A little Swiss town made history in June 2016, when it allowed its 30,000 citizens to pay local fees using the cryptocurrency Bitcoin. The same month bureaucrats at the New York State Department of Financial Services produced a Regulatory Framework for cryptocurrency transaction. Reminiscent of the quixotic attempts of countries with equally unenlightened leadership trying to restrict access to the Internet, New York officials require virtual currency businesses with activity involving New York State or persons that reside, are located, have a place of business, or are conducting business in New York to acquire a BitLicense.

A little Swiss town made history in June 2016, when it allowed its 30,000 citizens to pay local fees using the cryptocurrency Bitcoin. The same month bureaucrats at the New York State Department of Financial Services produced a Regulatory Framework for cryptocurrency transaction. Reminiscent of the quixotic attempts of countries with equally unenlightened leadership trying to restrict access to the Internet, New York officials require virtual currency businesses with activity involving New York State or persons that reside, are located, have a place of business, or are conducting business in New York to acquire a BitLicense.

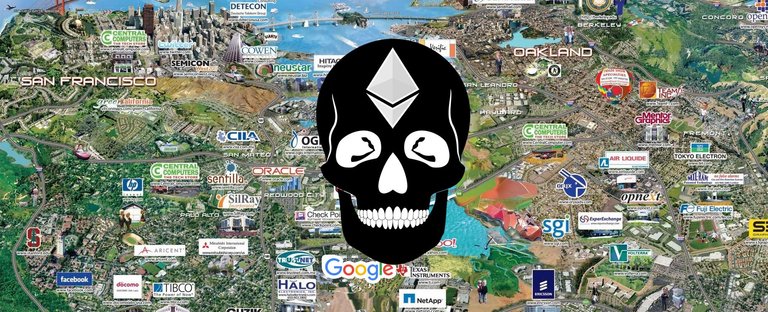

Today, Zug - the little Swiss town referred to above - is home to a number of cryptocurrency companies including Bitcoin Suisse AG, Crypto AG, Monetas, Sweepay, XAPO, and most notably the Ethereum Project. Ethereum powers many of the latest Initial Coin Offerings (ICOs) including that of Tezos which raised $232 million in its ICO in July, and Bancor which raised $153 million to build a protocol for creating tokens, using smart contracts to provide liquidity. Zug - which is the German word for 'train' - has welcomed both Tezos and Bancor, rightfully allowing the town to embrace the moniker Crypto Valley.

Maybe it should not come as a surprise that Zug's local initiative positioned it as major player in what is to-date a $100 billion market, since Switzerland is not only the birth place of the world wide web but also ranks first on the World Economic Forum's Global Competitiveness Report, outranking both Singapore (2nd) and the United States (3rd).

In contrast, the upcoming issue of Forbes will feature 10 American companies which according to the magazine are the biggest in fintech - the latter is a popular term for the describing the relatively benign act of applying technology to improve financial activities (although it turns out you can write a 23-page paper on the terminology alone). Combined these ten companies have a market value of $31.9 billion. To put this number into perspective: Ethereum's market cap by itself exceeds $28 billion as of this writing.

Everything that can be virtualized will be virtualized - a principle I'd like to call VirTech. While some analyst view Blockchain technologies as a subset of fintech, this is decidedly not the case and many of the current fintech companies will see their business disrupted by new entrants using the full potential of smart contracts while not limiting themselves to building platforms (a popular fintech meme). Since the elimination of middlemen is at the heart of network innovation every new coin in an ICO represents the death of one.

I love Swiss :-) very good content, will resteem now, followed u

Congratulations @kameir! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP