Bitcoin is going nowhere on fundamentals. Further investment is coming almost entirely from expectations of future gains.

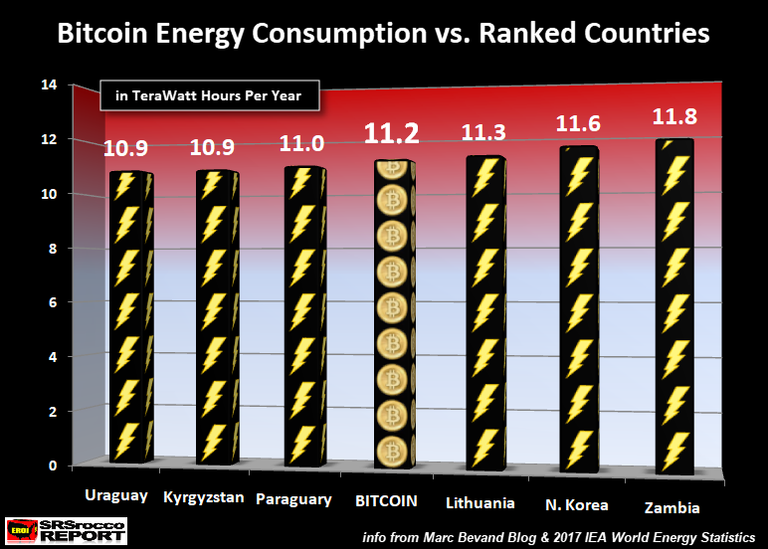

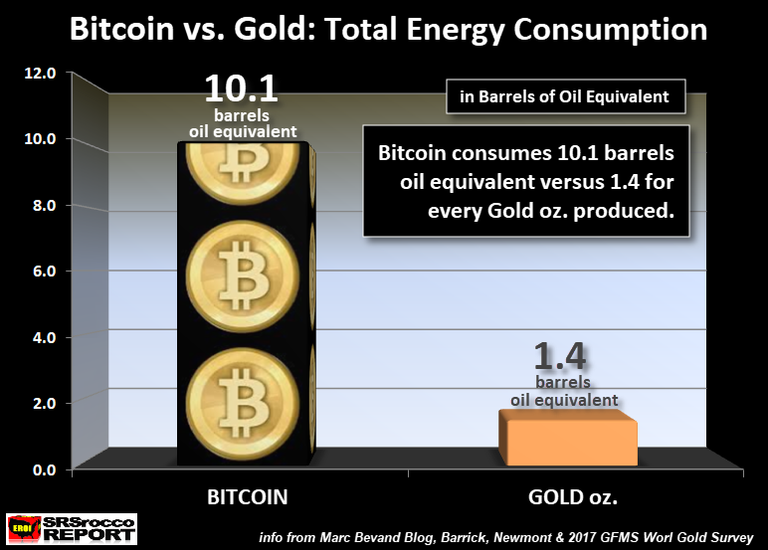

Throw a dart at CoinMarketCap and you'll hit a cryptocurrency with better technical design and a less toxic community. The real-world energy cost required to mine a Bitcoin has gotten a bit ludicrous, rendering claims of true economic efficiency exaggerated at best.

Even that old, perennially manipulated chestnut, Gold, is starting to look a lot less "obsolete", compared to Bitcoin, than it did 2 years ago. Note that, similar to Bitcoin, Gold is practically infinitely divisible and could be set at really almost any price to serve its function...just like Bitcoin.

New money continues to flow in, but only because it has no idea that what it thinks it is buying (the oldest coin with the most reliable and established developers/fundamentals) is now helmed by by the enemies of the original developers, while resting mostly on network-effect alone, and is rapidly digging its own grave with all the resources it can muster.

Anyone who tells (or told) you that SegWit is (or would be) good should immediately be relegated to, at best, a person who understands next to nothing about blockchain technology, and at worst, a disinformation agent or troll. Anyone who did not predict this extremely obvious, game-theory result of renigging on the NYA should never be considered a resource on cryptocurrency, game theory, human behavior, or predictions of really any kind.

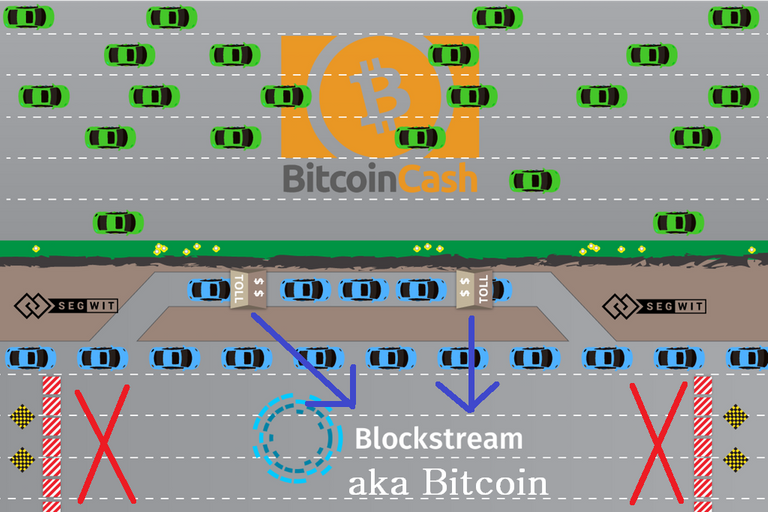

Try to move Bitcoin anywhere, and you'll quickly see recent fees have crested $9. This is nearly 1/3 the cost of a bank wire, with none of the fraud protection, insurance, or user-friendliness. Confirmation times of multiple hours remain the norm, making Bitcoin impractical for any point of sale puchase fathomable. Recently, it's been only a few hours faster than my bank wires, which are generally processed by 10am next business day.

Despite all these inarguable facts, Bitcoin has gone straight up, roughly doubling (again) in the last 3 months.

All I can say is, that's what Tech Stocks did....and Real Estate did...and Bitconnect did is doing...

There's no way to reliably predict short-term price movement. Bitcoin could continue to go straight up, in either real or nominal terms.

However, there is simply nothing under this rally anymore. Caution is advised!

If you have any additions or errata for this post, please let me know! I will see that they are voted to the top of the comments, and will make the appropriate edits (if possible).

We also have a Radio Station! (click me)

...and a 5000+ active user Discord Chat Server! (click me)

Sources: Reddit, r/BTC, Google, Mark Bevand, IEA, SRSRocco, ZeroHedge

Copyright: Reddit, LotR

Anyone who has been listening to me to get out of BS-BTC and into (real) Bitcoin Cash is doing well since my article:

I'm pretty much with you Lexi, but I think it best to not attempt to label crypto markets as rational ones. It's even possible to defend bitcoin from the stance that it's name gives it it's power.

It's probably another case of strong branding, do I believe the McD's has the best burgers, not really, but everybody goes to the clown and recognizes the arches.

One day of course this could change, and its impossible to know when it would, but one thing I do find interesting when comparing Bitcoin's quirks to those of the .com era is that when the tech bubble exploded we were in the vicinity of 33 trillion. So, there might still be quite a bit of runway before the first castles start to fall.

Maybe.... or maybe Tomorrow we will wake up to people burning their laptops on their grills smoking oregano laced with cyanide.

"I think it best to not attempt to label crypto markets as rational ones."

You'll certainly get no argument from me there. I'm pretty sure I make this clear most of the time:

"There's no way to reliably predict short-term price movement. Bitcoin could continue to go straight up, in either real or nominal terms."

Obviously, if you took my anti-Segwit advice 3 months ago, dumped BTC and bought Bitcoin Cash (or something?), you're probably not looking all that great.

Investing in this market currently is to be done not on fundamentals or logic, but on hype.

"when the tech bubble exploded "

I don't expect crypto to go down the same way. I wouldn't be surprised to see single coins go down, even BTC, with rapid market recoveries after.

With the Tech Stocks, that money could easily go to a bank stock or something. Does crypto money really want to go back to fiat? I think a lot of it is going to want to stay in crypto, for tax or ideological reasons.

We'll see!

Thanks for the rapid (and best so far) comment.

You do know that markets are oblige to the law

To inform the share holder to sell their stocks and get paid

within months.

But i think buying bitcoin right now is the worst idea because of the sudden boost in price!

however the events that you proposed are funny

#meno: tomorrow we will wake up to people burning their laptops on their grills smoking oregano laced with cyanide.

I cant disagree with you on anything you said @lexiconical - However consider this - In 2010 my 17 year old cousin comes to me with this crazy new thing he just discovered "It's called Bitcoin Dave, you have to get some bro - don't get left behind - it's the future of money".

You all have heard it before, and he was laying it on thick. I had no interest in anything that I couldn't hold in my hand, so I threw him $10 to get him out of my hair. The next day he comes back and hands me a burned CD with my name sharpied on it - and in the desk drawer it went...

Now fast forward to I think 2013 - 14, and I see on the news that Bitcoin has broken the $1000 threshold. Now picture me throwing shit against the wall out of my desk looking for that disk. There it was, at the very bottom of the bottom drawer- after 2 moves I still had it...

Since that initial sell where I made $8000 out of $10, I have baught and sold Bitcoin many times, and I believe then and now that there is no limit to where it can go. You are 100% correct in all your assertions, but the failure of the SegShit2 attempted takeover should be an indication that it will survive.

"You are 100% correct in all your assertions, but the failure of the SegShit2 attempted takeover should be an indication that it will survive."

You misunderstand what happened.

The 2x was the only "good part" of the Segwit2x deal. Now, Bitcoin is co-opted, and doesn't even get the block-size increase.

Bitcoin Cash is Bitcoin now. Bitcoin Core is a shitcoin that no longer conforms to the Satoshi Whitepaper.

It can easily go to $0 or $10,000.

I could be wrong (and am wrong often) but the way I understand the SegWit & 2x so called "upgrades" is - a majority of transactions are to be taken off the blockchain (segregated) via a "trusted" third party "The Lightning network" (witness) to increase speed and blocksize. Now this alone makes the whole concept as you stated...

IMHO (and we all know what opinions are worth) SegWit & 2x at its core (pun intended) will destroy the decentralization of Bitcoin. Nowhere in the Satoshi white paper does it say that removing transactions OFF the main chain is ok as long as... Maybe I missed that paragraph - but I don't think so.

The politics aside - my purpose in this comment was more to state that Bitcoin has reached a "critical mass" of support throughout the world, and nothing can stop it now - regardless of however many forks there are. Yes there are some serious problems and you might even see people walk away because of it. But one thing i'm relatively sure of is Bitcoin will survive - and prosper...

Hey Lexiconical

I agree that bitcoin has ''gotten a bit out of hand''...

You could say that again... How many bagillion megahashes would one actually need to mine one bitcoin. Who's got computer power like that LOL!

I remember I was buying them up when they were 100 or 200 dollars and I already thought it was a bit expensive but hey I wanted to have fun online

Now with the price movements and uncertainty in bitcoin I basically buy anything but them... Funnily enough, all my IRL 'friends' (people from around the way) who always thought I was crazy to tell people to buy and use bitcoin two years ago, now are coming to me asking me where I buy my bitcoin...

I tell them dude that ship has sailed a long time ago, get yourself invested in ethereum if you want the same opportunity that bitcoin was 2 years ago and is clearly not now...

Or i tell them if you really like gambling, go ahead and put your life savings in to bitcoin and pray to god you just get a whole bunch of free money.

But I'm not making those kinds of irrational gambles lol

"who always thought I was crazy to tell people to buy and use bitcoin two years ago, now are coming to me asking me where I buy my bitcoin..."

I went through this same experience.

The fact that they all want in now is not a good indication of future profits in Bitcoin. The last wave of a bull is the idiot-bagholders who do not know what they are buying.

''the last wave of a bull is the idiot-bagholders''

Lol! Nicely put, and definitely agree

I'll keep that one in mind as a future red flag for when a bubble's about to burst! Xx

Intriguing title.

I did not read till the end, I do feel compelled to do so later and reply again later.

For now, this is not true: "Note that, similar to Bitcoin, Gold is practically infinitely divisible"

If anything, right now, Bitcoin is more divisible, and more aggregable/unitable.

Bitcoin is also cheaper and safer to store and more often than not, also to transfer, the way things are these times.

Atoms come to mind, and despite them being divisible, the outcome would not be gold.

Bitcoin is also still a more honestly tradeable asset.

A realer commodity than (paper) gold.

In a world without enough people/internet, both gold and bitcoin would be worthless, and food would be king.

"For now, this is not true: "Note that, similar to Bitcoin, Gold is practically infinitely divisible""

Yes, it is true, considering I said "practically". Gold can be divided down to a single atom and placed into a variety of filler tokens from cards to coins. That means it could function at $millions per ounce. Whether that would be efficient is another story.

"If anything, right now, Bitcoin is more divisible, and more aggregable/unitable."

Bitcoin is neither more divisible nor aggregable, it's simply easier to do both, since it doesn't require movement in the physical realm. But, I see your point.

"Bitcoin is also still a more honestly tradeable asset."

I'm not sure what you mean by honestly. I think if you take a poll, the vast majority would disagree with you.

"A realer commodity than (paper) gold."

That's probably true, but I'm not talking about paper gold and have no use for it, really.

The inefficiency of dividing gold is what makes it unpractical.

Bitcoin is more aggregable, because in gold's case it should be melted/purified back to one piece, and to keep its certifications / signatures is even far harder.

Honestly traded means that in order to sell bitcoin, you should have it initially.

There are no "sell contracts" on it, as in "naked shorts".

This is why it is a realer commodity than paper gold.

If you refer to real gold, its price is dictated by the price of paper gold, so you implicitly refer to paper gold when you refer to real gold.

This comment has received a 44.25 % upvote from @upgoater thanks to: @stimialiti.

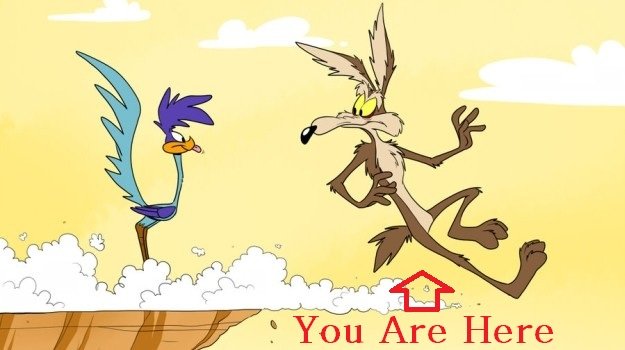

Did you make that artist's representation? That's brilliant.

It might be a topic for another discussion, but do you have a personal opinion on the CME Bitcoin Futures element? This has had some role in the Bitcoin price action recently as well. There are fears that it could be a price manipulation vehicle, but also praises that it could further legitimize BTC, while bringing much more adoption. Thanks.

I must credit Reddit user /ConalR with that particular graphic.

I added the shoddy MS-paint to it, though!

"There are fears that it could be a price manipulation vehicle"

Future markets basically are these by definition. I'd say this is an inevitability, and probably a good thing for crypto in general. It's bringing eyes and ears...even if they are buying the wrong stuff.

Thanks for the reply. I think MS-paint makes things better. It brings a perfectly imperfect human element to things and some humor. Always had fun with it before I got my Macbook.

Very interesting article. It's ridiculous how much power is wasted to mine Bitcoin, how longer and more expensive the transactions are. What would be the best altcoin to replace Bitcoin in your opinion?

Bitcoin Cash has the name recognition and a decent protocol...Monero is technically better and the darling of dark markets. There's a lot of other cryptos better than BTC now that I don't even care for, like Dash...

We need bitcoin shadow https://steemit.com/bitcoin/@sames/newest-idea-for-a-bitcoin-fork-split-anonymity

What do you think will happen to the value of Steem when the BTC crumbles?

I'd expect most alt-coins to be benificiaries of such an event, but it could truly go either way.

I think steem price will not go up very rapidly in the market.. because there are already many currencies which price is more higher than steem.

What do you think it will be a good coin for long term investment right now? Ether? Thank you so much!

Honestly, it's hard to say. I would have told you Bitcoin Cash a day ago (see this articles first image), but now it's already up like 25%.

BCH is what I mostly have...I also like NEO/OMG long term...

Outdated, expensive, slow, energy intensive.. Loads of promising altcoins that offer solutions to these problems but the brand awareness rules all..

I remember asking you a couple weeks ago about this issue, I am so glad I didn't buy into the hype thanks to you! I think I'll stick to crypto's that run way faster and charge less fees.

I don’t know much, but from what I have read I can only agree with everything here

I definitely prefer to invest in altcoins with some utility but I do own some BTC and will continue to hold, and maybe occasionally add a little - as I expect the ‘new money flowing in’ will continue for some time.

BTC seems to be the gateway in

Cheers

For now, but as you'll note in the first image, I think they are killing the golden goose there.

Because of you @lexiconical my thoughts of the capabilities of bitcoin

is thrown out the window!

It's just i cant believe that a cryptocurrency market could boom so fast,high and especially surpass certain GPD of Countries and miraculously surpass entire markets like Oil barrels!

Right now i think bitcoin is the most valued virtual possession in the world

and thats

OUTSTANDING!!!

I would have to agree with you on the B2X or the NO2X as I like to call it. However bitconnect does not claim to give you 1% percent everyday. At the moment that just so happens to be what it gives you on the average. I have received a few 0.00 and <.09 days but days as high as 2.88 percent.

I think bitconnects business model is viable for a few years. I hope you are knowledgeable about trading bot or "gun-bots". They average about 3% on the average everyday. So if you think about it, you can put everyones money into it and then keep 20% right off the top and reinvest and then still payoff the referrals (They again adjusted their referral program again). I've done the research and so far have a 40% above ROI with no referrals. I'm pretty damned convinced and so are the other 300,000 people are getting interest and the staking principle is interesting as well.

These are the crazy days of crypto. I'm interested in what you think about the electroneum coin and where you might think they may go in in terms of direction.

"They average about 3% on the average everyday."

No. No they don.t That's way, way over 1000% APR.

" I've done the research and so far have a 40% above ROI with no referrals."

Like every ponzi, the returns always start out great. The fact that your ROI is so high is the proof that you are far underestimating your risk.

If Bitconnect just a long-trading bot, which would have worked so far, it will collapse spectacularly eventually. That first image will tell you why.

I read in a article that chaina is investing in Bitcoin secretly..due to this Bitcoin increasing very very rapidly almost double in last couple of months..is it ture or not

I read in an article china is secretly investing in bircoin..due to this price of this growing very rapidly..is it true or not?

I don't know about secret...it's a popular asset over there though.

My friend good information.thanks for sharing.

Great post. Thank for sharing information @lexiconical

good information for me.thanks

Finally someone who speaks out for what Bitcoin is, outdated... Sure we all have love for this coin as it set the whole thing in motion, but there is too much ignorant investors as of now in the blockchain world... Go Bitshares! ;)

Congratulations @lexiconical! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPVOTED!

Please stop posting this in every thread. Flags next time.

ok sorry

img credz: pixabay.com

Nice, you got a 66.0% @zear upgoat, thanks to @lexiconical

It consists of $21.89 vote and $7.3 curation

Want a boost? Minnowbooster's got your back!

The @OriginalWorks bot has determined this post by @lexiconical to be original material and upvoted(1.5%) it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

This is a very new lending platform exactly like bitconnect and also has a token . its done with its ICO phase and its getting listed on coinmarket cap next month . you can check it out https://www.westerncoin.co/mortu and please don't forget to use my referral as a way to say thanks for sharing the info ;) . thanks and good luck guys