Disclaimer: Please note that while research did go into this article, I am not a crypto currency expert nor a financial adviser, and none of this should be taken as financial advice. I hold at least one of the listed assets.

As always, Do Your Own Research #DYOR.

Recently I had the opportunity to write an article on David Siemer for the Evolvement podcast, hosted by Michael Nye. The podcast in its entirety can be found here: https://evolvement.io/what-vcs-look-for-when-investing-in-crypto-with-david-siemer/.

David is the CEO of Wave Financial, a crypto asset management and treasury fund located in Los Angeles. One of the biggest ideas I took away from the interview is the viability of a crypto index fund, that is, a fund comprised of multiple crypto assets designed to spread out risk while still capturing market share. Last year I created my own index portfolios, all of which have reflected the losses incurred during the bear market.

Wave Financials initial index offering is comprised of 20 assets designed to represent the overall digital asset market, and currently covers ~95% of market cap. Of interest is privacy coins like Monero and Dash have been omitted from this index in order to avoid compliance issues. The complete list can be found on Wave Financials Index page.

While index funds are not a new financial vehicle, I decided to take a look at what David and Wave Financial have to offer, and have some fun in the process. I will take a look at the top 11 assets and briefly rate them on relative strength and market share (taken from livecoinwatch.com). Lastly I will create my own version of an index fund at the end (if you want a TLDR). I have attempted to eliminate my own internal bias when reviewing this list, but as David Siemer explains, the most important aspect in examining a project for investment is the Team.

1 - BTC – Weighted at 66.7% - Market cap $141 Billion

Strengths

• Highest market cap

• First mover advantage

• Massive developer community

• Institutional interest

• Longest blockchain

Bitcoin is currently the dominant crypto currency in the market. As the first widely used crypto, it benefits from a first-mover advantage and unmatched brand recognition. Bitcoin has grown from a pseudo anonymously authored whitepaper to an internationally recognized electronic money. Over this time it has gained the attention of hobbyists and institutional investors alike. Its use case has been debated, but it is used today as a medium of exchange and store of value. Due to the decentralized nature of its coders and consensus, Bitcoin has been criticized as being slow to both transmit funds and adopt new code improvements.

I believe that most crypto portfolios should be weighted heavily in Bitcoin.

2 - XRP – Weighted at 12.6% - Market cap $17 Billion

Strengths

• Fast

• Possible adoption by banks

• Inexpensive

XRP is the crypto currency that runs on the Ripple Labs protocol. Launched in 2012, it has quickly risen in dominance and enjoys a #3 rank in total market share. Due in part to its ties to institutions and speed, XRP’s use case is tied heavily to possible adoption by banks and other financial institutions for fund settlement. In recent years this speculation resulted in massive price increases, but this value proposition is being challenged by similar coins being released, like the stablecoin from JP Morgan. XRP has also been heavily criticized by the crypto community as being “centralized,” while advertising itself as “decentralized”.

There is little doubt in my mind that XRP will continue to play a role in the crypto market, but I believe it is over-weighted in the index.

3- ETH – Weighted at 11.2% - Market cap $27 Billion

Strengths

• Largest “Platform” crypto

• All ERC-20 tokens run on the Eth protocol

• Popularized Smart Contracts

• Has largest number of Decentralized Apps (DApps)

• Large development community

ETH is the token of the Ethereum blockchain. It was launched in 2015 with the promise of being a “world computer,” that would allow users to leverage the processing power of all computers on the Ethereum network. Originally designed to run on the Bitcoin blockchain, Ethereums creator, Vitalik Buterin, soon realized this would be nigh-impossible and decided to create his own platform. As such, Ethereum benefits from having a more flexible instruction set which allows decentralized programs to run on its architecture. These DApps include programs and games like the popular crypto kitties collectables. Ethereum was hard forked in 2015, resulting in ETH and ETC.

Until it is usurped, ETH will continue to enjoy a top rank in the market.

• Note: After Ethereum, the index becomes increasingly fragmented, as the following 16 projects make up ~2% or less of the total weight of the portfolio. I interpret these remaining assets as the “fringe performers” as described in the index’s thesis.

4- EOS – Weighted at 2.1% - Market cap $5.7 Billion

Strengths

• Massive funding

• Competitor to Ethereum

• Growing community

• Smaller carbon footprint

A newcomer to crypto, EOS was created in 2018 by Dan Larrimer, a veteran of the industry. EOS shares similarities to ETH in that both networks work on a distributed computing network and smart contracts with a focus on decentralized storage and enterprise solutions. It is currently being used as the protocol for Everpedia, a decentralized competitor to Wikipedia. As the premier “proof of stake” coin, EOS uses exponentially less electricity that proof of work coins, like Bitcoin. EOS also benefits from a massive treasury of over $4 billion raised from its ICO.

5 - EOS will play a large part in the future of crypto, one I would definitely watch in the future.

BCH – Weighted 2.0% - Market cap $7.3 Billion

Strengths

• Benefits from the “Bitcoin” brand name

• Faster than Bitcoin

Bitcoin Cash (BCash) was created in August 2017 as a result of a Bitcoin hard fork. The fork increased the Bitcoin Cash block size from 1 to 32 megabytes, allowing it to process more transactions per second than Bitcoin. At the time of the split, any wallet that held Bitcoin received an equal amount of Bitcoin Cash. This created an instant supply of new crypto for any Bitcoin holder. With the backing of former Bitcoin evangelist Roger Ver, Bitcoin Cash portrays itself as the “Real Bitcoin” (which he called Bitcoin Core), and created a deep schism within the crypto community. Hard forks are not a new phenomenon, but many were angered that there was a different currency claiming to be Bitcoin. As a result, first-time buyers were confused as to which coin was which.

Despite its controversial origins, I see Bitcoin Cash staying a widely recognized coin for some time.

6 - LTC – Weighted 2.0% - Market cap $5.8 Billion

Strengths

• Second most recognized crypto behind Bitcoin

• Faster than Bitcoin

• Bitcoin “Testnet”

Litecoin has been described by its creator, Charlie Lee, as “Silver to Bitcoins gold.” Created in 2011 as a fork of Bitcoin, Litecoin enjoyed the #2 rank in overall market cap for years. It has similar use cases to Bitcoin, as a store of value and medium of exchange. Due to the similarities in code several technologies adopted by Bitcoin were implemented first with Litecoin, Segregated Witness and the Lightning Protocol perhaps being the most recognized.

I am confused as to why the index has such a low allocation for Litecoin since it is #5 in total market cap. I suspect it is because Bitcoin and Litecoin have similar use cases, Wave Financial decided to put more weight into Bitcoin.

7 - TRX – Weighted 1.7% - Market Cap $1.9 Billion

Strengths

• Marketing

• Owns BitTorrent

TRX is a bit of an anomaly. The project was founded in 2017 by Justin Sun and is attempting to create a decentralized internet protocol. The original TRX whitepaper appeared to plagiarize sections of other projects including Filecoin, catching the ire of the community and Ethereum creator, Vitalik Buterin. Sun later addressed these accusations saying they were due to translation issues. He has also been accused of representing himself in the past as the head of Ripple Labs, the company behind XRP. Despite growing controversy, Sun and the Tron Foundation have been busy, buying the distributed file company BitTorrent for $126 million and integrating into the Oprah browsers native crypto wallet.

TRX is speculative at best, but I feel is weighted appropriately in the index.

8 - XLM – Weighted 1.5% - Market Cap $2.6 Billion

Strengths

• Partnerships with IBM and Deloitte

• Fast

XLM was created in 2014 by Jed McCaleb, Mt. Gox founder and co-creator of the Ripple protocol. It shares the similar money transmittance use case with Bitcoin and Ripple.

Aside from the partnership with IBM, I see no reason to hold both XLM and XRP. Pick one.

9 - BSC – Weighted 1.1% - Market cap $1.1 Billion

Strengths

• More programmable than Bitcoin

This is perhaps the most controversial asset on the index list. BSV (Satoshis Vision) is a 2018 hard fork of Bitcoin Cash which increased the block size from 32 to 128 megabytes. It was created by Craig Wright, who claims to be the creator or Bitcoin, Satoshi Nakamoto. Recently, Craig Wright has come under increased public denouncement and began to file lawsuits against those whom he feels have libeled and slandered him. These public accusations have resulted in BSV being delisted from several large exchanges including Binance and Kraken.

Several interesting programs have been able to take advantage of this increase in block size, specifically _unwriters API which runs on the BSV blockchain.

Do to the continued backlash and negative press, I recommend staying away from BSV at this time; I see no reason to include this in any portfolio.

10 - ADA – Weighted 1.0% - Market cap $2.2 Billion

Strengths

• Team

• Novel Proof of Stake Concept

Started in 2015, ADA is the cryptocurrency of the Cardano project, led by former Ethereum CEO, Charles Hoskinson. Cardano was created to replace Ethereum as a platform, focusing on a proof of stake security model and smart contracts. It is difficult to rate the project as there is no usable public blockchain, but the company has made significant contributions to crypto space and has a healthy development community.

Cardano is still in a very early stage but stands to benefit greatly if they can deliver on their ambitious promises.

11 - BNB – Weighted 0.8% - Market cap $4 Billion

Strengths

• Exchange coin of Binance

• Benefits from exchange success

BNB is the coin used on the most popular crypto exchange, Binance. It began a utility ERC-20 token used to pay fees, but BNB has evolved into an independent blockchain while still being used to pay fees on Binance. From a technical perspective it remains to be seen how useful the chain will be, but we do know that it is being used to run the new Binance Decentralized Exchange (DEX). Binance has grown exponentially is users and profit since its inception in 2017. The CEO’s handling of its recent hack of 7000 Bitcoin has been praised throughout the industry, and BNB has only grown in price since, signaling increased confidence in the leadership.

Since BNB is tied inexorably to Binance, it stands to reason that it will increase in value as Binance continues to report profits and grow customer size. This asset should be much higher on the list.

12 - DOGE – Weighted 0.2% - Market cap $357 Million

Strengths

• 1 DOGE = 1 DOGE

• Much currency

• How moon

• Such meme

• Wow!

This list was originally the top 11 assets, but how can I resist Doge? Dogecoin is a Litecoin fork created as a joke by Jackson Palmer in early 2014 and enjoyed widespread awareness during the first altcoin run. The meme coin surprised the entire industry by cultivating a fun-loving, irreverent fan base which continued development of the coin after its founder stepped away from the project. It defied all odds and showed that community involvement can boost a coins valuation through memes and gifs.

Every portfolio should include DOGE. Do it for the lulz.

Now that we have taken a look and analyzed Wave Financials asset distribution, the question must be asked: Is this the ideal allocation? I applaud the team of analysts as they have clearly done their research, and I feel that any DYO investor would benefit from hodling a similar index.

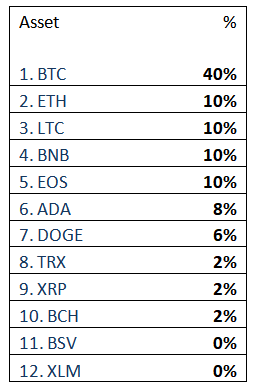

But I trust that any enthusiast who has read this far is more savvy than the average investor. Therefore, I have taken the opportunity to create an updated portfolio listing using the provided coins. As mentioned earlier, we are leaving out privacy coins for the sake of compliance.

As we can see, it is still heavily weighted towards Bitcoin, but has enough exposure to benefit from success across the other coins.

You can track this portfolio’s performance here: https://www.cryptocompare.com/portfolio-public/?id=443146

So what do you think, sirs? Does this portfolio make sense or do you employ a different strategy in maximizing your rate of returns?

Please comment below.

Well done my friend. I am in agreement that Team is one of the primary factors to consider when choosing projects as you'll see in my book. I love your Top 5. I once had NEO in mine and would replace it today with EOS. The only one I don't have that you have today if I made a list is BNB. I'd have BCH in mine. Thanks for sharing this with us.

My pleasure, my man. Glad you were able to enjoy it. I plan on doing these more in the future to not only help educate but codify these concepts in my own mind. It will also be interesting to visit this portfolio in the future and see if these were good choices or hopium dreams.