Today, unlike the classical banking system, cryptocurrency finance is not yet able to offer a full range of banking services, as there are the following limitations:

- There are no relevant financial instruments;

- Cryptocurrency are now used only in the form of investments and savings;

- It is quite difficult to make a regular private payment cryptocurrency;

- There is a significant distrust of all types of cryptocurrency at the household level.

Therefore, if it was possible to pay with these electronic money goods and services, and move from them to fiat money quickly and simply in a bank, which is not far from home, then interest in this high-tech currency would significantly increase, and increased The number of its holders. To make this happen, an innovative project Neluns was developed, which found its solutions overdue the issues of the modern financial system.

What is Neluns

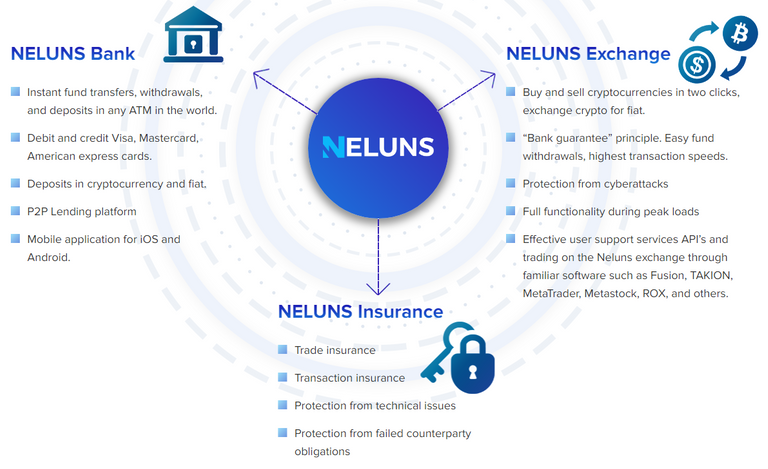

Neluns is a new financial ecosystem for blockchain technology, which includes: a bank to work with cryptocurrency and fiat money, crypto exchange stock and insurance company, which together create conditions for constant influx of new users, Education of a qualitatively new cryptocurrency market and, consequently, increase of financial capital. Neluns Bank provides a full range of banking services, crypto exchange provides optimal and safe conditions for trading operations, and the insurance company protects the interests of users in carrying out transactions and transactions.

The main goal of the Neluns team was to create a system; a kind of gateway, in which simple and without risks will be combined values of the traditional financial system with the latest technologies and granted free access to the cryptocurrency market to the entire population of the world.

Neluns Ecosystem

Learn more about the Neluns ecosystem:

- Neluns Bank

Neluns Bank is organized in accordance with the requirements of the legislation and provides the whole range of banking services both in fiat and in cryptocurrency. The user can have a deposit, withdraw, transfer money in different currency from anywhere in the world. Authorized users can give and take P2P credits, insured through Neluns insurance, to their bank card via mobile app on smartphone in a few clicks. Targeted and non-targeted credit products, brokerage and overdraft loans are provided in short terms, with possible benefits in the required fiat currency and in 28 types of cryptocurrency. To do this, Neluns developed its tools on Big Data and AI technologies to determine the reliability of borrower and determine the appropriate applications.

- Stock Neluns Exchange

The Neluns Exchange operates on the basis of the license of the U.S. Securities and Exchange Commission and manages the process of innovative exchange of cryptocurrency. Neluns Exchange is free from the disadvantages of modern exchange services, as it uses the «bank Guarantee» method, which creates safe and secure conditions for crypto exchange. Also, the high level of security supports the legislation and the ability to insure its assets and be able to receive compensation due to incurred losses.

Registered and verified users can carry out transactions of any size without restrictions and withdraw their earned funds almost instantly to their bank accounts. Accompanies all these operations 24/7 support service.

- Neluns Insurance Company

Neluns Insurance operates on the basis of the license of the U.S. Commodity Futures Commission and provides protection of all transactions in the system, as well as provides services for insuring the assets of users against possible losses during transactions. There are 2 types of insurance:

Full insurance compensates all losses and its cost is determined in the amount of 10% of the total amount of the transaction;

Partial insurance is determined on the specific lawful of the amount and conditions of occurrence of the insured event, which entails the individual conditions of its payment.

The Neluns ecosystem, built on the BaaS concept with its mobile applications Neluns IOS and Android, provides round-the-clock access to the banking services of all fiat and cryptocurrency assets holders.

Types of bank cards

Lite – card for first-level users, with the confirmed e-mail address, which can participate in trades on Exchange Neluns exchange for the sum not higher than 300 US dollars.

Silver – card for users of the second level, with the confirmed number of the mobile phone which can participate in trades on Exchange Neluns exchange for the sum not above 500 US dollars and to be on a platform of P2P lending.

Gold – card for third-level users, with confirmed mobile phone number and verification of identity, which have access to all services of Neluns Bank, Neluns Exchange, and Neluns Insurance without limits of trade amount.

Platinum – card for third-level users, with confirmed mobile phone number and verification of identity, which have invested in Neluns not less than 5000 USD and have access to all services of Neluns Bank, Neluns Exchange, Neluns Insurance without Restrictions on the amount of trade.

More detailed information about the project you can get on below official links:

Website, White paper, Bitcointalk , Bounty, MVP,