Bitcoin or Gold? Why Investors Should Consider Both in the Current Market

Now that we’ve seen how popular Bitcoin (BTC) has become over the past year, there is probably one question that almost every opportunistic investor is now asking: Is bitcoin worth the investment now?

The simple answer to that — of course — depends on one’s background, objectives, and wealth.

But an interesting proposition that’s been thrown around lately revolves around bitcoin becoming a topical investment that could even rival gold. Could bitcoin function in the same way as gold? Could it also be a store of value?

Coincidentally, both assets have roughly similar per-unit values at the moment. So now is a good time to ask these questions. To provide the answers, we must look at some of bitcoin’s key characteristics that make it attractive to investors.

Limited Supply

It is well documented that the bitcoin virtual currency has a limited supply — 21 million to be exact. Recently, reports came out informing the market that 80% of the world’s BTC has been mined, with approximately 4.2 million still remaining out there. In comparison, the supply of gold is said to increase by 1% to 2% annually.

Just by using the law of supply and demand, we can extrapolate that bitcoin’s value hinges largely on its demand. A perfectly inelastic supply — when all coins have been mined — signifies that any movement in bitcoin’s demand would directly affect its price without any part of the supply curve offsetting the demand-induced price movement. This is one plausible explanation (using market dynamics in economics) for bitcoin’s volatile; it is super sensitive to demand shifts.

Because its supply is set at a certain amount, there is a good chance bitcoin will become increasingly valuable as demand continues to go up like it did for the past year. Remember, the global population is also growing, so the number of bitcoin consumers can only rise.

Virtual Money

Because it is a virtual currency, bitcoin is extremely convenient to buy and easy to carry around. This has both its pros and cons.

On the bright side, every transaction involving bitcoin happens quickly, particularly those involving large sums of money, and its users can benefit from the anonymity of ownership, such that bitcoin can be used in all sorts of purchases. This makes bitcoin especially valuable in the black market.

On the downside, because it’s virtual, bitcoin is more vulnerable to disruptions to its system (i.e. hacks), therefore potentially losing all its value. Moreover, bitcoin’s benefits can only be realized by a select group of people in the society — those who are tech-savvy. For the older generations, even the concept behind bitcoin eludes them, segregating them from the world of cryptocurrency.

Lack of Regulation

For the most part, bitcoin is considered a decentralized entity not subject to any government regulations. Again, this is both good and bad.

While decentralization allows all members of the bitcoin community to engage in the mining and verification process, it does create problems that can only be mitigated by governing authorities. For example, without regulation, transactions in the black market, as well as money laundering using bitcoin, would be left uncontrolled.

Remember the story in 2015 about the arrest of the owner of the Silk Road website and how bitcoin was involved in that ordeal? This is why some jurisdictions are pushing for cryptocurrency laws to tackle these issues.

Bitcoin Compared to Gold

Indeed, bitcoin offers our society another choice of currency that’s both secure and easy to use with the potential to appreciate, but does that make it a good store of value compared to gold? For this, we must consider how their values would look years down the road.

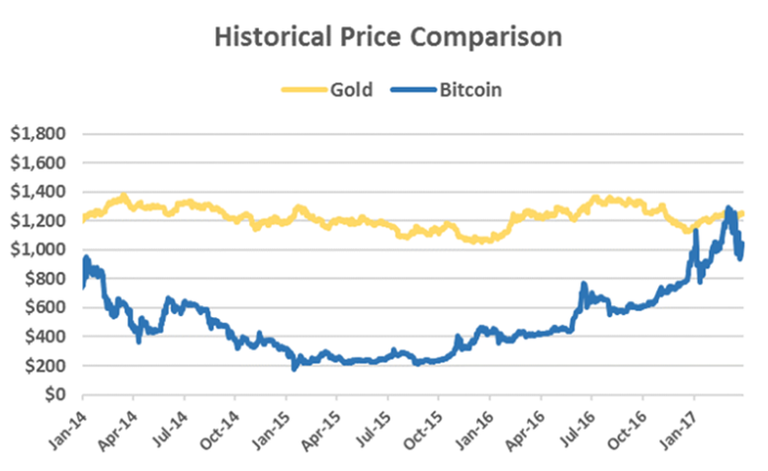

Looking at their historical prices, there’s a telling story: Bitcoin has a much higher variation over the past three years than gold, but overall it is trending upwards, while gold stayed relatively flat.

This says a lot about the risks involved with these assets. Obviously, Bitcoin has a higher risk, though its value could keep going up especially as it is even rarer than gold. Also, the problem some have with bitcoin isn’t about its volatility, but how the volatility would hinder its path towards becoming real money.

On the other hand, gold can be considered a relatively safer investment, especially as it has been around for thousands of years — nothing is going to hurt its status as the #1 precious metal.

Short Term vs. Long Term

As an investor, you want to know your investment horizon when making a judgment. As seen over the past few months, bitcoin does fluctuate. Hence, those investing in the short term would have a higher chance of profiting from bitcoin.

“For more than 5,000 years gold and silver have been tried-and-true money. They’ve lasted basically the duration of organized civilization,” said Dave Kranzler of Investment Research Dynamics.

In the long run, both assets would likely go up but for different reasons. For bitcoin, its limited supply and the rising popularity of digital currency right now would certainly boost its value. As for gold, investors would always view it as a good hedge against inflation and the stock market, which was traditionally its most common use.

Former PayPal president David Marcus once gave his own view on bitcoin:

“I really like bitcoin. I own bitcoins. It’s a store of value, a distributed ledger. It’s a great place to put assets, especially in places like Argentina with 40% inflation, where $1 today is worth 60 cents in a year, and a government’s currency does not hold value. It’s also a good investment vehicle if you have an appetite for risk. But it won’t be a currency until volatility slows down.”

Risks With Bitcoin

The security breaches in the virtual world could be seen as the biggest fear factor for those buying bitcoin. No one can change the fact that bitcoin is a man-made entity, and anything created by humans has its own implicit uncertainties. Some also argue that bitcoin is “easy to get in but hard to get out”.

In addition, interference by regulatory authorities has always caused fears in the cryptocurrency space. A government crackdown could hit bitcoin’s value depending on the nature and magnitude of change imposed.

Risks With Gold

If one’s looking for a safe and reliable investment, gold would easily be one of the ideal candidates. The only major problem investors have is that it is not as transferable as fiat money, and certainly much more difficult when compared to bitcoin.

Imagine you need to make a deal involving tens of kilograms of gold, someone would need to transfer that. Plus, there’s a possibility that it could get stolen on its way. So the speed in which gold can be used as a medium of exchange is not optimal in many cases.

Bitcoin and Gold Can Co-exist

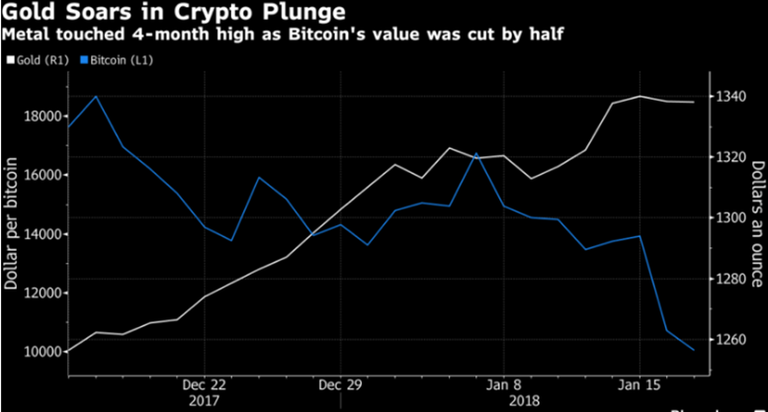

Whatever what your investment goals are, both bitcoin and gold are assets that have value in the future. In fact, as mentioned, gold can be a hedge against many things, and cryptocurrency may be one of those.

This week, the market saw an influx of money pouring into gold purchases, with 30,000 kilograms sold on January 17, due to the cryptocurrency market (including bitcoin) being down for consecutive days.

Therefore, one way to regard the “bitcoin vs. gold” argument is to see them as complements that diversify one’s portfolio.

On one hand, investing solely in bitcoin presents a “high-risk, high-reward” scenario, while putting all eggs in the gold basket is much safer but has a lower growth ceiling. This is tantamount to choosing between equity in a rising sector and bonds.

In the end, the investment decision and allocation really depend on how aggressive an investor wants to be.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.toptechnicalsolutions.com/bitcoin-or-gold-why-investors-should-consider-both-in-the-current-market/

buy both.