At least that is the advice given by one Crypto Analyst.

Yes "Crypto Analyst" is kind of a new term in financial markets, but there are a few self described ones out there.

Which brings me to Brian Kelly of CNBC's Fast Money, Crypto Analyst and Hedge Fund Manager.

He stated on CNBC Friday evening that investors should look to bitcoin to hedge against a possible trade war.

Cool, but why are we even talking about trade wars?

If you haven't heard, President Donald Trump announced a 25% tariff on steel imports and 10% tariff aluminum imports that would go into effect next week.

Though his thoughts seemed to be in the right place, the results thus far haven't been pretty.

The stock market has sold off over a 1000 points and Economists and Countries alike have weighed in with their displeasure over the announcement.

Basically saying that at the very least, it will do more harm than good, if not destroy more jobs than it creates and plunge the US into a recession.

Why bitcoin makes sense?

In the past, in times of trade wars, hard assets have done much better than currencies according to Kelly.

Specifically he had this to say:

"In this environment, I want to own those things that are deflationary and fixed supply in an inflationary environment. And look at what bitcoin has done the last couple of days."

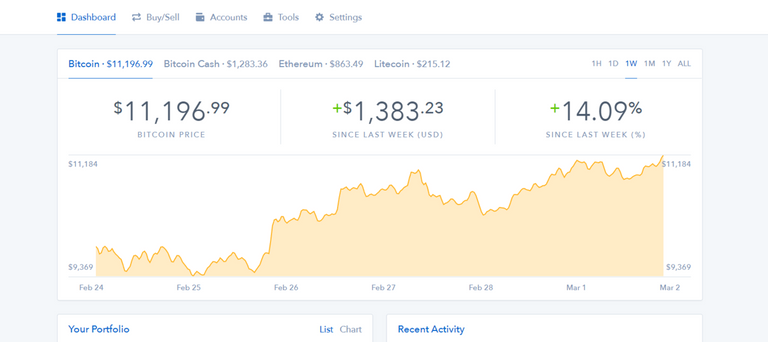

Bitcoin is up about 7% on the week:

(Source: https://www.coinbase.com/dashboard)

Not bad considering stocks are off about 4% and gold is down about 1%.

Which brings me to his next point.

According to Kelly, and many others, bitcoin is the new gold, digital gold.

Traditionally, gold has done well in times of turmoil. Kelly fully expects bitcoin to behave the same way.

Specifically he had this to say regarding bitcoin replacing gold as a store of value:

"But you know what, now we have bitcoin. Bitcoin has a fixed supply. It acts exactly like a hard asset, exactly like a commodity."

"In the trade war, it does well."

He makes a good point and I can't say I disagree.

As I type Bitcoin is continuing to march upwards now getting near $11,500.

Stay informed my friends.

Image source:

http://fortune.com/2018/03/01/bitcoin-price-sec-ico-crackdown/

Follow me: @jrcornel

I am holding to Ethereum as well

I believe both bitcoin and Ethereum will reach new heights in 2018.

BTW Are you on Discord as well @jrcornel?

its rallied well but it will sell off bitcoin wait and see

my thoughts as well

Hmm interesting - I can't help but agree as well with the overall analysis. I think the one wrinkle is whether Tether was actually artificially propped up. I think for BTC an alternative store of value it still needs a baseline value grounded in USD for the moment, but either way, I should probably rebalance a bit into BTC from Gold/ETH...

If there is a trade war, crypto would be a good choice.. now in crypto you can invest in DigixDAO ( DGD )...this coin is backed up by actual gold...they even mail you the gold you purchase if you demanded

Trade wars are bad for everyone but there's a Bitcoin lining to this one. As I write this Bitcoin is hitting 11,500 USD!

Gotta love them linings..!

This new piece of news is exactly what bitcoin needs to get back to its former glory! The FOMO is going to be strong!

Trump has been so good to bitcoiners! It was after the uncertainty of his election that bitcoin started mooning!

I love a good stand alone complex when it materializes and the cryptoworld is full of em!

We don't know what is causing this small uptrend in bitcoin above $11,500, but we'll take it! Yes, this steel tariff trade war may very well cause higher bitcoin demand as a safe haven in conjunction with the stock market falling. Investors have such a high hurdle rate in this market they will be forced to leave the stock market for crypto! :)

Any sort of distress in financial system will push people towards deflationary asset class. While we have a corrupt and erroneous monetary system in place its inevitable to see gains in Bitcoins . Because its more Dollar Implode than Bitcoins rise .

This does go some way to explain things. Interesting to see what the impact will be when tariffs go into effect next week. Surely this will push up costs for US manufacturers as it takes a while to start up steel producers!

The stock market dropped sharply in response to the tariffs, but Trump has been signaling his intentions for years. This should not have come as a surprise to anyone. Trump is focused on creating jobs so expect more tariffs to come down the pike. Trump is trying to do what Reagan did when he was in office, which was to impose tariffs on Japanese auto manufacturers to force them to build manufacturing plants in the U.S. It worked and can work again. I expect the Chinese to retaliate so there may be some turbulence ahead, but the U.S. is in a good position.

The announcement of the trade tariffs on steel are a big deal here in Canada There have been many news reports about this development over the past day or so and the Canadian government has already come out and said that they intend to fight this. The U.S. is one of Canada's biggest trade partners when it comes to many products and resources. Since Trump's election there have been several concerns about changes he is making to trade with Canada.

As far as Bitcoin being gold, I agree. If I am holding Crypto just to keep my money secure I think that Bitcoin is a great option. I'd also use Ethereum or LItecoin for this as well. I see these three as solid and safe in terms of their long term stability. Outside of that I will invest in other coins to make some profit on projects I believe in.

Everybody thinks it's a terrible idea including all his advisors...! It's nuts.

Chaos on a global level always sends cryptos up.

Im waiting for Little Rocket Man to launch a new rocket in 2018, and I expect that will cause BTC price to spike by 15%. Could be 50% spike if Trump decides to retaliate and take out the launch pad after the launch occurs. Could be 100% spike if Trump decides to retaliate and try to take out the leadership of North Korea with widespread cruise missile attacks.

there is a trade war, crypto would be a good choice.. now in crypto you can invest in DigixDAO ( DGD )...this coin is backed up by actual gold...they even mail you the gold you purchase if you demanded

Everyone concentrates on the headliner "trade war", I concentrate on the underlying issue of $800 billion annual trade DEFICIT. Instead of constantly complaining about Trump, can one person offer up a suggestion on how to turn a trade profit? What business (or Government) would continue any process that yields an annual $800b loss?

#unmundomejor si no existiera la codicia, existiera un mejor mundo, seres humanos excepcionales, no llegaríamos a las guerras, vanidad y poder, que al final de cuenta no han podido sobrepasar la muerte, te llega y que te llevas?. crean un imperio comercial satisfacen momentáneamente su vanidad, y que igualmente mueren

thank you bro for your bitcoin information.

good post ...

Good luck always ..

@syafriadi

Hi @jrcornel your post very interesting and very useful for us all. I follow you...

Donald Trump is wrong. Trade wars are bad for all except a small few in the protected industries (even this is not always certain). Despite Trumponomics, I am more than glad to see Bitcoin rise because of this. Hopefully this pulls up the price of Atlcoins Too.

Trump is a businessman and his main venture is real state. Knowing this, I don't know why he would impose higher tariffs on construction materials which will directly affect constructions. Or, is he already out of this kind of business?

Anyway, I really hope that BTC becomes the gold. Thanks for sharing! Cheers!

I think Bitcoin is just good for speculations and not for an "real life" use. The people need a stable cryptocurrency for trading, paying, etc...

great information indeed @jrcornel 7% high this week in bitcoin is showing that it's going

again to rise high well wait and see

whole crypto world is going downward nowadays. many social powers are working hard to put every crypto currency should go down.

but we all should work together and hold the steem coins so that its demand rises and the value of the coin also increases.

As soon as the big 'crash' hit recently, I started buying more #crypto with the hope that the values will eventually become more stable and then hopefully make a high bounce! If you look at the yearly charts for #Bitcoin for the past few years you might notice that bounces, spikes, and crashes are almost all predictable! The good part about all of that is that I truly believe that crypto is here to stay, and that holding on to your cryptoassets is the best idea! #HODL

Información muy importante que todos los que convivimos en este medio debemos conocer. Gracias y reciba un saludo.

Don't forget to stock up on tins of catfood! Meow Brrrrrrrr....😺

Currency related wars are not good for anyone. Hardly maybe its good for someone or something but overall its an unfamiliar situation you want to stuck in. Anyways it could just make steemit reach well high. Lets wait and see.

Trump has opened acan of worms with the 25% import duty announcement. Will have to see the effect on the EU and Asian markets on Monday for this.

Personally, I'm not sure if Bitcoin is a hedge against trade wars. Tried to correlate BTC and cryptocurrency volume grwoth against the Stock market index and couldn't find any direct or inverse relation over a 1 year period .. and I always used to think that in the future if there was a stock market repeat of 2008, crypto would be the safe haven for investors... that may be true in future but as of now no real evidence to suggest that other that just hte gut instincts of a few.

I had not really thought about this as a trade-war hedge but this is a brilliant strategy. I have not much bitcoin but I do have about 50 NEO I am now thinking about swapping into BTC after reading this.

Glad I found this article. I generally steer away from CNBC cz they really NEVER have anything good to say about Crypto.

Thank you very much

interesting post :) definatelly i will follow you .

Check my post about emotions in trading

https://steemit.com/bitcoin/@sergiudemerji/how-to-control-emotions-when-trading

Bitcoin price looks very similar to gold, at least at different time scale. https://steemit.com/bitcoin/@trisolaran/striking-similarity-between-gold-and-bitcoin-charts