Mike Novogratz says Bitcoin has serious upside from current levels.

In an interview with CNBC's Fast Money, Mike Novogratz said that he thinks it is basically impossible that bitcoin doesn't rebound to the $8,800-$10,000 range at some point by the end of this year.

He also called the end of the bear market just a few days ago.

More about that can be seen here:

https://steemit.com/crypto/@jrcornel/mike-novogratz-i-think-we-put-in-the-lows-yesterday

This was as bitcoin prices were just barely about $6k.

His reasoning being that bitcoin had now retraced all of the euphoric move that started in October of last year:

(Source: https://steemit.com/crypto/@jrcornel/mike-novogratz-i-think-we-put-in-the-lows-yesterday)

According to Novogratz that is what often happens when bubble-ish markets pop. The most vertical and euphoric part of the move gets taken back.

His call is looking pretty good right about now.

Blast off within the next 6 months?

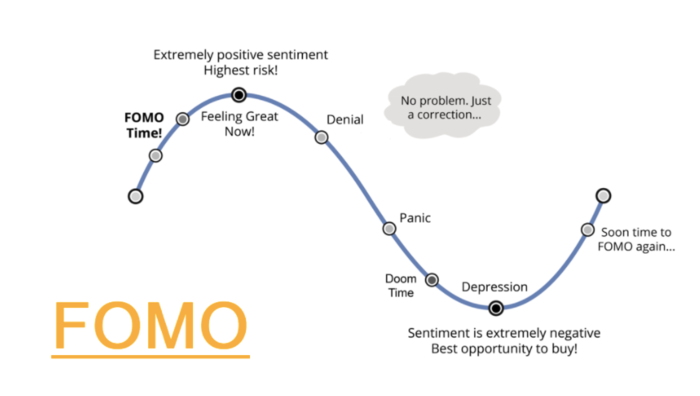

According to Mike, the next FOMO that takes markets to new highs will come from institutions.

Specifically, Mike had this to say:

"It’s also a bull market in institutions building the infrastructure needed for real money investors to start investing in this space. I think that in three to six months from now, there will be an ‘all clear’ sign for people — big institutions and pension [funds] — to start investing.”

(Source: https://www.ccn.com/10000-target-novogratz-sees-bitcoin-jumping-30-in-2018/)

All clear within 6 months?

Sounds good to me!

I think we will have a bitcoin ETF approved within the next 6-9 months as well, so that would also help further Mike's bullish thesis.

What might FOMO among institutions lead to?

According to Mike, he would not be surprised to see markets eventally reach $20 trillion at their peak.

Yes that is trillion with a "t".

At peak euphoria last year, the markets were not even worth $1 trillion, just for some perspective.

According to Mike:

“It won’t go there ($20 trillion) right away. What is going to happen is, one of these intrepid pension funds, somebody who is a market leader, is going to say, you know what? We’ve got custody, Goldman Sachs is involved, Bloomberg has an index I can track my performance against, and they’re going to buy. And all of the sudden, the second guy buys. The same FOMO that you saw in retail [will be demonstrated by institutional investors]."

(Source: https://www.ccn.com/10000-target-novogratz-sees-bitcoin-jumping-30-in-2018/)

The same FOMO you saw in retail will be demonstrated by institutional investors?

Yes please!

(Source: https://en.bitcoinwiki.org/wiki/Cycle_FOMO-FUD)

Some caveats:

Keep in mind that Mike Novogratz has roughly 20% of his net worth in crypto, so he is a big time bull.

However, also keep in mind that he was calling for a top back in December of 2017. Even delaying launching his crypto hedge fund due to market conditions.

IE, things being too frothy for him to feel comfortable buying into.

Overall, I would say Mike Novogratz has a pretty good pulse on the crypto markets and he is one I listen to when he makes price predictions.

Stay informed my friends.

Image Source:

https://coindiary.net/mike-novogratz-says-cryptocurrency-market-has-found-a-bottom-already/

Follow me: @jrcornel

Mike Novogratz is in a spot praying that bitcoin doesn't go below $5K. He's got investors to worry about. If it goes below $3K, then he might be forced to sell out to satisfy all the investors he's got. That's most likely the reason why he's saying what he's saying.

I agree that long term bitcoin is extremely bullish, but short term, I'm 90% certain we will see below $5K before this bear market is over. Someone like Mike Novogratz or Tim Draper "rage quitting" and selling out would be a sign that the bear market is over.

I fully agree - anyone who uses the word "impossible" when talking about investments is either a con-man or a clown...

Isn't it equally "impossible" that Bitcoin wont go under 4k this year? - Hell if I had to bet on one impossibility I'd bet on that one. But I already did that last December when I sold all mine at 17k...

Bitcoin is probably a dead horse now

I think he knows that it isn't technically impossible. He is looking at everything being built behind the scenes, taking that into account with the big money he talks to wanting in, and

also charts bottoming out along with regulatory clarity, and sees a snap back rally as something very probable over the next 4 months. Though, anything is technically "possible."

Markets follow patterns which suggests that if it goes below $4975, the next support zone is somewhere just above $3K. It might even flash crash to somewhere around $1K, but if that happens it won't last long. Ethereum did this briefly in June 2017 on rumors of Vitalik's death and went all the way down to about 10 cents, but that condition lasted only for about a minute or two.

I'd never count Bitcoin out in the long term. I think we will see new ATH's by the last quarter of 2019. The gains coming in the 2020's will be historic. I think that technically we will be out of the bear market by the end of next winter (Feb / Mar 2019) but trading might be sideways next summer, but it is definitely going back up well above 20K, it's only a matter of time.

I have reason to believe that the next parabolic FOMO will start summer 2020 and won't peak fully until early 2021. By then, bitcoin prices could easily be above 100K.

Have you been following Novogratz much? His fund is predominately his own money. He delayed launching to investors due to the price running up too fast late last year. Also he has been very particular about calling tops and bottoms, he was right about the top and I would not be surprised if he is right about the bottom as well.

Tone Vays says something different. While he's more bearish than I prefer, he's a former wall st pro from Bear Stearns. He's said Novogratz and Draper may be willing to hodl their own funds, but their investors are a different story. They may be forced to sell their investor's holdings. Do you know precisely how much is own funds vs others money?

That I do not know. I don't know when or if he actually launched his hedge fund. It was originally funded with his own money only. When it came time to take money from investors, it was December of 2017 and Novogratz said he didn't feel right taking investments from others at the same time he was selling his personal holdings, so he delayed the launch. I am not sure how long he delayed it for though. He mentioned something about after bitcoin peaking it December it would be a good 8 months before it was worth buying again, pretty good call on his timing thus far.

Really

Really

Can’t we all pull together to will BTC to $10,000?

👍🤑👍🤑👍🤑👍🤑👍🤑👍

I'm willing it, are you?

Yep 👍

Does this mean you agree?

Great news!

Posted using Partiko Android

I thought so as well.

I’m thinking that he needs to make all the hundreds of millions he lost back before the end of the year 😂

He was actually selling a lot of his holdings in December of 2017, and shorting things in January and February of 2018. Something tells me he didn't loose too much money ;)

Really? I heard his fund was down huge! His trades should be on the blockchain 😂

Yea, I mean he said he was selling his Bitcoin and Ether back in December, back in December. He also said hew as short a number of altcoins when they ran up in January saying valuations didn't' make sense on most altcoins. Do you have a link about his fund being down huge? He delayed launching due to market conditions last year...

Not sure, this was a few months ago. 1st quarter down 134 million. https://www.bloomberg.com/news/articles/2018-07-26/novogratz-s-galaxy-digital-sees-134-million-loss-on-crypto-drop

Though he didn't flat out say this, I am thinking that he might have shelved plans to launch his fun and replace it with his merchant bank idea. It sounded initially like he may run both, perhaps it is just the bank though that is public and the fund only holds his personal funds. Thanks for the link, it does appear his trading via the bank has been taking a beating. Though I do know he was talking about raising billions for his fund, if he did that for the bank, losing $100 million isn't that big of a deal, at least when there may be $3 billion or so involved.

Let's wait and see if his words become true. I hope that the prices will raise again. Only thing I worry about is that I'm not utilising the present time to invest much!

I hear you. If it moons we will kick ourselves we didn't have more when it was low...

thank u for infos

The potential of institutions getting directly involved in crypto assets seems like it is getting closer as the potential infrastructure investments they look for are running low and/or have hige valuations. Custodial solutions are also here and help.

Yep, not as easy to invest in the next coinbase as it was to invest in the original one. At some point they will turn to the coins themselves. Though, I would bet they stick predominantly to bitcoin, at least at first.

Let the FOMO begins and we will see some new high again :D

@jrcornel Taram-pam-pam