On Sunday, the Weekend Australian joined the slew of big media publications worldwide who are serving their readership by sounding the alarm about the life-ruining, world-shattering, state-dismantling dangers of cryptocurrencies.

The author of the piece, Alan Kohler, makes his living by giving traditional investment advice. Who would've guessed? You can read the article here. Or, you can save yourself the nausea and just read the most pertinent excerpts, along with pithy commentary provided by yours truly.

Alan does not waste time cutting right to the chase. He has our best interests at heart. He's trying to save us from financial destruction and a world without roads. And so before he even gets a good head of steam built up, he warns us of the dire truth: not only are Bitcoin and other cryptos a SCAM, but they were created by anarchists in order to destroy the monetary system.

In his own words:

...[the dotcom speculation surge of the 90s] was a bubble then, and this is one now. In fact it’s worse: it’s a giant scam.

Or else it’s a sort of global counterfeiting conspiracy, carried out by anarchists intent on bringing down the global system of money and government.

Yes, Alan. You've put your finger on it. Cryptocurrencies are a vast anarchist conspiracy to decentralize money and free people from their government chains. And, happily, it's working.

I'm constantly amazed at how many people view anarchism with a pearl-clutching, brow-sweating paranoia, convinced it is synonymous with doom and destruction; while simultaneously placing total trust in an institution which is responsible for more death, theft, and oppression than any other in all of history.

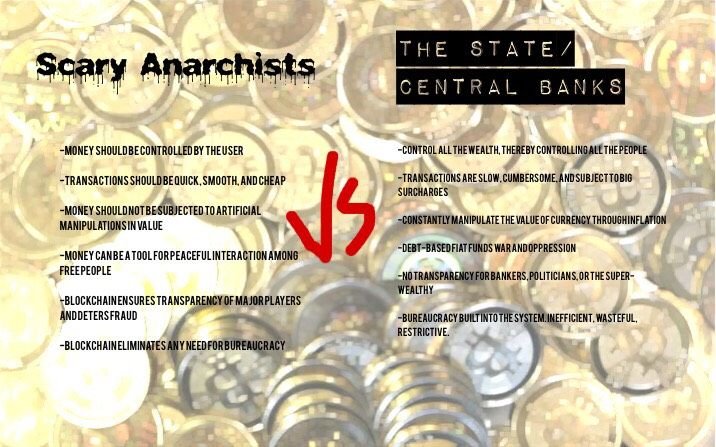

So, Alan, let's look at a brief comparison between the goals of these scary anarchists on the one hand, and, on the other, the actual results of shifting responsibility for the maintenance of civilization onto governments and central banking.

I really don't get the appeal of the government/central banking system. It must be because I hate roads.

Next, Alan draws a comparison between Australia's gold rush and today's cryptocurrency miners.

And here’s another metaphor: it’s like the Gold Rush of the 1850s, because then, as now, the fortune hunters were mining money.

I think this analogy has a lot of potential. Let's see where Alan goes with it.

In the 19th century, gold really was money, directly convertible, and the diggers in Victoria could mine and pan it without too much trouble, or capital. The modern miners of cryptocurrencies use stupid amounts of electricity and are hoping their “coins” become money one day. For the moment they are just tokens for speculating with.

Okay, but there was still an awful lot of speculation involved in gold mining, right? I mean, they didn't have the modern equipment required to determine if the land or water that they were digging around in had enough gold to compensate them for their time, effort, expenditure, and opportunity cost. Actually, I'm pretty sure a lot of people invested really heavily into mining during both the Australian and American gold rushes. A lot of trouble was went to, and a lot of capital was put out. That's why it's called a "gold rush", and not a "gold leisurely pace".

And wait! Today, cryptocurrencies really are used as money by many people. AND they are directly convertible into just about any currency you can think of, state-issued or otherwise. Just last week I paid for a professional service using a combination of Bitcoin and Ether.

But I guess that's just a barter arrangement in Alan's book.

I guess it just depends on what your definition of "money" is. Clearly, for Alan, something can only be money if it is issued and monopolized by a central bank. Whereas, out here in the real world, money is anything you can use to trade with someone who has an item you want, when you don't have an item they want that is of equal value.

Ah, but here's the kicker:

Gold and cryptocurrencies have two very appealing things in common: they are truly international, and can’t be devalued by governments using inflation as a form of taxation — they mostly go up in value instead of down, like money does.

HOLD ON. Didn't you just say that gold used to be money in the 1850s??? And if that was true then, how is it that gold has since lost the attributes that made it suitable as a currency?

In fact, aren't the two appealing qualities you mention (internationally standard and impervious to inflation) two of the very most important things we should want from a currency? And why the hell would anyone prefer a currency that always goes down in value over one that generally goes up?

Also, I'm surprised that Alan actually comes out and admits that inflation is a tax. How can you be completely aware that central bank issued fiat erodes your wealth, and still think it's the best way to run a monetary system?

Oh, never mind. Alan's got this all figured out.

...when gold was money, up to 1971, the supply was effectively unlimited and the price was fixed, whereas with bitcoin and ethereum (not sure about the 700 or so other cryptos) the supply is limited and the prices fluctuate.

That's right. Gold, back when it was money, didn't fluctuate much because it enjoyed a magically unlimited supply.

Alan, you gotta give me the dirt on what kind of unlimited matter generator those people in the 1800s were using, because I think we should probably put it back in use. Was it leprechauns?

The lack of fluctuations didn't have anything to do with the fact that several of the world's most popular fiats were, at that point, tied to the gold standard. No, not at all.

What do the speculators think they are doing, apart from playing the old “bigger fool” game? They are hoping that the world’s governments and central banks take leave of their senses and make cryptocurrencies legal tender.

Um, no. They're anarchists. They're hoping that cryptocurrencies will disrupt fiat currency as more and more people realize how much better they are. No legislation needed. BUT, if Japan and India and a few more countries want to recognize crypto as legal tender, it's probably not going to hurt the cause.

Since the supply of bitcoins and ethers is limited to 21 million and 230 million respectively, for either to become global legal tender — so that you could buy a cup of coffee with them in Zagreb or Anchorage — they would have to be divided up into millions of smaller units. The more that happened, and the more that small bits of bitcoin or ether were used for transactions, the more each whole unit would be worth. The problem is that money can’t have a limited supply, can’t be unstable and can’t be separated from government and central banking.

BUT I THOUGHT YOU SAID GOLD USED TO BE MONEY! PEOPLE JUST WANTONLY DUG IT OUT OF THE GROUND AND USED IT TO PAY FOR THINGS. HOW--WHAT--

Oh, right, the leprechauns.

But, Alan's not unreasonable. He tries to keep an open mind about these new-fangled things the youngsters are doing these days. He even allows that he might be mistaken.

(At least I think the right word is “can’t”, but I’m conscious that we used to think that bleeding was the right way to treat sick people, and that you can’t have a wireless phone that you instruct verbally, or a car that drives itself, so “can’t” is a dangerous word these days.)

Yes, exactly, Alan. And it seems like only yesterday that out-of-touch commentators such as yourself were going red in the face shouting about how Uber and AirBnB would never be workable alternatives to taxis and hotels. Or how the internet was "just a fad".

I'm reminded here of an old saying.

And Alan does not pretend that central banking is without its own problems:

...although the value of money is fairly stable, it tends to devalue over time as a result of deliberate inflation. Central banks have been trying to get inflation up for a decade, in order to reduce the face value of the world’s excessive debt. Following the adoption of independent “price stability mandates” by central banks in the 1970s and 1980s, prices have been anything but stable: inflation has averaged 3.5-4 per cent per annum, dramatically reducing the value of money ($1000 40 years ago would now be worth a quarter of that).

Okay, I'm so confused. On the one hand, you say that cryptocurrencies aren't money, because their value is unstable. On the other hand, you insist that central bank fiat is money, even though its values have been unstable since the 1970s. Which is it, Alan??

But now we get to the meat of the matter.

Anarchists will destroy the world using cryptocurrency (which is a big scam, btw), unless something is done.

So those pushing for non-fiat money, that is money not controlled by central bankers and/or politicians, have a point: under the current system, governments debauch the currency for their own purposes and periodically banks blow it up through greed and incompetence. But the people trying to build an alternative system are basically anarchists.

Oh, the horror!

So what's the solution, Alan?

...global governments will soon need to declare that cryptocurrencies will never become legal tender, and legislate to that effect. You can play with them, and have fun trading and gambling, but actual money? Nah.

Heh. Good luck with that, Alan. Try and stop me from paying with or accepting Bitcoin as payment for goods and services. You can't. That's what's so beautiful about decentralized money.

I love you, Steemit!

Hi! My name is Leslie Starr O'Hara, but my friends call me Starr. I live in the mountains of North Carolina and I write humor, fiction, musings, and essays here on Steemit.

Upvotes and Resteems are amazing! And thoughtful comments make me all fluttery.

Follow me @lesliestarrohara ONLY if you like to laugh!

Magnificent. It's like he's on the cusp of working out how great it is, but his religion won't let him quite get there.

Exactly! Silly statist...

It's funny -- I've never understood how the same people who abhor evil "monopolies" and crow about how the government is necessary to bust trusts don't seem to be capable of seeing that they are busting trusts with a monopoly.

And the same people who claim that monopolies are bad because they lead to a combination of the lowest quality at the highest cost the market will bear stoutly insist that some things are so important that they must be monopolized -- to protect their quality, of course....

It's like they are so intent at getting the dog crap smell off the tile, furiously scrubbing away at the grout with a toothbrush, that they don't realize that what they are smelling is the big gob of it that got stuck to the tip of their nose when they wiped off some sweat.

Great post -- love your style!

Monopolies are things that only happen outside the purview of government, didn't you know? Just like how money is something that can only be issued by a central bank.

Oh of course! What was I thinking.... ;-)

"What are you fools doing with your pretend money? You're supposed to be playing with my pretend money!"

Wonderful post, with funny style but full of knowledge!!! Best regards, I´ll follow you

Thanks, @humoalex! I'm glad you enjoyed the post.

It´s a pleasure dear friend Best regards and a hug from Venezuela, from the other side of the World!!!!

His grasp of economics seems to be better than his grasp of geology...

But not by much

Enjoyed your post a lot :-)

Thanks, @bubke

Great Post! I love the fact that the anarchist spirit is still alive in crypto-currency world.

And it's more than that: cryptocurrencies are anarchist by nature. Now the whole world is full of people who place high value on a commodity that erodes state power and increases individual autonomy, while making lots of anarchists very rich.

It doesn't matter. I'll still love crypto!

Funny... :)

Upvote :)

Plz see my account @kakilasak