Dear Steemians,

As I embark on my first crypto-related post in Steemit, I want to share my observations and experience in the world of crypto. After all, Sharing is Caring.

I have been in the crypto scene since 2009, having tried both mining and trading and yet there are still topics and concepts about crypto that I do not fully understand. Being inquisitive by nature, I will continue to find out more about such topics and share my knowledge with everyone through my articles.

There is very limited information available today about (Proof of Stake) coins and this topic remains greatly under-represented and discussed. I will share my personal experience and thoughts about POS.

Most people are engaged in either mining and/or trading activity and I will cover both areas.

Mining

To be honest, till date I have not had great experience from mining but I do believe that it can bring great returns if you know what and how to mine. I did try ASIC mining BTC with Antminers from S1 to S3, before I finally gave up. Both Wolf0 and Pallas are legends in this domain(GPU/CPU). A disadvantage in comparison to staking is: It is very complex and technical hence it requires a lot of knowledge and experience.

Masternodes

I have set up several masternodes — ENT / Eternity, CHC / Chaincoin and DAS (NOT the DA$ from Cryptopia!) — as an experiment and they bring nice small gains on a regular basis. But the disadvantage is: Setting up of masternodes is not easy for most people. While it is less complex than hardware mining, it is still an uphill task for people not proficient in Linux. I have to admit that it was tough for me as well — but I hope that I will reap the rewards in future. The annual returns for the masternodes above are somewhere between 90–150%/year (please bear in mind that cost will be incurred for VPS-servers). The really interesting part is when you get high returns and the price rises at the same time. You can find good overviews about different masternode coins here: (data is correct at the time of writing!).

http://masternodes.pro/

The cheapest VPS I could find are free. Please take note of what’s available at the free tier

1: amazon web service (AWS)

2: google cloud

Short Term loans

Short Term loans are offered at Poloniex and Bitfinex. When I first started trading, I made a lot of newbie mistakes, which resulted in a number of heavy bags. Luckily for me those bags of coins was listed at the loan section on Poloniex. Loan amounts are dependent on the coins. For bitcoin you could loan out a fraction of the coin while other alternative coins have different minimum requirements. You could loan out the coins from 2-60 days. I found it cumbersome to login to check on the loans daily as some loans would only last a few minutes. If I do not monitor the loans constantly and the loans lapsed, I would end up losing potential loan interest from the coins sitting idle in the exchange.

This led to me developing a loan bot which can be found at https://mycoinsbot.com. The bots would use A.I. to mine data and help us to give out loans at the best possible rates. I certainly have a much easier time and enjoy greater returns with these loan bots.

Term Deposits

Term deposits are offered for some coins and it might be a good idea for coins that you would hodl long-term anyway. I personally have or had term deposits in DOT and POSW. Cryptopia is offering term deposits for DOT. Poswallet.com also offers something similar for POSW . Please note that the interest rates are quite small, usually ~ 5–12%/year. So this really only makes sense for coins you believe in long-term.

Do bear in mind that the coins are locked up for the time frame of the deposit so if the price goes up by 100X during the term deposit tenure, you will not be able to sell your holdings unless you cancel the term deposit with a penalty.

My advice for you would be to split up the term deposits into multiple blocks for better liquidity.

Poswallet.com was hacked previously for BTC but POSW coin was not affected. I want to stress again that centralized exchanges are NEVER 100% safe, unlike ERC20 wallets, whereby you still have the private keys. If you know other coins that offer attractive term deposit options please let me know in the comments!

Proof of Stake (POS)

Now we come to the last topic of this article which is Proof of Stake (POS).

POS coins are alt coins that offer staking rewards. Staking POS coins has a huge advantage over mining and masternodes which also makes it my favourite.

It is much simpler to set up and let me sum it up in a single sentence.

To stake POS coins, ALL you need are the coins in a wallet running 24/7 on a PC.

Anyone can do it without much computer skills.

Hardware requirements

Personally I use an old laptop that runs 24/7 with wallets of 8 different coins.

What are the advantages?

- Laptops use less electricity than towers.

- CPU and RAM of an older or very cheap laptop ( i7 , age 8 years) is enough to keep several staking wallets plus a DAS masternode.

Key things to note

- The wallet must be unlocked for staking.

- Always encrypt your wallet for security. Or risk losing your coins!

- The laptop should not go into hibernation if you need to stake 24/7.

- You can limit the energy consumption by switching off the monitor or running it headless (without a monitor) even.

What are the basic advantages of POS coins?

- Liquidity

You get stakes (coins) without your coins being locked up in term deposits or masternodes.

These coins can be sold at any point without penalty. - Security

As the coins are not kept on the exchanges, this eliminates security concerns of exchanges being hacked. Do remember to always encrypt your wallets. - Prevent overtrading risks

It is common for everyone to buy on impluse and panic sell whenever there are price fluctuations.

Overtrading also greatly increases likelihood of making trading mistakes.

If you are staking and getting regular returns on your coins, you are less likely to sell it for marginal profits.

This helps you to hold the coin till it moons for greater gains.

My advice is to buy, stake, hold and sell some when it moons then buy back on the dip.

Try not to sell your entire holding of any coins. Just sell about 70-80% of the minted coins. That way your holding is always getting bigger.

On the flip side, the cons of staking coins in a wallet may mean missing out on quick strong pumps on exchanges due to the time taken to move the coins from wallets to exchanges.

This is not so much of a concern for well established and strong projects, but more so for smaller, unknown coins that often see quick random pumps.

How inflation affects POS coins

When trading, it is important to understand the co-relation between staking rate and inflation rate of the coins.

To do this, you need to look at ROI and [APR] (https://en.wikipedia.org/wiki/Annual_percentage_rate) of the coins.

APR is the annual interest rate for staking and together with ROI will give you an idea about the inflation rate of the coin.

Everyone will want to get higher interest from staking. However the highest staking coin isn’t always the best pick.

In fact, many very high staking coins (for example balls and tek) have gone to almost zero in price which makes them literally worthless.

Why does that happen?

It is due to the inflation being so high that more btc is needed to buy up the newly minted coins introduced to the ecosystem, just to keep the price stable.

Those who are in early enough might make crazy gains but those who are later to the game lose most of their investment. Please note that this only applies for VERY high staking coins and I will give examples for different categories of POS coins later in this article.

There are high staking POS coins that are still profitable even when we see a drop in price.

For instance, you stake a coin with an APR of 500% and the price drops by 30%, you would still have made a net gain of 350%.

In fact, you would have found a great source of passive profits.

Buying high staking POS coins without minting them puts you at a huge disadvantage versus those who stake.

They would be able to sell at a loss (as long as it is lower than their staking rate) from their entry price and still make profits.

APR is not the actual inflation rate of the coin as not all coins in the ecosystem are staking.

Let’s take CBX as an example.

APR of CBX is around 7.5% right now which is not too high compared to some other POS coins.

But what you should know is only 26.4% of CBX in circulation are actually staking, you can check it here.

So, the actual inflation rate of 1.875% (derived using 7.5%/26.4%) is even lower.

As a result of the low inflation rate, it is easy for CBX to maintain its price and it is easy for buyers to enter the market.

Hence I expect an overall price rise and good staking rewards what makes CBX one of my favourite POS coins.

Before I start on other examples of different categories of POS coins I’d like to add another point: There usually is no certain amount of coins you need to stake but if you have too little coins in your wallet your stake weight will be low and you will need to wait much longer time till you get rewarded. It doesn’t change your APR but it increases the periods of time between your payouts and that effects your compounded interest. Some coins even pay out several times a day!

I will go on to showcase other POS coins.

Explaining specific POS coins

You find links of where to get all the coins I mentioned at the bottom of this article.

Strong projects with good prospects and low APR

- CBX

A coin that fits perfectly into that category is CBX which I’d hold even without any staking rewards. With staking rewards of 7.5% this coin is a sure candidate for staking.

CBX is a strong project with a low inflation rate of 1.875% and a relatively low market cap so the price has a lot of room to grow. I expect its market cap to reach several hundred millions in the next 2 years and this is quite a conservative expectation.

- NAVCOIN

NAVCOIN is another coin that fits in this category.

NAV offers staking rewards of about 5%/year. This is really not much but hey, if you stake 1000 NAV, you will get 50 NAV in a year. While this might not be worth much now, imagine if price of NAV goes up to 50USD or 100USD someday. I am sure your perspective on NAV will change then.

As anon coins are booming and market cap of NAV is still low, it is not unrealistic. Again NAV is another coin I’d hold even without the staking and the staking just makes the deal sweeter for me. NAV also has low inflation rate due to the low APR.

Coins with a low APR

ONION/DeepOnion : 10% APR

XSPEC/Spectrecoin : 10% APR

CBX/Crypto Bullion : 6–12% APR

Note that some coins that are worth less than one satoshi can still be easily be traded on the DOGE markets!

Small cap projects ,with some attention and offer a good but realistic APR

These projects are still quite small in their market cap but already got some attention in the crypto community. The interest rates they offer are high but still manageable.

NETKO: ~50% APR

PIE: 20% APR (attention: will switch to masternodes soon!)

TRI/Triangles: 33% APR

V/Version: 60% APR

A relatively unknown coin that might fit in that category soon is:

JAPAN : 55% APR

As it has a tiny market cap and is very cheap so I got myself a small portion. I get payouts several times a day so I hope the compounded interest will be even higher.

Coins with an APR above 200%

RAIN/Condensate falls into this category.

I did not mint this coin but traded it for very good profits. If I had understood the staking possibilities earlier, I would not have sold all my holding or would have tried to buy back earlier.

I’m now very much saddened that I no longer hold this coin as the rising price gives holders very high returns.

The APR of RAIN is around 200%. Congrats to everyone who holds RAIN !

I will follow RAIN with great interest as a new economic experiment in crypto.

KOI/KOI coin

I did some research and found a totally unknown and low priced coin with similar interest rates called KOI/KOI coin.

It has a tiny market cap and can even be bought for one satoshi right now. The APR is 175%. I am staking it and get dozens of payouts a day so I hope the compounded interest will go up further. I limit the amount of money invested into KOI/KOI coin as the project might never move above the one satoshi price range or even die.

Again, do take note some coins that are worth less than one satoshi can still be easily be traded on the DOGE markets!

The inflation in this category is already VERY high and you should be concerned about the long-term perspectives of the price!

ULTRA-high staking coins (APR > 500%)

808coin : 17% eligible after 8.08 days, recommended block size amount is 650k

WomenCoin : 1000% APR (~2.74% daily and it is compounded) and recommended block size amount is 5000 WomenCoin.

The ULTRA high inflation in this category may be a red flag for the long-term perspective of the price!

Still I think that these coins offer great chances. If you look at the 808coin for example, you will realise that even if the price drops to 5% of your entry price after around 180 days, you will still be slightly in profit.

If you sell at 15% loss of your entry price, you will still have doubled your investment.

This category is the most risky of the various POS coins I mentioned.

Disclosure : I am holding some of the coins listed but for coins with higher APR, I keep the exposure of these coins to my overall portfolio to a bare minimum of not more than 5%.

Never risk more than what you can afford to lose. Never invest with borrowed coins.

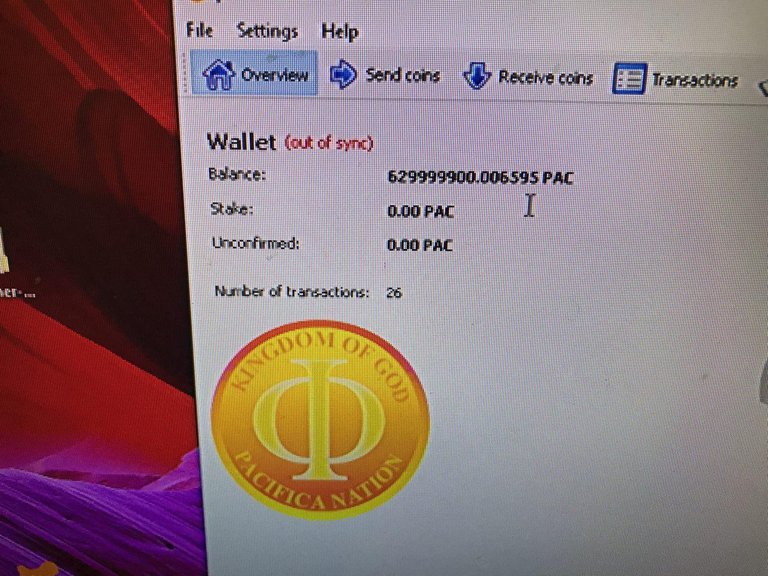

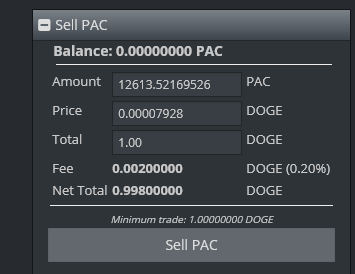

In the next few pictures I will show you proof of my passive income

1 : The amount of PAC / PACCOIN in my wallet

2 : The amount of PAC minted is 20.5 + 26.4 millions for a total of 46.9 mil paccoins

3 : The price of DOGE-BTC is 43 sats for every doge

4 : The conversion rate of PAC-DOGE 12613 PAC to 1 DOGE

So this single wallet gives me 3718 DOGE for September 2017, which works out to 3718 x 0.00000043 = 0.0015989 BTC (~7.40 usd).

You can view my results here.

Call to Action

I hope you enjoyed reading this article and are inspired to start implementing the methods I shared to start growing your passive income.

You can follow me on these channels and contact me if you need any help along the way.

Facebook group : Alternative Investments for Growing a Passive Income

Telegram group

Twitter

Thank you for reading

It took me many hours of research for this article and even more hours to write it. I’d really appreciate upvotes, resteems or donations if you found it useful.

Here are some of my addresses:

CBX-5To9Qkf8642rp4xhNC4WLnFr9draQZiBpM

ETH 0xdF15E9399B9F325D161c38F7f2aFd72C11a19500

BTC 17mMPpySrRFECZRCJGSitcTGmoPL6egFLw

NEO- ARaEQe3iMLHLqspx8hRaqMYcq4pbeNkR4B

PAC-

CBX(POSP)-

RAIN-

ROI-

POS -

APR -

Cryptopia: for Chaincoin

Livecoin : for Eternity

Amazing post realy very helpful for all specially for those who want to get more with less investment.

@minnowpond1 has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.

To receive an upvote send 0.25 SBD to @minnowpond with your posts url as the memo To receive an reSteem send 0.75 SBD to @minnowpond with your posts url as the memo To receive an upvote and a reSteem send 1.00SBD to @minnowpond with your posts url as the memo@eileenbeach has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.

To receive an upvote send 0.25 SBD to @minnowpond with your posts url as the memo To receive an reSteem send 0.75 SBD to @minnowpond with your posts url as the memo To receive an upvote and a reSteem send 1.00SBD to @minnowpond with your posts url as the memo@alchemage has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.

To receive an upvote send 0.25 SBD to @minnowpond with your posts url as the memo To receive an reSteem send 0.75 SBD to @minnowpond with your posts url as the memo To receive an upvote and a reSteem send 1.00SBD to @minnowpond with your posts url as the memo