When Henry Ford built the first car it was the most popular 4-wheel combustion vehicle. The invention was something that touched magic. It was also the underlying blueprint for all other cars that came shortly after. Today, not many people own an original first model Ford. If they do, they keep it for sentimental value — or worse — as a very expensive antique. Not as a utility.

Bitcoin is very similar to the early Ford T model. It was the first coin that introduced the world to the blockchain universe much like Ford introduced us to cars. Nonetheless, much like Ford could not upgrade the first cars into the next generation vehicles the same fate awaits Bitcoin. It arrived 8 years ago and due to the fast pacing development of blockchain technologies it is becoming obsolete because there is only that much we can built on it in order to get it upgradable (and functional). Which reminds me. My dad spend the other day $1500 to paint a car that is worth $600. Why? Sentimental value.

The recent forks and small additions to the technology are just desperate attempts to upgrade something that is no longer upgradable. The early developers of Bitcoin support and preach about it because they have a massive stake as earl adopters. They hold Bitcoin. They also happen to control many other alt coin ventures as angel investors. Bitcoin is still the funding tube for everything else in the ecosystem that found them to be kings.

In addition to this, people get their feet wet with blockchain technologies by first buying into bitcoin and then spreading their capital into alt coins. I decided to write this post at an alt-time high to demonstrate the point of my argument. If you asked me to do the same a few years back, I would have a completely different analysis since there were no revolutionary breakthrough coins that had blazing fast transactions, variant block sizes or smart contracts embedded in their code.

Most people that entered over the last few years and caused this massive spike in market cap have no clue about the alternative technologies that are being developed in the blockchain world. Mainstream news that serve as the gateway to the general public almost always cover the spike in Bitcoin rather than the spike in blockchain technologies. People buy the news, not the technology. This is what is driving and keeping the price so high.

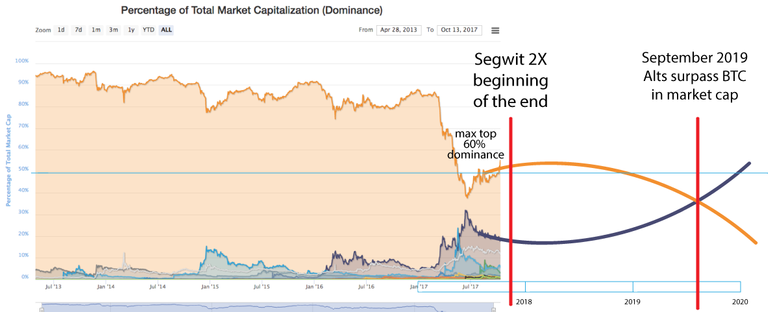

As the market cap increases we will witness a steady drop of BTC dominance and a rather crazy investment into altcoins that will overshadow May of 2016. It will be slow bleeding that will last over a year. I don't believe Bitcoin will serve any purpose in the future other than an antique for Bitcoin evangelists. Holding Bitcoin will be similar to keeping your wealth in a precious rare rock that weighs a ton. It will be cool to look at but hard to secure or transact with. The decentralized world demands utility and speed not relics that make life harder. Yes it was the first, yet it was revolutionary but the world will move ahead as new and more efficient coins dominate the market. More importantly more and more coins ensure true decentralisation which is the whole point of blockchain technologies.

I understand your argument, but I think you may be under-valuing the network effect when it comes to money. The USD isn't a great ledger system, and it's being inflated every day, but everyone still uses it as the world reserve currency because of it's massive network effect. Well, that and the aircraft carriers / petrol dollar / military industrial complex backing it up with threats of violent force. Now, I get how we should be comparing cryptocurrencies to cryptocurrencies here, but I wanted to give that as an example to show the power of the network effect when it comes to money.

For more on the "what gives bitcoin value" argument, see @sean-king's argument which I recorded to audio here. It's all about the network effect and Bitcoin's is huge.

Also, Bitcoin is open source. Changes, even difficult ones, could be made if the network decides it's necessary. As those altcoins rise, it will create more pressure to upgrade Bitcoin to compete. Anything is possible. We're seeing this with Ethereum talking about moving to proof of stake. That's an example of a huge change which can be done in open source projects. Unlike the Model T which was physical, protocols are just software code and can be changed at anytime as long as the consensus of the miners allow it.

That said, I recently had a transaction hang for 48+ hours and ultimately had to push it through with $9+ in fees and the "Child Pays for Parent" trick. I'm not a huge fan. I much prefer the newer technologies that are coming out. I do think they will take quite a bit of bitcoin's marketshare over time and maybe two years is a good timeline for that. Still though, most people have no idea what cryptocurrency is. Those that do, often think Bitcoin is the only one. It will take time for information to spread enough for people to reject Bitcoin as a good store of value.

Thank you for your input man. I am sharing your views as well. The last part about people being ignorant about blockchain is what is important. Bitcoin reached these levels with a very small % of the population. Imagine what would happen when alts hit 10-15-35% of the population — from businesses to programmers. I believe Bitcoin's overshadowing is inevitable (considering that Blockchain moves to massive adaptation).

We are 5 months in @lukestokes

What’s your point? Check back in five years, not five months.

Well, I called the Alts December pump + not even halfway to the flippening yet. 2019 is the time for me to come back. not 5 years.

To be clear, I'd love to see BTC's dominance go away. In many ways it's like the petrodollar, controlling the prices of all other cryptocurrencies since they are all traded on BTC pairs. I prefer to see good decentralized exchanges with volume trading in every pair with simple-to-use bots anyone can hook into to automatically arbitrage the markets.

Will we get that any time soon? I'm doubtful. Predictions about what the future markets will do are always... iffy. Maybe you're right and September 2019 will be the flippening to altcoins. Already, however, we're seeing some divergence from your image:

But who knows. It's early. I'm fine with checking back in 5 years and in crypto currency terms, September 2019 is a decade away. :)

My image has a huge zoom out and surely i can't draw the entire path from last year to q3 2019. BTC will come even lower in the coming months and Eth will start gaining traction. There is no other way really.

Thoughts on posts like this? Do you think this is just maximalist idealistic thinking and they will be in for a rude awakening by mid next year? Maybe EOS will eat the world. :)

Or how about this one?

Never underestimate the network effect. That's probably the #1 selling point of Bitcoin. Everyone in the cryptocurrency scene can accept and send bitcoins. It's used as the gateway to and from fiat for quite many.

I like to compare Bitcoin with IRC. Back in the 90s, everyone that was chatting on the Internet would be connected to the IRC network. In 1996 the network was efficiently split in two parts due to disagreements on the obscure details of protocol development - and I'm quite sure that of all those remembering the split, very few remembers what the argument was all about. The split followed geographical borders pretty much - making it very clear that the very most of the irc server administrators didn't really look objectively into the arguments and technicalities and made up their own mind - that's just what we're seeing with Bitcoin too, I believe most big-blockers and small-blockers haven't really tried hard to make up their own mind based on the technical arguments and objective facts, they just happen to trust and believe in some people, while distrusting the others.

The utility value of IRC fell when users experienced that some of their chat-friends ended up at the wrong side of the fork.

In 1996, ICQ also appeared. Compared to IRC, I think it was quite retarded - i.e. no group chat, just person-to-person-chat, users identified by numbers instead of easy-to-remember nicks, and worst of all - it was a centralized, closed commercial silo. I experienced that quite many of my IRC-friends stopped being on IRC, they told me to install ICQ to get in touch with them. I won't say that the network split was the only reason, but I believe it was a major part of the reason why people went to ICQ instead.

In absolute numbers of users, IRC probably peaked around 2003 - but as for the percentage of the internet population being connected, it probably peaked in 1996. ICQ outpaced IRC very quickly.

Where is IRC today? Well, I do use it, and I'm not the only one ... but I do admit it is indeed quite bad, very little protocol development since 1996, quite bad security-wise, and quite many bad design-choices. Unfortunately the alternative to IRC has become a jungle of alternative chat-platforms, most of them commercial centralized closed-down silos, some few alternatives based on open source and open standards.

Anything Bitcoin can do, some alt-coin can do better - the problem is just that if Bitcoin would fail (arguably, for the payment usecase - the very usecase bitcoin was supposed to fill - Bitcoin has already failed), there would not be one alt-coin to fill the vacuum, there is indeed a jungle of them, there wouldn't be any universal agreements on "let's use this one" ...

Cosmos, Kyber, EOS, Wanchain will make the network effect irrelevant. how long?

well...like i said. in about 2 years.

I totally disagree. Bitcoin will remain king for a very long time. I never should have spent some of my bitcoins on steem, or any other shitcoin for that matter. The development team behind bitcoin smokes any other crypto development team on the planet right now. The altcoin circlejerking on this site has reach ridiculous levels. I don't have the time or energy to explain it all right now, but go watch Richard Hearts most recent youtube videos if you want to be more informed about why you are just wrong.

I watched them actually. If you noticed summer of 2019 is pretty long time still to be king. Also don't forget that many of the bitcoin gurus are moving to other projects to maximize their profits. Once regulation comes, once governments start issuing their own coin, bitcoin won't matter than match and all exchanges will bow. I don't like it but it is what it is.

you still disagree?

How likely is it that Bitcoin will become obsolete? - Andreas M. Antonopoulos

"hard to secure or transact with" - I disagree. It can be 99.99% secured and the transaction will be just as easy as other coins.

Will BTC get replaced? Of course. Every tech does at some point.

The fees, slowness and lack of progression of the Bitcoin protocol is what the author is more or less talking about here if I am not mistaken. Generation 2.0 blockchains are upgrading at a very rapid pace compared to Bitcoin. For example, ETH has two major hard forks schedule shortly and another one within the year transitioning from proof of work to proof of stake. Its my belief and many others that have been in the space for a while that mining blockchains are similar to the Model-T. Yes it still works. Even today a Model-T still gets you from point A to point B. However, the end user will still choose the Tesla or the Camry if they have the chance. The Model-T was a revolution at that time but eventually got replaced due to the fact it only came in black and was not upgradable. Is was like a one function vehicle similar to how Bitcoin is today. Slow expensive and not very user friendly along with a host of governance and funding problems that lead to a variety of protocol inefficiencies.

fees are high. this is after all why BCC was created..and failed

Bitcoin Cash hasn't failed yet, if anything it's just getting started. It's possible your thesis is right and Bitcoin Cash will overtake the legacy coin as it seeks to provide more utility, speed, and lower costs.

BCC hasn't "failed". The price is being suppressed at the moment, but that means the banks are scared of it, not that its failing.

I support BCH and the reason I think it failed is the FUD and Dash. Why bother with BCH when Dash offers the same scale plus Privacy+1.3second transactions and excellent governance that also has a self funded treasury. Also there are my other 2 favorite currencies NEM and PIVX.

Why switch to BCH when you can switch for something even better.

Bitcoin cash hasn't failed at all. :/

Hey, @kyriacos.

Did you write to golos.io?

Your post was stolen?

See more: https://golos.io/ru--apvot50-50/@naminutku/bitkoin-ustareet-ranshe-chem-vy-eto-poimete

The one issue Bitcoin boosters will never ever address is the possibility of government regulation and what that will do to their "to the moon" trajectory.

The evil overlord agencies have yet to really put their foot down in the activities in the crypto space. In this day and age of budgetary shortfalls and ever increasing expenditures, do you really think they are just going to turn a blind eye to an asset that is trading outside their control?

But, "Bitcoin is Decentralized", "It's not just in one country, it's worldwide", "Bitcoin can't be controlled". I've heard all these arguments before. But, in the end, Bitcoins are useless if they cannot be converted into a local currency.

And, that is the choke point. Uncle Sam and his never ending string of alphabet agencies does not need to control Bitcoin, it only needs to control the conversion points. When that happens, Bitcoin $10K becomes Bitcoin $10.

Look at Amazon. Look how fast they caved to the States demanding they collect state sales tax. These states are all scrounging for revenue because of their rampant spending. When they figured out the they were losing revenue because the giant Amazon was beating the competition because you could by items state-tax free, they came after Amazon with a vengeance. In the end, Amazon caved.

Do you really think Coinbase or Poloniex will be any different???

Jamie Dimond says bad things about Bitcoin and it drops 20%. What do you think will happen when the IRS speaks up?

it's an interesting theory. I don't disagree; however, there's usually a first out of gate dominance that will prevail.

The key I think is that people see value in buying small portions of one Bitcoin to enter the market and use it as a currency. Time will tell of course. Personally, I glad to be part of it at this early stage.

I upvote all comments and replies on all of my posts to help my fellow Steemians earn Steemit rewards and gain more voting power. Consider doing the same.

You might have a point, I believe some coins will come and go but I do think crypto currency's are here for a very long time. Cheers mike

Bitcoins strength is that Is was first. Massive first mover advantage and network effect

I'd have disagreed six months ago, but damn, these hard forks are scary and pointless. If you have an alt, build it. Don't fork bitcoin again and again.

It's hard enough for noobs to understand as it is.

I don't know, maybe you're right, or maybe not.

IBM PC's knocked all the others out of the park. Yet IBM is out of the PC business today. The decline was a slow transition that lasted a decade or more. So it wasn't a shocking disruption. Still, today's computers on the market are the inheritors of the original PC.

I suspect some other coin that will fork off from Bitcoin will be the dominant inheritor because it will add all those bells and whistles that the great alt coins have. Contracts from Ethereum. Privacy from Dash. Etc.

My thoughts for today's age ...

Diversify.

I don't think so ... just like you can't add all the bells and whistles of a modern Tesla to the old Ford ... sometimes it's good to redesign something from the very start.

Software has the luxury of being edited, automotive engineering also can be edited pre production anyway, the finished products cannot be changed(Compiled Software, a Vehicle).

I agree with a couple others here that bitcoin will dominate for a couple years due to it's network effect and then as other altcoins allow visa level transactions and easier banking capabilities the flow out of bitcoin will trigger development to capitalize on the required hard fork like BCC allowing protocols to be upgraded.

I also think that bitcoin's slow transaction time has a benefit where it prevents the madness that is Wall Street NASDAQ Ultra High Speed Computer Computer Trading. While good for price arbitrage not so good for anyone honestly trading values.

At some point it's almost always cheaper to rewrite software from scratch (or replace old software with new software) rather than trying to fix old software. Software tend to turn into junk due to bad design choices from the start, due to code slowly into "spaghetti" due to "technical debt" as more and more features are added improperly and without sufficient maintenance, or because the programming language of choice is getting arcane or encourages the programmers to create "spaghetti code". I don't see the Bitcoin Core code being any exception.

Bitcoin is also a protocol. There has almost become a cult movement that changes to the protocol makes older clients incompatible ("hard forks") should never occur. The block size limit has been discussed for many years, perhaps we'll get an upgrade in November, perhaps not. Now, of all protocol improvements requiring a "hard fork", increasing the block size ought to be the least controversial and easiest thing to do - considering how difficult it has been to move this one, I don't have much hopes for doing other changes to the protocol.

Bitcoin has numerous design weaknesses and problems (personally I think the mining centralization is possibly the biggest problem) - SegWit was an attempt on solving some 3-4 design flaws. Well, I'd say it's more of a work-around than a fix. The main selling point of SegWit was that it's backwards compatible ("soft fork"), as such it's complicating the protocol as well as the software, generating "technical debt".

Everything considered, from a technical point of view, Bitcoin will never be able to compete with the best of the alt-coins.

Such trading will always occur "off-chain", typically on the bigger exchanges.

I like your post. Agreed. Today, I am contemplating at writing a post with a similar conclusion but with another twist to prove the arguments:)

Ethereum FTW!

How about no? :D

I think you may be right on that one. It was a total gamechanger till now but I think banks and governments are so sick of it that they're gonna fight fire with fire and design better cryptos and transaction systems than before and because they have the majority of the population informed they will eventually win. The thing is much time will have to pass for that to happen I think.

Really good post, cheers.

Nice thought process @kyriacos. I believe you have a point and are correct. The timeframe that this happens in will be more interesting. As a newbie myself it's a confusing world let alone without forks etc. I bet half the people owning BTC have no idea this is about to happen though. Adoption is still the greater means here so I believe we will see an increase in adoption next year possibly upto 3% which means for me at least next year BTC still has a lot to offer. I will certainly be watching with interest.

The amount of electricity required to mine Bitcoin will make it obsolete. There are more and better alternatives. The more people who come to this conclusion, and I believe that new people entering the cryptocurrency markets come to this conclusion much more quickly than people who had time to bond with Bitcoin in a less busy marketplace, the quicker will be the demise of Bitcoin. Only Bitcoin diehards believe in its primacy - it's a bubble. It's surging right now because if people buy it, they will get free Bitcoin Gold. After the November release of Bitcoin Gold, money will flood into altcoins. There are several coins I prefer to Bitcoin, including Dash.

It's interesting to stumble upon this article now that the opposite is happening. The marketing has consolidated into Bitcoin, while other altcoins are pretty much dead by now.

So let's buy Steem.

Of course BTC will become obsolete. If it didn't have a cult following, it would already be obsolete.

Im sure the sentimental value will be enough to keep it upfloat.. afterall a very old saying is that old is "Bitcoin" ryt.. :P

Interesting take that many are scared to think about. However, from my understanding all of the best people are working on bitcoin and I think there is still a lot of money to be made before a drop like you are mentioning occurs..

You are more than likely right but not because of the points made, IMO, but rather that the big turds are now raising their eyebrows and want total control as usual. The rats will figure it out and then have us all in one of those futuristic f*cked up movies we all watch and cringe over................

Everything has a purpose in life, and when, or if it is not needed anymore. It will disappear or become less popular. So yes, you do have a good point.

I disagree somewhat. Ford is still a brand even though the model t is gone. Also..were talking about apples and pears. Btc is a currency and store of wealth. Very different factors must be accounted for imo.

"blockchain" is the brand name her.

anything can store wealth really. it is not as if bitcoin is not volatile.

Naah..combustion engine or the concept of a car is blockchain imo.

Sure btc is volatile still but less than alts.

What is an ideal coin that hold value? In my opinion it should be like a fiat currency. Like monero or sumokoin

I never saw it from this perspective; making me see it like this makes you a smart person.

However i think bitcoin will maintain that number one spot for a long time leveraging on the first come advantage and i think there are already a lot of altcoins that could dethrone bitcoin. Just the right time to come is what we should be waiting for.

Instead BTC will be like an antique masterpiece which has more value than other items nowadays in the world. There is a chance which you are saying can become true. But mostly the first thing which happens always becomes the most expensive later on.

How much will the people spend to buy a top condition Ford model? We cannot even expect the price. The same would be with BTC

Bitcoin is being developed actively. If it keeps on evolving, it will not be obsolete for a long time ! However we can't predict anything in the Crypto World !

I do agree with you.

Bitcoin is just a kind of gold, we do not work every day with gold in our exchanges (most of us), we need one or a few different coins according to the kind of usage we make of it.

What is difficult technically is to be able to handle an important transaction volume while keeping the decentralization.

The problem comes to both the network bandwidth and mostly the data storage of the whole blockchain in such case.

Bitcoin will be obsolete about as much as the pen or pencil. I see it being used for the remainder of my lifespan at a minimum.

Well i guess not. Its the alpha coin the pre-requisite for other coin to follow

Lightning Network

Combining speed, low fees and decentralization is a genuinely difficult problem to solve with the blockchain. The Lightning Network will be a good partial solution for some use cases.

LN will help whenever it finally comes out? But like many experts have said for a currency to truly scale you'll need on chain and off chain scaling at the same time, where users choose which is best for them. Not forced to use off-chain system where trust is still involved. Let's say LN really takes off and gets handles mega amounts of transactions and all the sudden there is a scare where everyone decides the the need to settle on-chain when chain can only handle 7 transactions a second. Now imagine 1 million LNodes needs to settle on-chain. See the problem?

But like many experts have said for a currency to truly scale you'll need on chain and off chain scaling at the same time, where users choose which is best for them. Not forced to use off-chain system where trust is still involved.

I don't think the use of LN is intended to be mandatory. Secondly, no trust will be needed in LN.

Let's say LN really takes off and gets handles mega amounts of transactions and all the sudden there is a scare where everyone decides the the need to settle on-chain when chain can only handle 7 transactions a second. Now imagine 1 million LNodes needs to settle on-chain. See the problem?

I don't think that scenario would differ in any way from a scare without LN. When a channel in LN is closed all the transactions will be aggregated into one.

If multi channels need to close at same time it could a major problem due to the 7 transaction per sec onchain limit. Additionally, LN is not being used and not even ready. It could be 1-2 years before the average Bitcoiner can use it with a friendly user experience. Again, the public does care about ideology, they just want a product that looks and feels easy to use. Bitcoin so far is still very un-user friendly and does not scale. The core team has shown many times they don't care about user friendly or practical use. Its all about their ideology - them and not the user experience.

If multi channels need to close at same time it could a major problem due to the 7 transaction per sec onchain limit.

How likely would such a problem be? The problem is this: a single blockchain will simply not scale to the degree necessary for mass adoption without a) massive centralization or b) a mesh network on top of the blockchain such as the Lightning Network or the Raiden Network (to be used with Ethereum). It is possible, however, to utilize atomic cross-chain swaps. But then we're talking about multiple blockchains.

Additionally, LN is not being used and not even ready. It could be 1-2 years before the average Bitcoiner can use it with a friendly user experience. Again, the public does care about ideology, they just want a product that looks and feels easy to use. Bitcoin so far is still very un-user friendly and does not scale. The core team has shown many times they don't care about user friendly or practical use. Its all about their ideology - them and not the user experience.

Sure, the LN and other similar solutions not ready for production. But they are not ready for any coin. User friendliness is more a property of wallets and not the underlying blockchain.

Which coin are you a proponent of?

Due to Bitcoin size and liquidity its def not going anywhere any time soon. I do think over time protocols that can self fund, self govern, market themselves, develop killer features and build big equitable communities behind them will go very far. There's so many economic incentives and features a blockchain needs to have to be truly successful. A lot of Bitcoin's future success will rely on scaling the problem of mining centralization. One of the main hurdles holding back coins like Dash and NEO is lack of big fiat exchange support. It was only until last year ETH got added to any fiat exchanges and only this summer before Asia adding ETH/fiat trading pairs. The decentralized exchange protocols could really change the game in liquidity and accessibility + the peer to peer fiat options under development. Once we see better ease of use crypto should really take off in developing world.

I agree about what you say about decentralized exchanges and the developing world.

But I still maintain that no single blockchain will ever be able to scale to the level necessary for mass adoption without very heavy mining centralization. I'd say decentralized exchanges and atomic swaps between chains in addition to mesh networks such as the Lightning Network are required for mass adoption. The value of Bitcoin may rise to the tens of hundreds of thousands per coin only if becomes generally accepted as a digital store of value ("digital gold").

I think for payments Dash will win a big market share because they are building an entire eco-system for a mass appealing payments platform. https://smartcash.cc/ is also very interesting.

You are right about Bitcoin being eventually replaced. I mean it could take decades like the Model-T did. The first generation of new tech usually always ends up getting replaced at some point. I do think with a an established currency its probably not going away any time soon due to network effects of money and liquidity. However, the flippening by alts is inevitable. It can happen by the end the year or later into next year like you suggest. Ultimately, the users will decide and not the Bitcoin core developers. In my personal view, the future of Crypto will be all about user experience, governance, community, usefulness, store of value, fast cheap n' and scalable payments, marketing, effective developer teams and budgets. These are just some of the attributes they add to the overall utility of a token and ultimately is directly correlated to its long term intrinsic value.

Interesting theory, right now bitcoin is king and i cant see anything alse taking that place any time soon. Other coins may eventualy overtake Bitcoin but it will always hold centimental value which is why i dont believe it will ever become obselite.

They will wake up. Eventually.

To late. Buy bts.

Could be true, I'm really not sure. You make a very strong argument, though Ford didn't disappear, in fact they kept innovating and growing as they needed to to survive. Not sure if BTC will or is even capable of doing something similar but we will see!

Glad to see someone having the same opinion; especially a whale. Most people who are into cryptos almost treat BTC as a religious idol. I'm pretty new to these stuff. But from the very beginning I've been calling BTC something that belong in a museum much like a steam engine, Nokia phone or Internet Explorer.

It's genuinely frustrating to see a coin with no internal harmony going through unnecessary forks and pointless upgrades (SegWit) while having zero significant protocol level developments coming up go to the moon while the rest bleed red. So glad to finally see ETH making some moves which actually have some real improvements coming up.

I find I strongly agree with your assessment of BTC. As the big money seeks safe havens, in this prehyperinflationary environment, BTC is having it's heyday.

Statements by heavy hitters in fractional reserve banking indicate that cryptocurrency will replace fiat, but those players aren't interested in games they don't completely control. If BTC won't be just as useful to them as fiat, they will make alts that will be, and this is just the way of the world.

In my final analysis, I don't think any one coin will become a new 'dollar' and dominate the currency markets. Rather, like conveyances today, a diverse ecosystem of blockchain based currencies will fill the various needs of users, although the ephemeral nature of code will enable practically unlimited variety to arise and execute myriad purposes.

It is through the practical uses of blockchain in infinite expressions that both security from plunder, and the dominance of coercive - and corrosive - substantial holdings, will simply replace any particular currency, including BTC.

I am sorry, when you start your argument with BS I tend to take the rest of your statement the same way.

Ford was the first to try and automate car manufacturing. Hence the black paint being the only colour choice, it dried fastest.

Cars/ motorised carriages had been around before Henery was born.

As for bitcoin I think it will go up and down like old fashioned money does.

BTC doesnt need to have any of the features your are talking about, its doesnt need flexebility or speed. It is Bitcoin in the end, all the alt coins you are talking about not only exist because of it, but directly derive their value and more from it. It is the backbone of the blockchain ecosystem, and I dont see even closely how it being is only getting started being regulated and adopted by masses and regulators or goverments going directly into stage of dinosaur extinction in over 2 years?? dude no ofence thats a bit over emotional statment , well at least basing on my subjective opinion. Peace wijuwiju. but generally I get what you trying to express, yet it ain't what you are saying in this post.

The model T might be gone..but Ford still exists and sells improved

'model T's.'

So you get paid for being the voice of doom!FN Amazing!

He is not the voice of doom. He is saying that blockchain is here to stay. It is truly revolutionary. But Bitcoin is outdated. It isn't moving with the times. Inside the Bitcoin camp, there are opposing camps, pulling and pushing in different directions. They do not have a unified front. They freely acknowledge internal dissent about the best way forward. Meanwhile, other altcoins are looking at Bitcoin and making improvements. New adopters might buy BTC first, to trade for altcoins. Some altcoins have amazing features which make promises for the future and have development plans that promote the altcoin's future continued utility, as well as enabling a ROI through PoS; DPoS etc.

Nope. You are incorrect. An automobile loses utility value as it ages, but a cryptocurrency gains dependability as it ages. If i had $100,000 to spend on a vehicle, I sure wouldn't buy it with the newest coin to market. I would choose the oldest, most reliable. Bitcoin!

Very good post CONGRATULATIONS friend i support for your every thing post,good luck

If anything Bitcoin will become the "gold" of crypto. It will act as a store of value as opposed to a transactional currency. There are so many better alts for that, but sentimental factor leads me to believe it will become a store of value.

At the moment, I buy bitcoins just to trade altcoins.

I think I get your point.

Totally agree! Any DAPP on EOS will be better than Bitcoin on a technological perspective. Bitcoin lacks governance, scalability, decentralization and speed. The network effect can disappear very quickly when EOS projects will start to gain momentum.

I wouldn't say this is 100% bound to happen as people sometimes are quite stubborn in supporting something and something should be clear - while both Bitcoin and other blockchains have their utility and utility is definitely a factor, what really gives any currency, investment tool or resource value above all is people's trust. And people often misplace that ;)

But it's only natural that Bitcoin will become obsolete sooner or later, after all it's really the first major attempt at this and aren't quantum computers coming to get us sooner or later anyway?