by Nathan Martin

I have read many articles lately claiming that Bitcoin is in a bubble. Some proclaim it similar to the famous Great Tulip bubble of 1637… but that comparison is only for those who do not understand the significance of what is happening currently with blockchain technology. If you are new to Bitcoin and blockchain technology, I would suggest that it’s highly important for you to take the time to research the basics of how it works and why it’s different – simply Google “how does Bitcoin work.”

The main argument of those who proclaim it to be in a bubble is that the people buying it at these prices are not buying it for its original purpose – which they believe to be enabling transactions. Yes, it is being used for transactions, much more than 100,000 businesses now accept Bitcoin for transactions. But instead naysayers believe that others are buying it as an “investment” and thus will surely be burned.

For me, and I believe most who understand what is happening, we are not buying it for either of those reasons. We own it because we see it acting as a “store of value,” where nothing else priced in dollars is. With interest rates artificially low (manipulated by central banks), a normal person cannot earn even near the pace of actual inflation with any type of traditional savings account. Bonds are artificially in a bubble, stocks are artificially in a bubble, real estate is in yet another bubble, everywhere one who understands bubble dynamics looks they see a bubble (but not Bitcoin, people are trading in their worth less and less dollars for them). The bubble is the dollar – the world’s “reserve” and “petro” dollar is being drowned by central banks all over the globe, not just our own “FED.”

And thus there is no store of value to be found. This is a terribly ugly situation for people who believe in hard work and saving to get ahead; to someday retire comfortably. Retirees on fixed incomes simply cannot, and will not be able to keep up as the impossible math of dollar debt continues on its vertical ascent.

We would love to love gold and silver, but those too, are manipulated by central banks who own the majority of it. They manipulate and derivative the markets to artificially keep devaluation of the dollar hidden.

Control of the dollar is centralized with the banks, that’s why we refer to them as “central” banks. All the power and control resides with them; as private individuals were wrongly, and illegally, given the power to “coin” money with the Federal Reserve Act of 1913.

What makes Bitcoin a better store of value?

- It is decentralized. This is huge! It means that it is not under the control of central banks, and thus cannot be manipulated directly by them. This is THE MOST IMPORTANT aspect, it is a game changer as it changes the WHO is behind it – something that gold and silver do not do because central banks have printed “money” to buy the majority of it.

Caution – Central banks may be able to indirectly manipulate blockchain currencies in the future if they create ETFs and other derivatives based upon them. This, however, will not change the underlying store of value, and when it happens I would encourage you not to own the derivative, but to instead buy Bitcoin directly, again because it’s not in control of the central banks, is decentralized versus their centralized everything which makes them vulnerable. Yes - Central Banks can print dollars and use them to buy Bitcoin, but that will only drive the price up and cause others to enter as well. In the end they cannot manipulate what they don't control.

Even if central banks were to “ban” exchanges in one country, all one will have to do is join an exchange overseas. This has the central banks trumped, it cannot be stopped.

To better understand the power of decentralization, please take the time to watch the video at the end of this post, or (click on this link). - Unlike tulips, dollars, or even precious metals, Bitcoin is strictly limited in its supply. This is where the math comes in. Bitcoin was founded in 2008 and there will ultimately be only 21 million Bitcoin ever mined. Today we are approaching the 80% mark, the remaining 20% will take years to mine, and the “mining” gets more difficult and slow as we go.

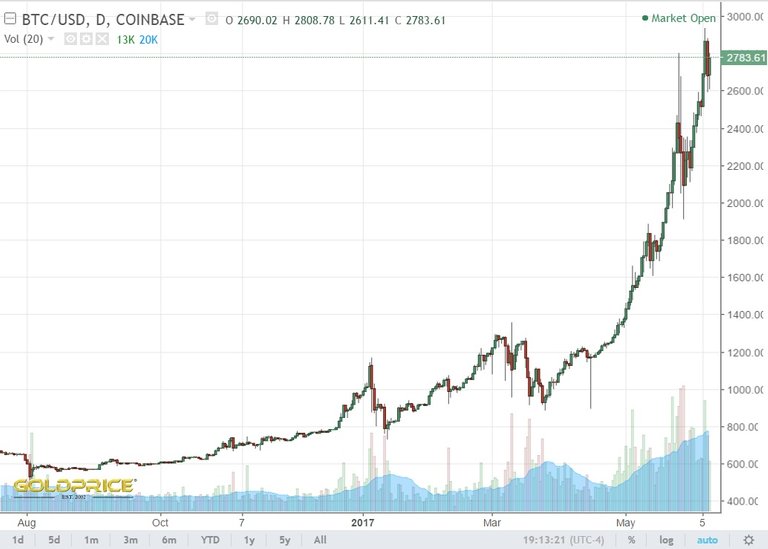

This is a hard feature built into the coding. It’s what makes Bitcoin a store of value – the more money that comes in, the more each Bitcoin is worth. As I type, that is $2,774.00 per Bitcoin according to Coinbase where you can go to open an account, much like a brokerage account (there are currently 7.3 million Coinbase users). Of course you can buy Bitcoin in any increment, you don’t have to buy them in whole units.

People all over the world can buy, own, and transact in Bitcoin. There are now 7.3 billion people on the planet, so if all 21 million Bitcoin were distributed evenly to every person on the planet, each person would have only .0028767 of one bitcoin! Another way of stating that math is that only 1 person out of every 347.6 people can possibly ever own a whole Bitcoin.

Today the market cap of Bitcoin is $45.17 Billion. The more money that comes in, the higher the market cap, the higher the price of Bitcoin. Many analysts start to compare Bitcoin’s market cap with that of large companies like Apple, whose current market cap is 18 times that of Bitcoin’s at $810 Billion. But here’s the deal. Bitcoin is not a company, it is a form of money. Unlike dollars, there will not be an endless supply. In fact, if you took the entire M2 money supply of the United States, currently $13.5 trillion, and put it all into Bitcoin instead, then each Bitcoin would be worth $642,857. But Bitcoin is not just traded in dollars – it’s traded in every currency in the world. And right now global M2 money supply is calculated as roughly $72 trillion, or $3.4 million per Bitcoin. It’s true that other blockchain currencies are springing up like daisies, or tulips. But their market caps combined are just now rivaling that of Bitcoin’s. So, yes, they will be “diluting” bitcoin’s math. Not all crypto currencies have hard limits to their supply, and that will mean that they will always be worth less. Right now Ethereum is in second place with a market cap of about $24 billion compared to Bitcoin’s $45 billion. Litecoin is another cryptocurrency designed to be “silver” compared to Bitcoin’s “gold.” There will only be 84 million Litecoins ever mined, exactly 4 times the amount of Bitcoins. However, Litecoins are currently trading for roughly 1/100th the price of Bitcoin, I would expect the math to eventually catch up as more people become aware of Litecoin’s also limited supply. - Bitcoin is a better store of value because it is secure. Decentralization and encryption make it secure. It can be stored in electronic cyber “vaults” where you keep a hard copy of the encryption cypher. This means that your exchange can be hacked, your computer hacked, but your bitcoin don’t actually reside in either! They reside on someone else’s computer somewhere – and only you have the code to get to it. Thus they cannot be confiscated by a government, a banker, or a hacker.

I liken this to the pursuit of freedom versus the pursuit of security. When you pursue freedom, you get security at very little cost. That’s what decentralization does. Bitcoin is the pursuit of freedom – whereas centralized systems, such as central banking, or even socialism, are the pursuit of security and the abandonment of freedom.

Pursue freedom! - Bitcoin transactions are stored on a public ledger, all confirmed transactions are included in the blockchain. Again, decentralized bookkeeping is less vulnerable and more secure than centralized legers. This is where Ethereum, another blockchain currency, shines. Ethereum is built upon an encrypted ledger and can be used for many purposes, not just as a currency.

One use is that these encrypted ledgers will enable safe and secure online voting one day soon.

Someday Bitcoin will, in fact, be in a bubble. But that day is not now, not even close. The great thing about all cryptocurrencies is that they can and do exist alongside of whatever “money” we use for our transactions. They also exist alongside of gold/silver, and may in fact be drawing money that otherwise would be seeking a store of value there.

So I say, let competition reign! I will use dollars for transactions because I have to (for now), but I will use cryptocurrencies, gold, and silver to park my dollars so that the central banks cannot destroy their value. And that in a nutshell is why Bitcoin is NOT in a bubble, and won’t be for quite some time.

That said, do expect many sharp pullbacks along the way. Remember that NOTHING moves in a straight line, EVERYTHING moves in waves. You need to pullback to fuel the next push higher – this is true with all waves. The chart shape is definitely showing parabolic growth, but I expect that when looked at across many more years this will simply be a part of building a base.

So how will we know that a true bubble has formed? For me I know that cryptocurrencies are the future and that they will trade alongside sovereign currencies and will eventually replace them. I will NOT own any cryptocurrency created or “managed” by a bank. Until the market cap of Bitcoin rivals that of the United States, I will not be convinced that growth has stalled. There are, of course, other signs we can look for.

As a review, here are HYMAN MINSKY’S SEVEN BUBBLE STAGES:

The late Hyman Minsky, Ph.D., was a famous economist who taught for Washington University’s Economics department for more than 25 years prior to his death in 1996. He studied recurring instability of markets and developed the idea that there are seven stages in any economic bubble:

Stage One – Disturbance:

Every financial bubble begins with a disturbance. It could be the invention of a new technology, such as the Internet (Bitcoin). It may be a shift in laws or economic policy. The creation of ERISA or unexpected reductions of interest rates are examples. No matter what the cause, the outlook changes for one sector of the economy.

Stage Two – Expansion/Prices Start to Increase:

Following the disturbance, prices in that sector start to rise. Initially, the increase is barely noticed. Usually, these higher prices reflect some underlying improvement in fundamentals. As the price increases gain momentum, more people start to notice.

*I THINK THIS IS WHERE BITCOIN IS NOW

Stage Three – Euphoria/Easy Credit:

Increasing prices do not, by themselves, create a bubble. Every financial bubble needs fuel; cheap and easy credit is, in most cases, that fuel (central banks creating it still like mad). Without it, there can’t be speculation. Without it, the consequences of the disturbance die down and the sector returns to a normal state within the bounds of “historical” ratios or measurements. When a bubble starts, that sector is inundated by outsiders; people who normally would not be there (not yet with Bitcoin). Without cheap and easy credit, the outsiders can’t participate.

The rise in cheap and easy credit is often associated with financial innovation. Many times, a new way of financing is developed that does not reflect the risk involved. In 1929, stock prices were propelled into the stratosphere with the ability to trade via a margin account. Housing prices today skyrocketed as interest-only, variable rate, and reverse amortization mortgages emerged as a viable means for financing overpriced real estate purchases. The latest financing strategy is 40, or even 50 year mortgages.

Stage Four – Over-trading/Prices Reach a Peak:

As the effects of cheap and easy credit digs deeper, the market begins to accelerate. Overtrading lifts up volumes and spot shortages emerge. Prices start to zoom, and easy profits are made. This brings in more outsiders, and prices run out of control. This is the point that amateurs, the foolish, the greedy, and the desperate enter the market. Just as a fire is fed by more fuel, a financial bubble needs cheap and easy credit and more outsiders.

(I believe stage 4 is still in the distant future for Bitcoin)

Stage Five – Market Reversal/Insider Profit Taking:

Some wise voices will stand up and say that the bubble can no longer continue. They argue that long run fundamentals, the ratios and measurements, defy sound economic practices. In the bubble, these arguments disappear within one over-riding fact – the price is still rising. The voices of the wise are ignored by the greedy who justify the now insane prices with the euphoric claim that the world has fundamentally changed and this new world means higher prices. Then along comes the cruelest lie of them all, “There will most likely be a ‘soft’ landing!”

This stage can be cruel, as the very people who shouldn’t be buying are. They are the ones who will be hurt the most. The true professionals have found their ‘greater fool’ and are well on their way to the next ‘hot’ sector. Those who did not enter the market are caught in a dilemma. They know that they have missed the beginning of the bubble. They are bombarded daily with stories of easy riches and friends who are amassing great wealth. The strong will not enter at stage five and reconcile themselves to the missed opportunity. The ‘fool’ may even realize that prices can’t keep rising forever… however, they just can’t act on their knowledge. Everything appears safe as long as they quit at least one day before the bubble bursts. The weak provide the final fuel for the fire and eventually get burned late in stage six or seven.

Stage Six – Financial Crisis/Panic:

A bubble requires many people who believe in a bright future, and so long as the euphoria continues, the bubble is sustained. Just as the euphoria takes hold of the outsiders, the insiders remember what’s real. They lose their faith and begin to sneak out the exit. They understand their segment, and they recognize that it has all gone too far. The savvy are long gone, while those who understand the possible outcome begin to slowly cash out. Typically, the insiders try to sneak away unnoticed, and sometimes they get away without notice. Whether the outsiders see the insiders leave or not, insider profit taking signals the beginning of the end.

(This is where I believe Stocks, Bonds, Real Estate, Auto prices, Student loans, etc. are today; although it is wise to remember that the best performing markets in terms of percentage rise are the ones where hyperinflation is occurring - Zimbabwe, Nigeria, and today Venezuela. An interesting thought is that we may see cryptocurrencies appear to be inflating while real assets move to another round of deflation - dollars seek safety/store of value)

Stage seven – Revulsion/Lender of Last Resort:

Sometimes, panic of the insiders infects the outsiders. Other times, it is the end of cheap and easy credit or some unanticipated piece of news. But whatever it is, euphoria is replaced with revulsion. The building is on fire and everyone starts to run for the door. Outsiders start to sell, but there are no buyers. Panic sets in, prices start to tumble downwards, credit dries up, and losses start to accumulate.

(When this happens to stocks, I expect Bitcoin and other cryptos to benefit).

In summary, it is the centrally manufactured dollar that is in a bubble because it is produced in unlimited quantity. People who EARN dollars want to keep the value that they earned, and are thus rightly seeking freedom by buying Bitcoin and other cryptocurrencies. Most importantly Bitcoin changes out the WHO is behind money. It is secure because it is decentralized, and because politicians and private bankers cannot make an unlimited supply.

Copying/Pasting full texts is frowned upon by the community.

Some tips to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

If you are actually the original author, please do reply to let us know!

Thank You!

When I follow you, would you give me a hint when it's time to exit? ; )