Something I've noticed for a long time played out yet again the other day...

Early Friday morning (October 25th) an important technical pattern triggered on bitcoin.

A pattern known as a "Death Cross".

It has an ominous name and is often quoted by traders as an extremely bearish technical indicator/pattern.

Specifically, it is where a faster moving average, usually the 50 period MA, crosses below a slower moving average, usually the 200 period MA.

It triggered early Friday morning on bitcoin:

(Source: https://www.coindesk.com/bitcoin-charts-death-cross-after-47-price-drop-from-2019-high)

What happened next?

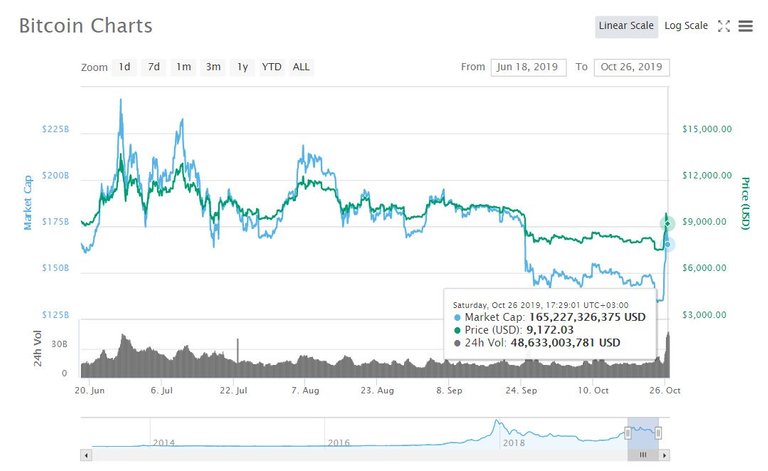

Well, unless you have been living under a rock the last couple days, you know very well what happened next.

Bitcoin spiked some 40% in a 24 hour period!

Briefly touching highs over $10,500 per coin after being below $7,400 just a day before.

Not only that, but bitcoin saw record breaking volume in the process:

(Source: ~~~ embed:1188206893262618627) twitter metadata:bWlzaGFsZWRlcm1hbnx8aHR0cHM6Ly90d2l0dGVyLmNvbS9taXNoYWxlZGVybWFuL3N0YXR1cy8xMTg4MjA2ODkzMjYyNjE4NjI3KXw= ~~~

Bitcoin saw $48.6 billion in dollar volume on October 26th, which was a new all time high since bitcoin was created over a decade ago.

The previous all time high was $46.4 billion on June 27th earlier this year.

And this started on a very day that this supposedly extremely bearish technical pattern triggered.

A bearish pattern you say?

I have noticed throughout my years of trading that the Death Cross is so much of a lagging indicator and it happens after an asset is already so beat up, that it often signals a short term bottom at the very least.

And possibly an outright entire trend reversal.

In fact, I am not the only one that has noticed that.

Check this out:

(Source: https://www.coindesk.com/bitcoin-charts-death-cross-after-47-price-drop-from-2019-high)

The same thing likely happened here.

We had sentiment at such extremes that it didn't take much pushing in the other direction to get a massive snap back rally, right at the time when things were starting to looking their most bearish.

Stay informed my friends.

-Doc

BTC will moon soonish

I agree. I have been saying $20k by May of 2020 for a long time now. Looks like a better chance for that now then say a week ago.

Haven’t heard of death cross before. Good to know. Thanks.

The Golden cross is basically the opposite?

don't quote me.

Yep.

Apparrently the Death Cross doesn't count if the 200 SMA is still rising. Check out this video on the subject.

For most technical definitions of the pattern, that doesn't seem to matter. Though I agree back-testing using that data would probably make it less reliable.

I really wouldn't use CMC as a measure of volume. They take every exchange at their word for volume stats.

Fair enough, though I would still speculate there was more real volume the other day than on any other day as well. Mostly because there is likely less fake volume now then say two years ago when bitcoin made its all time highs.

Why would you think that volume was fake back then but less now? Back then exchanges were overloaded with people in a rush to buy Bitcoin and cryptocurrency. Today, there's almost no interest in Bitcoin or cryptocurrency.

Exchange web traffic is also way lower, according to Alexa. Binance was in top 200 sites worldwide in late 2017. Today it is far lower:

It was also only a few months ago that Bitwise report concluded volume on CMC was 95% fake.

https://www.forbes.com/sites/cbovaird/2019/03/22/95-of-reported-bitcoin-trading-volume-is-fake-says-bitwise/#4aa038896717

That report came out 7 months ago and that is actually part of the reason I believe it is harder now. CMC acknowledged the report and has beefed up it's reporting protocols. They even have a metric on their page now that says sort by reported vs adjusted volume. Not only that, but exchanges are looked at much more closely now then they were 2-3 years ago and it's more difficult to pull off shady practices then it was then just in general.

Traffic metrics could mean several things. For one, it likely mostly just applies to retail. The CME futures are much more robust then they were back then, by orders of magnitude. That volume likely came from somewhere and is much more likely to be institutional. Plus you have Bakkt and a couple other institutional side investment products/platforms showing increasing activity. It's very possible you could have a drop in retail interest and an increase in institutional interest that more than makes up the difference, and you likely wouldn't see that at the popular crypto exchanges.

Regarding google trends, again that is likely showing a drop of retail interest plus there is always the fact that once you search for something like bitcoin to understand what it is, there is less of a need to search for it again. Bitcoin is more well known now than at any point prior. It's on CNBC every single day and has been mentioned by the president, the treasury secretary, and the FED Chair all in the past several months.

There is no way of knowing for sure that the volume is 'more legit' now than say 2-3 years ago, but intuitively it seems very likely that it would be citing some of the reasons mentioned above.

seems to me the shorts got overrun lmao and i like it that way also lol

have a great day bud and i hope your weekend is looking good

Yep, they most certainly did. Lot of margin shorts were liquidated at Bitmex on Friday.

Congratulations @jrcornel! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

This is a welcome sight for hodlers. When BTC dropped below 8K, I dared not to look at a chart.

I hope to see a higher uptrend soon enough, maybe bring cryptos back into a new bull run.

On other news; Bakkt also recorded new highs for volumes.

So, all in all, it's been good news these past few days.

Yep, I saw that as well. I did a post on it the other day in fact. :)

Ah, yes you did. In fact I read it, enjoyed it, and upvoted :)

Keep it up with the informative posts!

Posted using Partiko Android

What about the reverse? Would that bullish signal also be a leading indicator and thus actually be a signal for a correction perhaps?

Possibly. I think there needs to be a bit of context. As someone else mentioned, when the 200 MA is pointing up, the death cross tends to fail more often. That likely has to do with prices being in a longer term uptrend during the pullback. The inverse is probably true as well. The golden cross probably is a contrarian indicator more often when the 200 MA is pointing down during the cross...

Congratulations @jrcornel!

Your post was mentioned in the Steem Hit Parade in the following category:

Cool, thanks.

You're welcome @jrcornel

Your post has been curated by the bitcoin myk project. Tokens are available for this account you can trade for steem at: https://steem-engine.com/. Join our curation priority list to earn more tokens by registering at:

http://www.bitcoinmyk.com/register/

Bitcoin MYK

admin

Register - Bitcoin MYK

Bearish signal or not, I'm putting BTC at $42K within the next few months, so...

Can I sell you mine there right now? :)

That would be an incredible move, with that money you could buy 5X more and enjoy the ride up 5X richer!! :D

Does that mean we have a deal? :) Haha but yes it would be awesome to see.

No deal, just because I´m still waiting for BTC to go a little lower before I do another big buy!

What price are you looking for?

Before this move up, I was expecting $6k, but now I´ll be happy to buy around $8K (not ideal, but it´s money that I just can´t have sitting in my bank if I have a great opportunity right in front of me).

Looking forward to more good news like this ✅