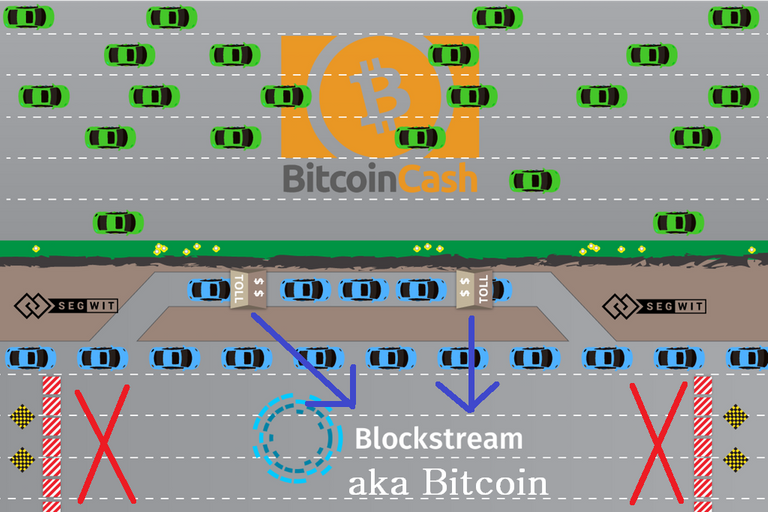

Ever wonder if today's hottest Shitcoin, Bitcoin, can keep going up despite technical inferiority to almost every single other cryptocurrency, and fees that have touched $20 in November more than once?

It can, at least for now.

TLDR: It is impossible to verify that any Tether are backed, and in fact, it is starting to look like they are not. This could lead to a price washout on Bitcoin to three digits, and given its status as shitcoin-figurehead extraordinaire, such a drop could even lead to chain-death. (See possible follow-up article - BTC Thanksgiving Chain Death Conspiracy)

See the link dump at the bottom to do your own due diligence, but leaving your coins at exchanges throughout this holiday weekend may be poor judgement.

I would prefer to be more thorough on this topic, but I am short on posting time due to working on some behind the scenes projects for Steemit. This information is too important to hold until I have proper article writing time.

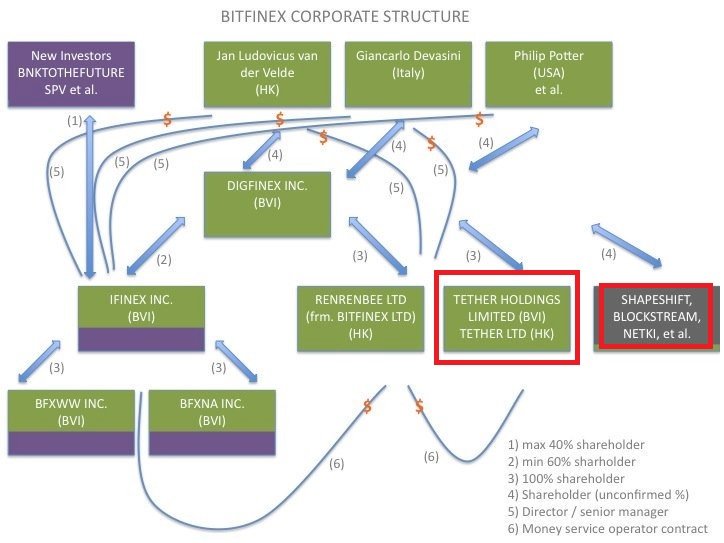

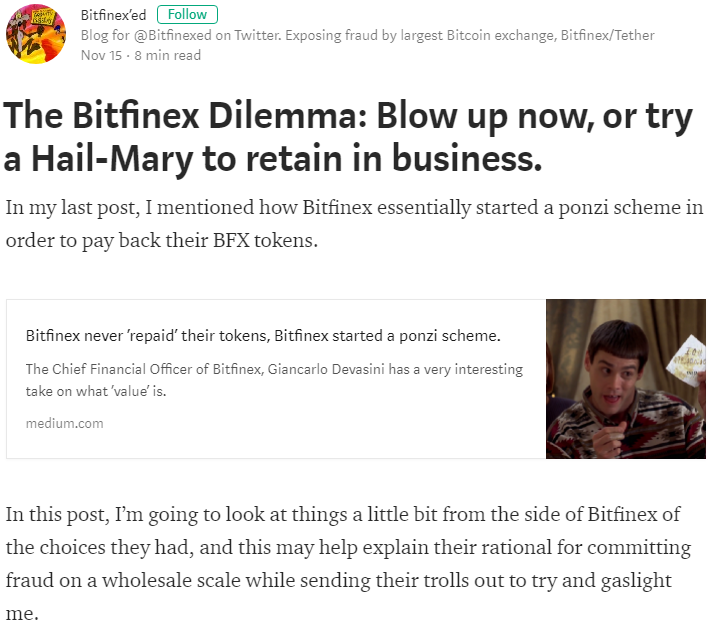

Bitfinex lost their banking services in April, which means they have no public, official channel for handling deposits and withdrawals. This also prevents them from actually backing any Tether they have been creating, unless they are taking in wheelbarrows of cash and burying them in the back yard.

If most tether are unbacked, then it is nothing more than a fiat-shit coin being used to allow the matching of depositors and withdrawals without banking. In other words, it is the token allowing a literal ponzi scheme, where new deposits are the only way to fund withdrawals. Tether is closing that gap.

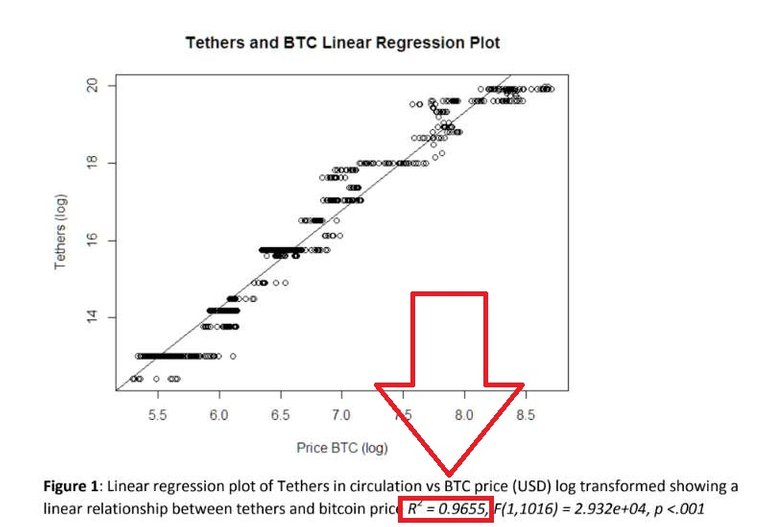

Every single time Tether prints, price goes up.

How strong is the correlation?

I wonder if the Bitfinex CEO has a poster that says "Correleation =/ Causation"...

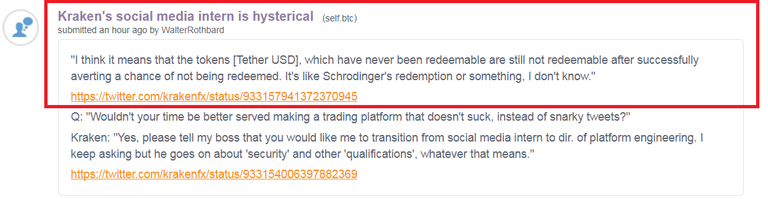

If you think I'm full of shit, ask yourself, why would this topic be such common knowledge (and immune to accusations of libel/slander), that Kraken's own Twitter acknowledges it?

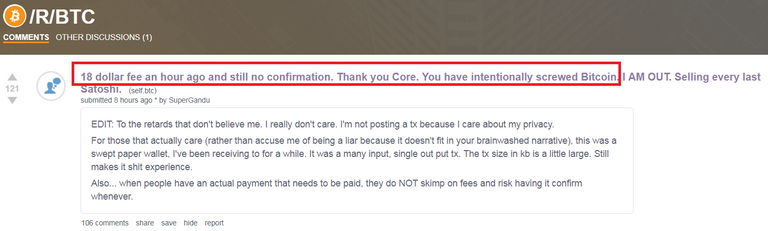

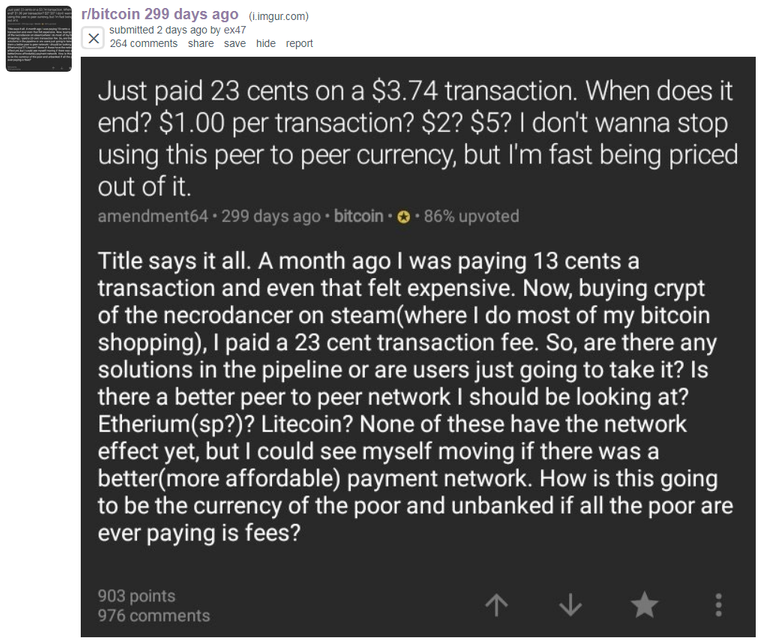

Why are over 57% of Bitcoin addresses fee-locked (contain less BTC than the fees required to move it?)

Does this look like success to you?

The smart money has already been quietly heading for the doors the past month. Didn't you wonder how my Bitcoin Cash call managed to more than octuple from $300 (temporarily)?

It is truly remarkable that people who value cryptocurrency could be stupid enough to trust an unbacked, un-audited token less legitimate than Federal Reserve Toilet paper.

There's always a greater fool...

PS - What am I doing? I'm hiding out in Bitcoin Cash, for now, although nowhere will be safe in this type of event but maybe fiat. Plenty of room for you all to come join us...

When most holders of Bitcoin BS Core get absolutely destroyed, I will be here, with a soft whisper of "I Told You So" (again) and an an already functional, technically superior replacement...

http://www.ofnumbers.com/2017/11/09/a-note-from-bob-on-the-transparency-of-tether/

If you have any additions or errata for this post, please let me know! I will see that they are voted to the top of the comments, and will make the appropriate edits (if possible).

We also have a Radio Station! (click me)

...and a 5000+ active user Discord Chat Server! (click me)

Sources: Reddit, Kraken, Twitter, Bitfinex, Bittrex

Copyright: Reddit

I have been looking into this as well, but the thing I struggle with is even if all the tether does end up being completely unbacked (which it could or could not be, doesn’t necessarily need the US banking to still have it be backed) there is only around $676 million tether in existence. With Bitcoins market cap at about $135 billion, the amount of tether in existence is just 0.5% of the entire Bitcoin Market. I just don't see how that will have this catastrophic impact dropping the Bitcoin market back down to 2016 levels that I have seen people talking about online.

The other point that I struggle with is why people actually think a large portion of people would even want to redeem their tethers, from what I have seen Tethers are just a safe place for people to park their currency when trading out of BTC or ETH before making a move back in. Seems to me the biggest holders of tethers are the exchanges themselves.

I'm not saying this analysis is wrong at all, or that there aren't issues with bitcoin that need to be fixed before any sort of mass adoption, just that I don't think we have the full story and there are still a large number of holes in this story to fill before I will start to panic.

Again, huge thumbs up for your comment mk40. Tether is but less than 1% of total bitcoin valuation. Calling bitcoin "shitcoin" might be premature. There are alternatives where the devs and the community are honest. Honesty will pay for itself in the end. Mind you, im heavily invested in DMD coins.

Huge thumbs @mk40 up for your rational point on the total amount of tether to provide some perspective. This post starts off calling bitcoin "shitcoin", so there's heavy bias off the bat and at the end. If anything Tether should be the "hottest Shitcoin" and the focal point here. Drawing attention to Bitfinex and Tether is great, but leading and closing with Bitcoin Core FUD is free advertising for another agenda.

As for the risk to Bitfinex account/tether holders, I appreciate the post alert for that. People need to be aware of the big risks here and take action to protect themselves. Strictly talking Tether, I agree that there's a big scheme involved.

I hope Bitcoin and Bitcoin Cash both work out, and that any Bitfinex/Tether nonsense blows up for the health of the space long term. Hopefully people will protect themselves for that. I also hope that the BTC Core vs Bitcoin Cash arguments will grow old so the tokens can coexist without trying to kill each other, or at least be discussed separately.

PPS - I realize the Bitcoin Cash image at the top, for example, could seem a little off the main point I'm making here. I can understand that perspective, but I'm simply making it easier for people to at least consider selling some Bitcoin, whatever that may be for.

The facts are that Bitcoin looks scary on fundamentals right now, the chart is at nosebleed highs, and now we've got increasingly loud murmurs of Tether problems amid Tether hacks at the #1 exchange.

Is that a "wall of worry" you want to climb from $8200 to wherever the next "big, round-number slamdown" happens? $9000? $10000?

Thanks for all of this constructive debate and acknowledging some things fairly. Respect that. I'd upvote your comments my small stake to be in good form for your effort, but I see that it'll throw off the sorting logic of the string.

np ill handle the voting

@steemmatt that is so hope Bitcoin and Bitcoin Cash both work out, and that any Tether nonsense blows up to stop the crooks, and let the markets continue on after any fallout

I recall seeing the Ether market sell on that particular exchange live. I guess that we should set some low buy orders, right? I also remember the Ether price globally being resilient and strong afterwards with respect to recovering from that drop. Fortunately, I believe that the impacted exchange made good on compensating those who were affected by that incident. I'm not saying things would be the same for BTC.

I now understand that you had an ugly divorce with Bitcoin and will try to keep your devil's advocate focus in mind from now on. Without knowing your history, it's not out of the question to interpret how you opened with some Bitcoin bashing how you see em, and close with whispers of I told you so as FUD. You reach a lot of viewers, and not all know about your track record/efforts/warnings/advice at top of mind. I edited my post because I missed the whisper comment at the bottom, which set me off by feeling like taunting.

People have debated Core vs Cash forever, so I'm not going to have any life changing input here. I don't have the solution other than the hope that in the long run there can be a coexistence. I think a lot of the coins you hit with darts have far less adoption and demand on their systems. I perceive that this gives them the advantage via more nimble development teams to not have to deal with as much red tape and politics to improve their technology. They can also be more progressive with their solutions.

Thanks for the tips otherwise and additional transparency. It's wise for everyone to be diversified and prepared to accept that it can all go to $0. That's why we ideally play with money we can afford to lose.

"I also remember the Ether price globally being resilient and strong afterwards with respect to recovering from that drop. Fortunately, I believe that the impacted exchange made good on compensating those who were affected by that incident. I'm not saying things would be the same for BTC."

Correct on all points. I am worried the same might not be true of Bitcoin. I wonder, how price-setting was GDAX at the time for Ethereum? Today, it is only #4:

"I now understand that you had an ugly divorce with Bitcoin and will try to keep your devil's advocate focus in mind from now on. Without knowing your history, it's not out of the question to interpret how you opened with some Bitcoin bashing how you see em, and close with whispers of I told you so as FUD. You reach a lot of viewers, and not all know about your track record/efforts/warnings/advice at top of mind. I edited my post because I missed the whisper comment at the bottom, which set me off by feeling like taunting."

All fair points well taken. I'd be lying if I said I didn't use inflammatory language sometimes to get people's notice in the "sea of attention."

"People have debated Core vs Cash forever"

True, and you could easily interpret my post as more of that.

I'm more interested in debating Core vs ANYTHING. It looks bad compared to every coin I look at, in terms of fees, privacy, and transaction time. This should REALLY WORRY all of us, because it means buyers have no idea what they are buying, and BTC is floating on basically hype and name recognition. r/Bitcoin users are telling new users they should buy LTC instead because of the fees...that sounds like terrible precedent.

"I think a lot of the coins you hit with darts have far less adoption and demand on their systems."

Also great points. However, Steem is a monster for transaction numbers, and it's fast and practically no-fee. Just one example of a more load-bearing chain.

"It's wise for everyone to be diversified and prepared to accept that it can all go to $0. That's why we ideally play with money we can afford to lose."

I really don't want to sell any into fiat, but I'm a bit worried. Trying to talk myself into it. Bitcoin Cash could quadruple, or quarter, in an event like this, but I bet most sub top-10 crypto is going down hard.

@lexiconical as you said "I really don't want to sell any into fiat, but I'm a bit worried. Trying to talk myself into it. Bitcoin Cash could quadruple, or quarter, in an event like this, but I bet most sub top-10 crypto is going down hard."

@lexiconical you are right but you are not the only one worried, every one holding on tightly for a gain

lex will respond to this, he can't post atm. he says the gains/losses are far more than the amount. btc dipped 6-800$ on 30m tether hack which is like 5% tether. "market will have no bids"

Oh, I totally understand that gains and losses are more than the amount of tether created, however, there are a lot of exchanges that don’t use tether at all. There are more options than just tether.

I do think tether is a little shady, and the link to Bitfinex is concerning as well. I just don’t see tether being the thing to take down bitcoin to where some people are saying. Again I could be wrong, don’t claim to know every inner working of these two companies relationship.

This post brings up a lot of good counter arguments to bitfinexed. Just want people to see both sides before reacting.

Honestly, that link goes to r/bitcoin. Nothing there is trustworthy.

Despite that, I looked, and unsurprisingly, they do not seem to understand that it does not matter if "not too much" of the volume is in Tether.

This is a potential Mt Gox event at the #1 Bitcoin price setting exchange that appears to be both unbanked and trading heavily in a token that is refusing to conform to its own audit structure.

Nothing at that link disputes any of those facts, which I believe are the core argument.

PS - Everyone SHOULD do their own due diligence. I bring the facts that appear most likely to be correct to my readers attention, or when applicable, the facts that if they are wrong will be most damaging for them to be on the wrong side of. If I'm wrong and people move their coins out of the exchange, or sell into something more stable temporarily, the potential damage is far less in my estimation.

It indeed necessary that we all do our Due diligence @lexiconical you did a good job in bringing out almost all the facts to all those with interest and concern in this matter

That last point is very fair. Appreciate the solid dialogue! Like I said previously, I will definitely be keeping an eye on all of this ready to make a move if need be. It’s not quite there yet for me, but things can change instantly.

@nikez452 you got it right

just tellin u what he said =) all my info comes from him. mostly greek to me

Wao So Great

I Followed You & did Upvote Now Do Same Visit To My Posts.

Thanks

@mk40 Very interesting to hear that there is only around $676 million tether in existence and also Bitcoins market cap at about $135 billion, the amount of tether in existence is just 0.5% of the entire Bitcoin Market.

It really interesting to hear this

Wao So Great

I Followed You & did Upvote Now Do Same Visit To My Posts.

Thanks

Interesting development but I have a feeling that the hack stunt would take the attention away from the inner workings of the company.... This would present an opportunity for the other pegged base cryptocurrency...

One the other hand I would take Craig Wright statement with a pitch of salt and his motives are rather clear now.... but realistically Tether is very much a small fry in the space

I'm just going to repaste this here, so others will see it (I doubt you need the advice):

"See the link dump at the bottom to do your own due diligence, but leaving your coins at exchanges throughout this holiday weekend may be poor judgement."

Just a note on the nature of Ponzi Schemes. The US/UK legislative definition of a ponzi scheme is one where the money taken in from new investors is used to pay promised returns to earlier investors - meaning that as soon as new investors stop joining the scheme, the scheme collapses. See here:

https://www.sec.gov/fast-answers/answersponzihtm.html

So I'm not sure that the tether can be classed as a ponzi scheme since there are no promised returns and it's not even classed as an investment, it's merely a vehicle of exchange.

lex will respond to this, he can't post atm. he says u are right, but its not tether but the exhcnage that is ponzi (it cant pay withdrawers without new money) - tether is just tool

ps - he's playing piano for mommy haha =)

i think the absence of a promised return on investment means the exchange is not technically a ponzi - system. Thought it's debatable, yes. Since I'm not a 'lawyer' I don't really know and am not being paid to find out ;)

I'm going to assume that's not a euphemism for something less publicly acceptable. lol ;oP

I've been outed as a pianist (if I had gotten to make this joke in real life, the humor would have come from the fact that pianist sounds very much like penis).

...pause for laughter...

I believe that if people deposit to an exchange, they have a contractual and legal right to withdraw from it. If the exchange can't service that with real banking, and is hiding that with shell games on the books enabled by failing to audit Tether as their own "TOS" require, I would say this is close enough to "paying out previous investors (depositors) with new investors (depositors)money" for colloquial ponzification.

However, it's possible that I over-use the term. There is no promise of wild gains here or any attempt to make money off of MLM or referrals. They aren't trying to run a ponzi, I think they are trying to dig their way out of a banking problem and have inadvertently created something very much like a ponzi.

Thanks for keeping me honest.

PS - Bitcoin Cash's superiority is mostly cited as an alternative to get out of BTC, and to point out that BTC's fundamentals relative to price look shaky. If this event actually happens, the smart money will be in FIAT and cleaning up the blood in the streets after.

hehe - the list of jokes about tiny pianists is too long even for this high speed blockchain ;)

I think the absence of any underwriting or government protection means that if the exchange goes bankrupt, you lose your 'money'. So that also infers that if they behave fraudulently and take in more than they can pay back (as most banks do offline) then while technically they owe you the money, you might not ever get it back if they just declare bankruptcy and run off to hide in a very expensive jungle for a few years.

It would likely be simple enough to prove a degree of fraud, just as it is with mainstream banks - but decades after many learned about the fraud of fiat banking - it's still with us... the magical money gift made of imagination that just keeps on giving!

Fractional banking, definitely something that exchanges had better not be messing around with. Sadly it wouldn’t surprise me if there were a few dabbling in it...

There is to the very least (volontary ?) missed guidance or fake advertising as people expect 1 USDT = 1$ yet don't even have half of it in true $.

If it ain't a Ponzi it's a fractional reserve and illegal/unregulated banking...

I agree with you. Even though they are not redeemable, and may be legally "just" in their jurisdiction (which, iirc, is some money-laundering island like the Caymans) people should be exhibiting extra caution at these ATHs, especially given the lagging fundamentals of BTC.

There are possibly numerous 'rules' being broken somewhere along the line, yes - but I am not familiar enough with the contracts involved and the legislation that is relevant (or even which jurisdiction applies) to comment with any sense of accuracy!

Warning Reward Pool Abuser + Spam Flagger.

https://steemit.com/steemit/@isacoin/repost-due-to-flag-reward-pool-abuse-supporting-evidence-lexiconical

Spamming troll.

Replying so you can't delete and repost. Again.

You have collected your daily Power Up! This post received an upvote worth of 0.73$.

Learn how to Power Up Smart here!

Chinese exchanges (ie. aex.com) are moving away from Tether and starting to use bitUSD, which is backed by 200% collateral on a blockchain so it's completely decentralized and risk free - no shady corporation making promises. bitUSD and bitCNY currently have three second transaction times and can do over 3300 transactions per second - one of the fastest, largest, oldest, most used and most secure blockchains in existence. See www.bitshares.org. Honest money, no bullshit!

I only wish Bitshares had more adoption, but it is doing fairly well at recovering post-Bittrex de-listing.

Hmm maybe the coin that is listed on these centralized exchanges receive some kind of bonus payment that decentralized exchanges don't provide. I really wonder why is it such low adoption of coins with bitshares. Isn't decentral exchange much more safe?

Interesting Topic. As you may know I'm kind of new to this Crypto world; I'm not holding Btc right now, actually was planning to have some in the future. I have a little Eth, Dash, Lite and of course Steem. From what I understand it would be safer to have some BCC because prolly most of Btc holders will migrate to Bcc when people realize that Btc is an Utter Failure, Right?

BCC is the acronym for bit-connect a complete scam that is not related to bitcoin, do not by it. BTC and BCH (bitcoin cash) are the only BTC coins you should consider buying. BTG probably isn't a scam but it to new for me to recommend.

BCC is a scam hoping to target new people who confuse it for BTC. Don't trust me, do your own research but you will find its true. A reasonable explanation on Steemit is here: https://steemit.com/scam/@thegrinder/the-bitconnect-scam-exposed

I am a proponent of Bitcoin Cash, but if something like this happens, even Bitcoin Cash could get absolutely whacked. I would probably tell you to hold some sort of more stable source of value and wait to pick up the pieces after this event. Even if something like this doesn't happen, I don't know how much more this Bitcoin bull can really run. It has no fundamentals left at all.

Look at Ethereum, Bitcoin Cash, Litecoin....Us dollars might be the safest of all. Buying things at all time highs rarely works out well.

Thats not true. It worked out well for everyone who bought Bitcoin at 1$, 10$, 100$ , 500$, 1000$ etc. All all time highs at some point.

I have a feeling most of the early adopters couldn't care less about transaction fees. When you got your $8,000 coins for basically free, what's a $20 transaction fee here or there?

The longer this continues the worse the drop when/if it does blowup. I have a bad feeling this could destroy crypto for the next year and beyond. If billions are lost big money and small investors alike will pull back for a good long while.

Flagged for promoting btrash completely out of context.

Flagged for continuing to provide nothing of value to this platform.

PS - Your ignorance of cryptocurrency is showing, hard: "btrash"

The truth will set you free (from being ignorant, at least; it can't help with your anti-social tendencies):

Guess our "btrash" just made us 32% since this posting while you jerked yourself off for $5.10+ with this shit-post.

Eventually you'll see it...maybe when fees for BTC are $100? That is, if you aren't too busy running authors like @Michelle.Gent off the platform...do you actually have time for anything constructive in your day?

What does the BCH part has to do with the status of USDT? Nothing.

Woah Lexi, I had no F-in idea! I’m definitly going to do my due diligence in researching the trash that is USDT haha

What do you think about iota? I think the tangle network is a great solution for long transaction times and high costs because the more people who use the network the faster it goes and every transaction is free!

Wow. Just wow.

I think I had to read this 7 Times. Haven’t heard much about the Bitfinex shenanigans but this sounds like Bitcoin could be facing an impending doom! Thanks for the heads up

I like your all content because your content type and quality is so good.

When the first sentence is calling Bitcoin "Shitcoin" you know what you are about to read is heavily biased...

Tethers total value is 0.5% of bitcoin's market cap. How so many people think a tether collapse will crash the price by 50%+ is beyond me.

I have my doubts about bitcoin as well, but it has proven to be a very solid long term store of value despite much worse problems than tether. Tether may we cause a correction but Bitcoin has survived much worse.

I had to come back to this article. So you're with me on this...I thought I was the only one tripping over Bitcoins expensive transaction fees. From what we all heard, it was supposed to be cheaper and faster, right.....Riiiiiiigggght.....

The perfect bitcoin storm Tether has no backing and the developers of Bitconnect shut everything down.

Mt. Gox would be remembered as the good times of Bitcoin.

I'd hate to hear us start saying things like "Remember when it only took 1-2 years for us to get back to new All-Time Highs"?

We'll end up digital gold-bugs.

That's about how long it took after Mt.GOX isn't it?

Crazy times indeed. Got myself spread between BTC, BCH and so many others in case of shit like this.

I'm sure we could all use your suggestions on what might whether an exchange drop event like Mt Gox best.

Do we really have to convert back to fiat?

If only someone had created a cryptocurrency tied to the dollar, with full backing...that would be really useful right now...

An event like Mt. Gox would create the ultimate buying opportunity, so there is that silver lining. Oddly enough SBD would prob be one of the safest places, cus it's "tied" the the dollar just less that whole full backing thing.

But honestly, even after the segwit HF cancellation I dumped some BTC into USD as many of the other coins were volatile as shit too.

It's the wild wild west my man! Only place you can 10x your money in less than a month and also lose it all in days. I accept the environment that I am in, both good and bad.

I love your opening salvo, "what we think we know". There is a certain schizophrenia and madness to this frenzy to forecast the future. Our brains are so inundated with information.. It is a comfort that people such as yourself try to take it on and help the rest of us. Thank you.

I hope it helps. Be careful out there. Might be no crypto is safe. Diversify out of BTC at this ATH is my opinion. Fundamentals look bad and rumors sound nasty. Holidays are often times when "bad" events trigger in markets and due to thin trading, have outsized effects on price.

Bitcoin is such a name-brand now that it will take a bigger event than this to kill it.

I'm pretty sure that's why they named Bitcoin Cash, Bitcoin Cash. However, I hope you are right, this will not be a good event for many people at all.

I bet if Coke failed, people would take faster to "Cohke" than "Pepsi".

Or Choke..

Great post and well written. Tether is a nightmare waiting to happen. Its no wonder why smart money is moving over to bitUSD and bitCNY at least that is backed by around 200% of its value and no counterparty risk.

Sorry, I'm not a big fan of BTC but this post seems like a BitcoinCash fanboy post :( It's targeting the areas BTC-supporters aren't defending. BTC-fans' main argument is philosophical, not technical. Which -again- I don't support.

At the same time, Bitcoin Cash's technical attack on BTC is meaningless, as there are loads of coins that are technically way better than Bitcoin Cash :)

A little more unbiased posts would be welcome.

You should probably check out my comments above. This post is not intended as serious financial advice, but a warning. You'll note I said no crypto was going to be safe in such an event. Considering Bitcoin is indeed a shit-coin now, I had to defend that statement at least a little.

I just gave you fundamentals and rumors for why BTC is a sell, and one option to buy. Do with that what you will.

"If Bitcoin is not a shitcoin, why do (almost? not even sure I need the qualifier...) all the other top coins have faster transactions AND lower fees? Why is Bitcoin worth 8x what it was a year ago, despite performing all of its functions more poorly (other than speculation?) Did the whitepaper say "Casino Shitcoin" in it somewhere that I missed?

I was BTC's biggest proponent for most of its life, while it had fast transactions and almost no fees. Now, I can't throw a dart at CoinMarketCap without hitting a crypto that has BOTH faster transactions and lower fees. We're typing across the platform of one right now.

FWIW, I think there are many options better than Bitcoin Cash on fundamentals, but the market is not always huge on fundamentals. Monero is one. If you're ok with higher risk, there are many more worth considering.

What you call bias, I correctly call telling it like it is. The fact that Bitcoin Cash is the best current alternative to fulfill the market's fickle need for name recognition and network effect, and the fact I have put my money there, does not detract from the obvious points of fees and transaction times."

BTC (which I own literally zero - I'm an altcoin trader), isn't a shitcoin and you know it. Slower and more expensive transactions aren't the only elements to consider when talking about crypto-assets. Name recognition aside, which of course it has, it's also the gateway to almost all other coins. It has a much MUCH larger community in terms of both philosophical supporters and developers (compared to BTCash).

I can't believe you made me defend Bitcoin! Honestly, to me, any hoarding-rewarder coin is philosophically wrong and that includes Bitcoin and Bitcoin Cash. They're also opposite of what they claim to do; instead of seriously decentralising, both coins take the centralisation away from governments but give it to miners or a few wallets with hoarding goals.

PS - I hope the fact I put this early in my article clarifies my intentions:

"See the link dump at the bottom to do your own due diligence, but leaving your coins at exchanges throughout this holiday weekend may be poor judgement."

Dump your barbarous relic and become a virtual zillionaire!

Is everybody in? The show is about to begin.

When I got a notification saying they were cutting their ties with US residents, I knew something was up.

@lexiconical it seems I need time

for reading. I need this information.

thank you for sharing

If you're holding Bitcoin, I'd definitely read the whole thing twice!

I'm new in Steemit. I want to understand

about bistcoin. thanks @lexiconical

Hey @lexiconical,,,, it's always great to see your report and always have investors to take the right decision for your post you really done a great work

Thank you, robert!

Nice information well what do you say about Btc adresses fee locked?@lexiconical

It's a very, very small amount of Bitcoin. Under 1%, but it is a large number of addresses.

If fees ever come down, that Bitcoin can move again.

cool

A logical and in-depth analysis confirms the credibility of your say Thank you for your efforts

SYDNEY/MOSCOW: Bitcoin’s relentless and volatile rally shows no sign of abating, with the world’s largest cryptocurrency defying growing bubble fears to hit yet another milestone.

Bitcoin rose as much as 6.7% to a record $8,224 as of 9.27am in New York. It’s been a tumultuous year for the virtual currency, with three separate slumps of more than 25% all giving way to subsequent rallies.

"The inflation in this thing is massive," Luke Hickmore, a senior investment manager at Aberdeen Standard Investments in London, said in an interview with Bloomberg TV. "When will it collapse? Who knows. It will cause a lot of pain."

Even as many sceptics call the asset a bubble waiting to pop, it’s becoming too big for many on Wall Street to ignore. CME Group Inc, the world’s biggest exchange, will start offering futures trading on bitcoin next month, while senior executives at Goldman Sachs Group Inc and Citigroup Inc have said they are researching cryptocurrencies and the blockchain technology that underlies them.

Recent volatility has stemmed from a pickup in people switching to alternative virtual currencies, notably bitcoin cash. That’s gaining popularity due to lower transaction costs and faster speed. New cryptocurrency iterations are springing up as disagreements over bitcoin’s design persist and opportunities for making a quick buck prove hard to pass up.

Bitcoin cash dropped 0.6% on Monday to trade at $1,184, down from a high of $1, 388 on Nov 12, Coinmarketcap.com prices show. Bitcoin has advanced more than 700% this year and now boasts a market value of more than $130 billion.

"I find it remarkable and somewhat frightening how, no matter how much bitcoin is pummelled by sellers, it simply bounces back even stronger," said Lukman Otunuga, an analyst at currency brokerage ForexTime Ltd. "Will bitcoin hit $10,000 before year end? This is the question every investor is asking."

Nothing to see here, folks. Totally normal market.

Man you never seem to dissapoint, your posts are always full of valuable info and tend to be super informative. The only thing I could not conclude from your post is why is tether a problem for BTC. And why would it have such a huge negative impact on BTC if it came crashing down? Pls elaborate.

Thanks in advance!

Hi,I am Bangladesh and I upvote you.Wow thank you for this information. I think you are doing a best work on steemit.Really this blog is very information to other.GOOD LUCK✌✌

Hah, a pleasant surprise that it was not!

such depth analysis and understanding are unbelievable.You are a piece of uncut diamond I can say.

Thank you for the compliment.

@lexiconical This post concerning these centralized exchanges and the shit tether coin is a perfect example of why I threw so much at Bitshares and why decentralized exchanges are high on my list of things im looking out for.

BTC cant keep up forever with these fees and transaction times. It will end eventually. When? No idea. Just eventually. I firmly agree with you in that BTC is nothing more than a shit coin now. Also, very interesting how the value correlates to Tether produced. But, that isnt necessarily a bad thing is it? It just means more USD was coming in to the market? Correct me if Im wrong please.

Hi @lexiconical .All is well done there is nothing to say, I'm under the impression, I want to review more and more, great information. All is well done professionally.

USDT NEEDS to be audited. We need proof that it is truley backed dollar for dollar for token.

I refuse to take part in any use of USDT until they can show their community some proof and so should everyone else.

This post has received a 19.80 % upvote from @buildawhale thanks to: @lexiconical. Send at least 1 SBD to @buildawhale with a post link in the memo field for a portion of the next vote.

To support our daily curation initiative, please vote on my owner, @themarkymark, as a Steem Witness

This post has received gratitude of 26.19 % from @appreciator thanks to: @lexiconical.

will definitely check..Thanks

Good Post, I'm continuing to buy more BTC. This crypto is going up, up, up!

u need to read closer

With you bro on the BTC to BCH move. Wish I done it sooner. Missed out on the quadrupling.

So, how about your feelings? I'm ready for that. What do you think @lexiconical

BTC is the future of Money.

Excuse me sir, may I ask why did you chose Bitcoin Cash instead other cryptocurrencies like Ethereum?

I'm very worried about Bitfinex/Tether actually. The main thing is I have some IOTA on Bitfinex and I don't trust them much at all. However IOTA has continuously had trouble with their wallets so I kind of don't trust the private wallet situation much either...

The alternative is transferring it to Binance and hold it there.. But I am not sure if that is much of an improvement per se. What do you think I should do with my IOTA?

I've been with Binance for a good while now. I love them! There was only one time where I was unable to get to my account due to high traffic i believe. which is no good. but other than that theyve been great for me.

I never understood the concept of Tether. Even from the beginning it sounded like a scam to me. The fact that you can buy a cryptocurrency "backed" by the dollar but can't convert it back to fiat basically makes the backing useless.

What Coin has the best fiat entry ratio currently?

I just started recently with crypto so I went for BTC to buy and traded those for some of the other coins I have now.

I´d like to buy some more different coins I see potential in, so I wonder, would it be wise to start from fiat to something else than BTC? (Due to BTC price so high)

Thanks guys!

Tether will vanish without a trace eventually. There is no backing of one to one physical dollar as claimed. Even if it does, usd is itself not backed and hence the original reason we are into crypto. So it's a full circle, dog chasing its tail. When that event happens, it may or may not cause a major general correction. Then after, things will be up again but another tether will appear. It could be Canadian dollar tether. Yen. EURO. Anything. Someone will copy this method.

How much will move the Bitcoin during the thanksgiving? Let's try to estimate this.

My estimate is it is going to be over 9.000$!!!

This wonderful post has received a bellyrub 43.71 % upvote from @bellyrub. Please make sure to vote for my pops as a witness @zeartul,Here

This post has received a 43.46 % upvote from @boomerang thanks to: @lexiconical

@boomerang distributes 100% of the SBD and up to 80% of the Curation Rewards to STEEM POWER Delegators. If you want to bid for votes or want to delegate SP please read the @boomerang whitepaper.

Thanks for the heads up.

It is refreshing to see someone with similar views on BTC. BTC seems to have really lost it's way lately. I remember only a few years ago one of the selling points of BTC was "micro transactions."