"I also remember the Ether price globally being resilient and strong afterwards with respect to recovering from that drop. Fortunately, I believe that the impacted exchange made good on compensating those who were affected by that incident. I'm not saying things would be the same for BTC."

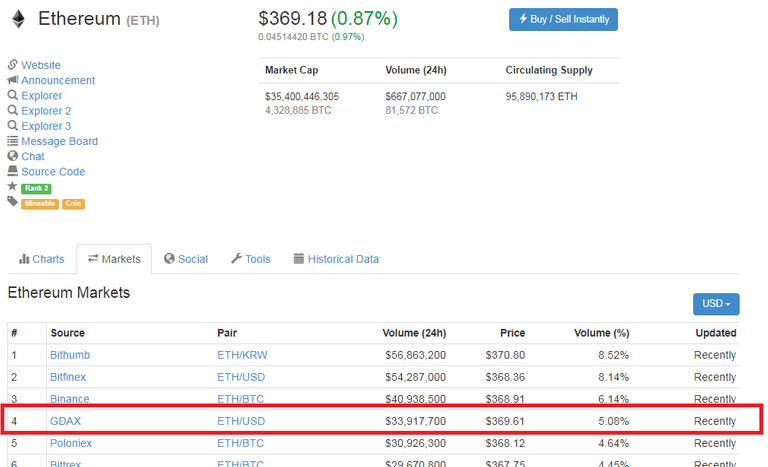

Correct on all points. I am worried the same might not be true of Bitcoin. I wonder, how price-setting was GDAX at the time for Ethereum? Today, it is only #4:

"I now understand that you had an ugly divorce with Bitcoin and will try to keep your devil's advocate focus in mind from now on. Without knowing your history, it's not out of the question to interpret how you opened with some Bitcoin bashing how you see em, and close with whispers of I told you so as FUD. You reach a lot of viewers, and not all know about your track record/efforts/warnings/advice at top of mind. I edited my post because I missed the whisper comment at the bottom, which set me off by feeling like taunting."

All fair points well taken. I'd be lying if I said I didn't use inflammatory language sometimes to get people's notice in the "sea of attention."

"People have debated Core vs Cash forever"

True, and you could easily interpret my post as more of that.

I'm more interested in debating Core vs ANYTHING. It looks bad compared to every coin I look at, in terms of fees, privacy, and transaction time. This should REALLY WORRY all of us, because it means buyers have no idea what they are buying, and BTC is floating on basically hype and name recognition. r/Bitcoin users are telling new users they should buy LTC instead because of the fees...that sounds like terrible precedent.

"I think a lot of the coins you hit with darts have far less adoption and demand on their systems."

Also great points. However, Steem is a monster for transaction numbers, and it's fast and practically no-fee. Just one example of a more load-bearing chain.

"It's wise for everyone to be diversified and prepared to accept that it can all go to $0. That's why we ideally play with money we can afford to lose."

I really don't want to sell any into fiat, but I'm a bit worried. Trying to talk myself into it. Bitcoin Cash could quadruple, or quarter, in an event like this, but I bet most sub top-10 crypto is going down hard.

@lexiconical as you said "I really don't want to sell any into fiat, but I'm a bit worried. Trying to talk myself into it. Bitcoin Cash could quadruple, or quarter, in an event like this, but I bet most sub top-10 crypto is going down hard."

@lexiconical you are right but you are not the only one worried, every one holding on tightly for a gain