Cryptodepression is a term from the physical geography and geomorphology , but it is also such a nice fit to the current situation in the cryptocurrency sector.

So rich in economic, psychological and all other subtle connotations of depression.

Without any shadow of fundamentalism or maximalism after all this entire decade of observation unfortunately for me bitcoin and crypto are yet synonymous. NOTHING after Satoshi , nothing fundamentally new - only alts, shits and, thanks God, some Layer. Okay, quite a few projects with promises of post-satoshiness around, but yet none of them yielded anything working. Mere variations of the already ancient tune is all the crypto musical scene we have.

You know already my ''obsession'' that growth is the only mode of sustainability that we knew, know and probably will ever know. This ''fixation'' predates bitcoin and makes my focus on crypto to be kinda predisposed. For the blockchain being the most powerful transactor we have ever known and had. The strongest monetary algorithm. Doing the most with the least, so far.

Economy could be viewed as a network which yields wealth, like the brain - a network that outputs thought. ''Individual'' computer's circuitry is also ... network. It is all about quantity and quality of connections. Structure is gradient, per se, but on this some other time... All objects are relations connectomes.

The better the transaction, the tighter the connectivity, the bigger the output. Check this out, per instance!

In this and this essays of mine - almost an year across the time - I outlined some of my findings and thoughts on the great grower's growth.

If bitcoin is such a good of a transactor, and if better transaction = greater growth, then why the hell bitcoin's growth itself is so hesitant and wobbly?

or

Well, the answer seems to gravitate around how the human attention, motivation, memory and public attentioning works.

FIRST, watch this vid.

It is from 6th of January 2017!!

The fact that it is so up to date even now - up all the crypto-booming 2017 and down all the crypto-busting 2018 reveals the quite a strong level of understanding by the author. Well done, Chris Dunn !

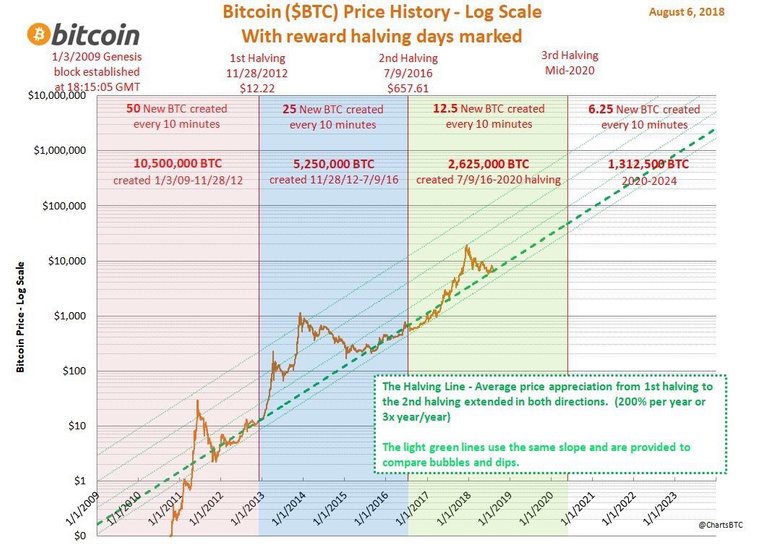

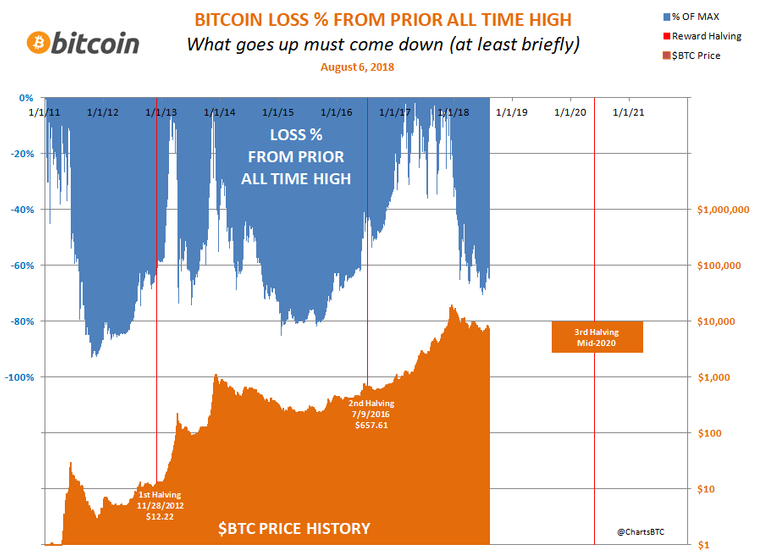

In a nutshell the idea is.: Bitcoin price grows all the time. So far nothing different from my Blue Line. It goes up gently and steadily when not observed. Once the growth noticed it attracts attention in a runaway fashion. Out of the sudden the Dead is Risen again and fully back in the news, all headlines flashing as cyberpunk neon lights. The attention brings fiat in, lots of it - dollar the ticket for the roller-coaster ride is. Nobody want's to miss the train. More dollars in = higher price, to a level of bullish anxiety maximum, ATH, bitcoin fever ... overshoot and BUST!

The bigger the forced deviation away from the Blue Line, the bigger and longer lasting is the yo-yo effect. The higher it's pushed the deeper it will go and the longer it will stay under the Line. And vice versa.

This is also an explanation about why the overally smooth bitcoin adoption increase does not correspond to the price dynamics. Dumb money buys and sells are not adoption.

It is like momentum conservation. Bitcoin is not only parabolic, it is also ELASTIC.

Two take-aways from up to here ::

- Mass media rather distort the market, than to mitigate the economic calculation,

&

- Bitcoin has kinda Schroedinger growth mode - if you look at it - it stays between the life and death, when unobserved - it simply grows.

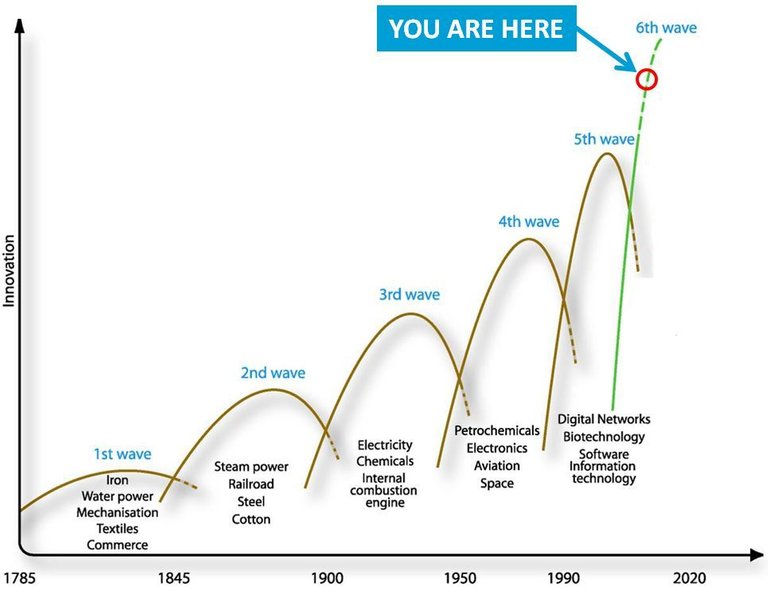

SECOND, do we know other such exemplary mechanisms in play?

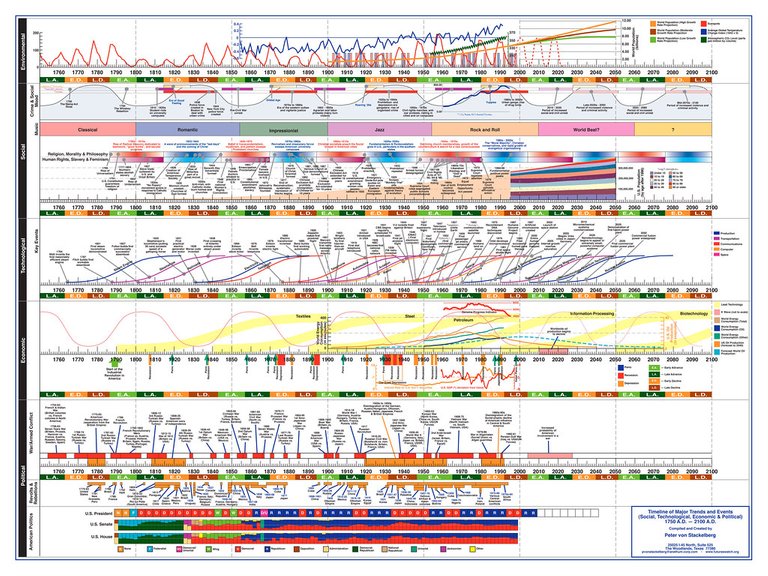

Well, it seems, yes. Perhaps it is everywhere, but here you are one: The K-waves.

The wonderful graph of Peter von Stackelberg's from here.

Kondratiev was a honest econometrician. A fact proven by the reward he got for his great work - endless years in a Gulag camp and a shooting squad for parole. He couldn't make it with rigorous theoretical explanation for the drive behind these cycles. He would if he had his own lifetime, I'm sure.

I paid a lot of attention of the bubbliness and wobbliness of economic growth in the Dark immediatelly after the subprime crash of 2007-2008. Few years of really serious literature archaeology.

And the best explanation for the K-cyclicity I found was the most natural one - the human generations and social memory.

Somebody noticed that K-wave specific frequency of about 50-60 years is almost exactly 2 human generations of average 28 years each. (Best definition of ''generation'' was something like average age of parents divided on average age of their progeny.)

The K-wave is defined by the pulse of the human reproduction.

Once a human generation is 1 nanohertz. Once per two generations (Kondratiev) is half a nanohertz. Two billions of times less frequent that once in a second.

Like with ICE, or with a bicycle, walking, birds flight ... the overall curve of growth is smooth on greater scale, but because effort excercise is never uniform in time this makes it to look like a staircase upon zoom-in.

Bitcoin's wave specific frequency of 4 years?

Pulsed by the built-in reward halving rate.

And human attentional herding amplified by the mass media ... as the wave peak-lifter and though-deepener...

The big picture? .:

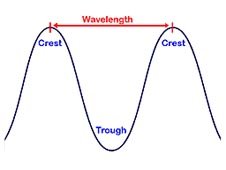

Wavelength - about 4 years.

Crest - as high as the herding buying pushes it up.

Through - as deep as the panic sale dig is (but not deeper than the Bottom).

Bottom - the average mining cost.

Can it death-spiral bottomlessly?

Rather not, ... ''what is dead may never die''. ;)

18qSKUUTAGw1uL53simrSiZ6pJpfxKACvj for research support. Thanks.

Copyright © 2019 Georgi Karov. All rights reserved.

/bitcoin_mining_costs_around_world_chart-5bfd7c89c9e77c0051bce8f0)

Great post! Thanks!

another few hundred are coming. Thanks for following my writings.