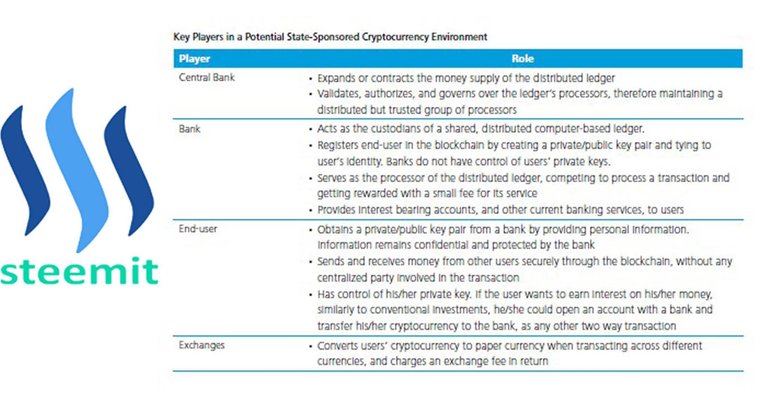

The foundation of a state-sponsored cryptocurrency would be much like Bitcoin - individuals or companies would utilize computer-generated public “addresses” to send and receive payments. Payers could use an electronic wallet on a smartphone or computer to send money to the public address of the recipients. Unlike Bitcoin’s current system, however, banks and other financial institutions , previously approved by the Central Bank, would be the custodians of a shared, distributed computer-based ledger (called a blockchain in Bitcoin parlance). The currency in this distributed ledger would be existing fiat currencies (e.g., USD, CAD, Euro, GBP, etc.) rather than a new, unfamiliar digital currency like Bitcoin, and the digital currency would not necessarily have to supplant paper currency. A crypto-dollar would also need to have the same legal tender status as paper currency.

Ensuring Security and Controls

A key area of concern by those more critical of existing cryptocurrencies are their security and control mechanisms. In this scenario, existing Financial Institutions (FI) could link a private key to an identity for AML and KYC purposes. These links would need to remain confidential to the FI and key owner except when disclosure is required by law. Financial institutions would serve as the processors of the distributed ledger, through which they could compete to process transactions and be rewarded with a small fee for their service. In short, banks would ensure that both the sender and receiver of the payment have a valid private key in the ledger, as well as confirm that the sender has enough funds for the transaction. Once a transaction is confirmed, it could be posted on the public ledger, thus making the transaction transparent, auditable, and irreversible. In a key departure from the Bitcoin system, financial institutions would not be able to mine cryptodollars, but would be solely responsible for processing and confirming transactions. This scenario would certainly mean a big change for banks, as the need for an intermediary could decrease once users have the ability to safely store their cryptodollars on their private keys.

Driving Lower Processing Costs

As we have seen with Bitcoin, cryptocurrency transaction fees also have the potential to be dramatically lower than current credit card fees or check processing costs. By creating a distributed, but trusted, group of processors the goals of openness, competition and security could be balanced. Individuals could transact with one another without the need for a centralized authority – financial institutions would have to reach a consensus in order to process/confirm a transaction and the Central Bank would play a key role in authorizing financial institutions as processors but exercise no authority at the transaction level.

The Impact on Monetary Policy

In this hypothetical scenario, the Central Bank could expand or contract the money supply just as it does today, through open market operations. The increase and decrease of cryptocurrency money in circulation could be governed by the Central Bank, according to demand, policy, and protocol. In order to increase the supply of money, a Central Bank could transfer crypto-dollars, in realtime, from its private key to different financial institutions’ private keys. In order to contract the money supply, a Central Bank could increase reserve requirements and financial institutions would transfer crypto-dollars to the Central Bank’s private key, in a manner that would be functionally identical to how this process works today. Under state-sponsored cryptocurrency, supporting cross-border payments would be straight-forward and not require any additional steps than previously described. The payer and payee requirements would be the same; that is, foreign entities would obtain a private key on the cryptocurrency’s distributed ledger through the previously mentioned regulated channels. Once they have the private key, they could seamlessly transfer money in the source currency, applying the same conversion rates as fiat currencies do today.

Applying Bitcoin’s innovation to the myriad issues in today’s payment ecosystem offers an exciting opportunity. While this highlights only one hypothetical scenario, the goal is to advance the debate on the future of the payment system as there are a number of alternative routes that may be pursued. And while a state-sponsored cryptocurrency may not replace Bitcoin or any other virtual currency or paper fiat currency in its entirety, in this hypothetical world, consumers and institutions might be utilizing several digital wallets built around multiple currencies like Bitcoin, airline miles, credit card points, and the like. Consumers would be able to choose the most appropriate currency for a particular transaction with the best exchange rate.

good post. thanks for shearing.

Very nice

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www2.deloitte.com/content/dam/Deloitte/us/Documents/strategy/us-cons-state-sponsored-cryptocurrency.pdf

hola! I like your post! Thanks for it! I went to jail because of cryptos... lets make steemit together to a better place with our content! I would like to read a bit more about you and maybe do you have some more pictures? I also just wrote a introduce yourself. Maybe you upvote me and follow me swell as I do? https://busy.org/introduceyourself/@mykarma/1-jail-review-bitcoins-3-years-ago

Good article! I do feel you could make to content nicer to read by applying more markdown styling rules. More subtitles would make the article smooth to read. This is only my opinion though :)

I wish you all the best.

Feel free to check out my blog @maxdigi, this way we can support each other!

Cheers

maxidigi

Love the article ! You make some great points. I believe bitcoin will always be our gold standard. I believe this crypto space has room for multiple currencies , such as raiblocks, electronium, ripple and of course ETH. Cant wait to see what the future holds my friends! hop over to the SERIOUS CRYPTO channel!

BCH should be viewed as the preferred crypto for fast and affordable payment transaction use while BTC will be regarded as a store of value digital asset.