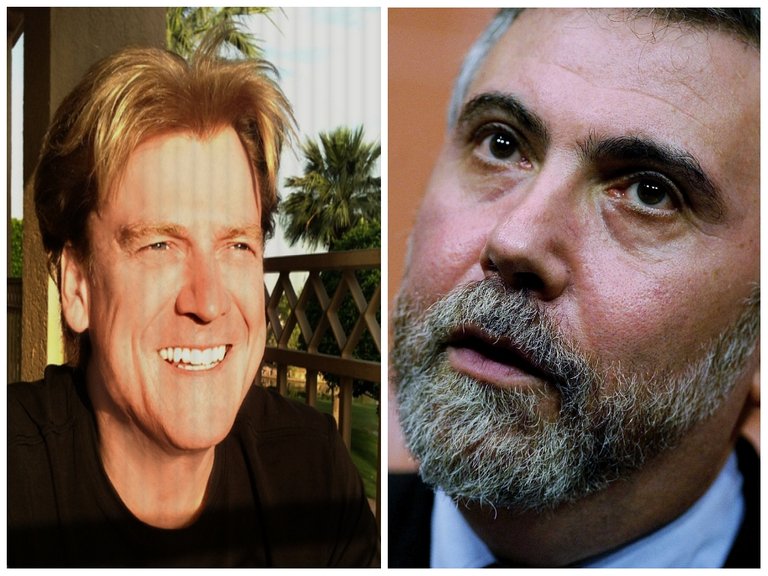

Patrick Byrne of Overstock.com.

Patrick Byrne of Overstock.com.

Byrne “[Krugman] went crazy about a decade ago, more than a decade.” After I asked him about Krugman's statements on Bitcoin Patrick said, “Well hopefully it will do exactly what Krugman said and destroy it.”

Patrick Byrne: You got to remember Krugman did some great work before he went crazy. But he went crazy about a decade ago, more than a decade. Anyways, I’m not speaking of just the Enron thing but assume your listeners know that on Wall Street he’s called Dr. Enron or Professor Enron because Krugman took a I think it was a $50,000 honorarium to speak to Enron people and very shortly after Enron turned into Chernobyl and Krugman wrote an op-ed in the I think it was New York times or maybe Wall Street Journal defending Enron but without disclosing his $50,000 honorarium highly unethical.

But setting that aside even though Krugman gotta remember these guys old wine new bottles. People like Krugman are all about saying that the market fails therefore you need more government, freedom fails therefore you need more control. That's even his academic work which has a lot to do with past dependencies and market failures. The reason this people want to explore and document and I believe exaggerate the tendency of the market. They never heard examine government failures it’s all about examining market failures. That’s his academic work and he basically wanted to be a Secretary of the Treasury or something on a council economic advisors. He never got that job and has made up for it by becoming more and more vitriolic, writing stuff that no economist I mean there are open letters from economists, like Harvard who are saying Krugman, you should stop calling yourself an economist. His policy ranting has just gotten so extreme it’s such a clear defense of Kaynesian magic money tree theory with no ties to reality that he has really even offended people within his profession so the fact that he doesn’t like Bitcoin is a really…a.. of course he doesn’t like it, he believes in unlimited government and if you believe in unlimited government you don’t want handcuff government by introducing a currency that it cannot make up with a pen stroke.

But as Jefferson said free government is founded in jealousy and not in confidence because it’s jealousy which makes us tie down, bind down governments with constitutions. He doesn’t want government to be bound and he wants unlimited government and therefore you don't want currency that Ben Bernanke or Jenet Yellen can just create once she feels that she need to goose the economy.

Kurt Wallace: Now, Krugman said that Bitcoin is evil is his article he points to a gentleman–

Patrick Byrne: He actually used that word Bitcoin is evil?

Kurt Wallace: His article title is “ Bitcoin is evil” and he quotes Charlie Stross saying that bitcoin looks like it was designed as a weapon intended to damage central banking. Money issuing banks with libertarian political agenda in mind to damage states ability to collect tax and monitor their citizens’ financial transactions. What type of impact do you think Bitcoin will have on central banking?

Patrick Byrne: Well hopefully it will do exactly what Krugman said and destroy it. Let me remind you that the central banking is.. we laugh at Soviet Union. We old timers look back and laugh at this complex society tried to run with $23 million prices set by some Mandarins and building in Moscow. And they really did they tried to run the whole society they had great big ledger books and they did all this Marxian accounting and tried to run society with prices being set by some Mandarins 23 million prices.

And how visible was that to us? And yet here the most important price our civilization faces is the price at which we discount the future against the present which is to say interest rate and in a case of that price that overwhelmingly important price that decides our own future. That price is being set by central planners just like Soviet Union being set by central planners at a central bank called the Federal Reserve.

Milton Friedman was asked in 1992 the Minneapolis Federal Reserve did their magazine interview with Friedman with a reporter ask him what’s the most issue facing America. And Milton Friedman said the most important issue facing America is how do we get rid of you the Federal Reserve and had a horrible track record and it never right and they missed all the big calls and they missed all the big turns. Their original function was because there were bank runs but the F.D.I.C. come along and probably does a better job on preventing bank runs by guaranteeing the deposits. It caused the Great Depression according to Friedman and Schwartz by contracting the money supply by a third and starving the economy just when it should have been provided liquidity. Now we had so many mistakes they’ve made horrible track record but in general it’s an institutional problem it’s not gonna get better with smarter people they are smarter people the people there Bernanke and Yellen are really really smart people.

It’s institutional design when you have central planning doesn’t matter how smart you make the planners. You can’t, central planning doesn’t work so one could only hope that Bitcoin will do some of these things that Krugman finds evil like destroy the Central bank but this is what so crazy about Krugman. He should remember the goal isn’t having a Central Bank the goal is we’re all trying to find what institution is allow us to cooperate with each other and some of those institutions can be price based and some government based.

But he’s confused the means with the purpose. The purpose isn’t to have a central bank, the purpose is for the central bank to accomplish something which it has a history of not accomplishing and now can be accomplish by somebody else and in fact and the central bank has a history of preventing the accomplishment of stable prices in it’s 100 year history and we’re a 100 years into the history of the Federal Reserve the dollar has lost 98% of their value. So how have they done on the mandate of maintaining stable prices in such? It’s just got a horrible – if they were a business they would have been out of business long ago cause they never get anything right.

Kurt Wallace: Dr. Patrick Byrne Overstock.com now accepting Bitcoin. Thank you for spending some time with us on Rare.

Patrick Byrne: Thank you Kurt, my honor.