As bitcoin rises, the shorts are piling back in.

Short bets against the price of bitcoin shot up significantly yesterday.

In fact, check out this action in a very short amount of time:

(Source: ~~~ embed:1036190362170081280) twitter metadata:Y3J5cHRvU3F1ZWV6ZXx8aHR0cHM6Ly90d2l0dGVyLmNvbS9jcnlwdG9TcXVlZXplL3N0YXR1cy8xMDM2MTkwMzYyMTcwMDgxMjgwKXw= ~~~

Margin short positions on Bitfinex shot up some 10k bitcoin in a matter of hours.

According to the poster who noticed that action, this was pretty unusual...

"This is the first time in my 5 years of trading Bitcoin that I've seen an increase of almost 10,000 $BTC of shorts in less than 3hours on Bitfinex."

(Source: ~~~ embed:1036190362170081280) twitter metadata:Y3J5cHRvU3F1ZWV6ZXx8aHR0cHM6Ly90d2l0dGVyLmNvbS9jcnlwdG9TcXVlZXplL3N0YXR1cy8xMDM2MTkwMzYyMTcwMDgxMjgwKXw= ~~~

Ok, but what's the context?

Hearing 10k bitcoins being sold short may not mean much to you without some context.

To better understand how significant that is or isn't, we need to see the total short positions.

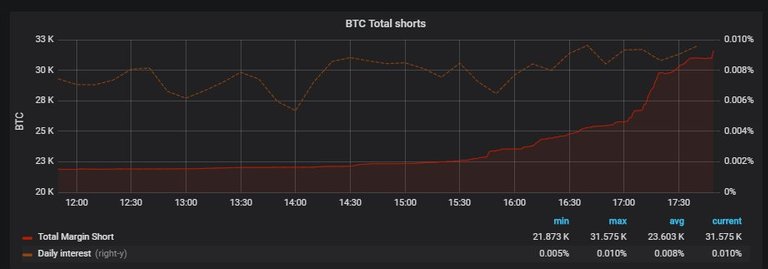

Take a look at this chart of the total short positions on Bitfinex:

(That big fat green candle is what just took place, mentioned above)

That 40k number briefly topped the number seen in April and represents the largest number of short positions on Bitfinex, ever.

Is rising short interest a good or bad thing?

Some may say that it is bad as rising short interest may mean that people are expecting prices to go lower...

However, I think a high short interest is a very good thing.

Often you need a healthy amount of pessimism in markets in order for them to keep going higher. When everyone is on the same side of a trade there is not really anyone left to keep pushing prices in that direction.

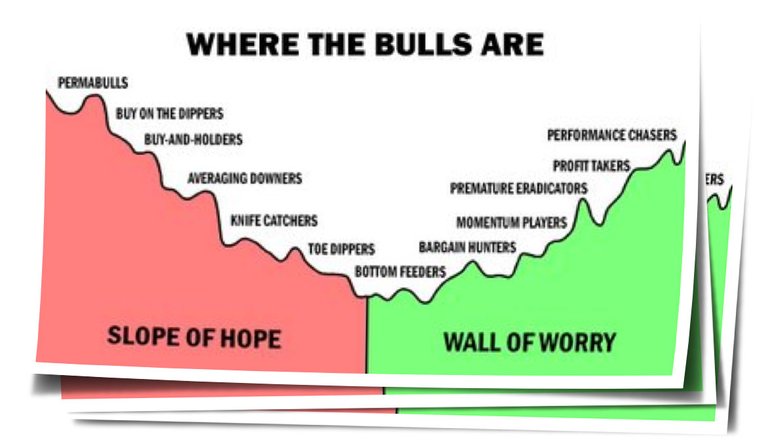

Ever heard the phrase, "stocks tend to climb a wall of worry"?

It's kind of the same thing.

(Source: http://advisoranalyst.com/glablog/2013/08/14/the-wall-of-worry.html/)

A short position represents built in buying at some point as those short positions must be bought in order to close the position.

For that reason, I welcome rising short positions.

It provides the fuel needed for a major bitcoin rally when they get squeezed!

Stay informed my friends.

Image Source:

Follow me: @jrcornel

I read that the ETF managers did not have enough Bitcoin to back their ETF initially.

Did it ever change?

Are the future contracts on the Bitcoin ETF price, or on Bitcoin's price?

How good did the short positions were so far at prediction of Bitcoin price?

I hadn't read that about the ETFs being short on bitcoin, but it seems likely they wouldn't purchase their inventory until they got approval from the SEC.

You got a 57.42% upvote from @luckyvotes courtesy of @fersher!

You got a 100.00% upvote from @sleeplesswhale courtesy of @fersher!

This comment has received a 38.46 % upvote from @steemdiffuser thanks to: @fersher.

Bids above 0.05 SBD may get additional upvotes from our trail members.

Get Upvotes, Join Our Trail, or Delegate Some SP

Nice analysis @jcornel

Which part did you like best?

Generally this is a bad thing. Means short term pullback.

Nah, the short positions are already put on. Yet prices haven't dropped. Probably means it's gonna take a lot more shorting or we are moving higher.

i put my bet on more shorting before moving up.

I found the culprit who is opening up all these short positions on Bitfinex:

That sure looks like them!

Thanks for your information.

Maybe that (I hope so) but maybe that's mostly a single very wealthy group that knows it's about to manipulate the market.

While a short squeeze is great we have also seen the bad side of it as it could lead to exchanges not being able to handle and cover the positions. This could lead to FUD with exchanges again and more doubts regarding the SEC ETF decision due to their concerns of volume and risk management. However, I would not complain to see short sellers in pain...

Haha true. Though there are enough exchanges out there now, that if someone wants to allow or put on that much short exposure that it risks their firm, I say let em fail. Poor risk management.

maybe hire a better trade manager.

Another short-squeeze incoming? Let's push BTC to 8000 to see that happen ;-)

I am thinking so. $8,500 could be in play these next few weeks.

nice informations

That slope of hope and wall of worry are spot on. Yea I think the price may drop a bit on BTC, followed by a nice rise.

We've been sliding down that slope of hope for 8 months now. It's time to do some climbing!

This is a great information

The price often pulls back to around 30% down from the supposed peak @jrcornel and then goes back up to a higher price.

There are often patterns with price action sure. Is that one you've noticed?

The chart tells it all @jrcornel

Thanks for this information lets cross fingers that more short positioned traders will get burned when the price of Bitcoin starts to raise or stabilize.

Posted using Partiko Android

I won't feel bad one satoshi.

I never heard of his saying that you mentioned: "stocks tend to climb a wall of worry". Thanks for your info!

Oh yea, it's a common saying among stock investors.

Maybe we'l see a short squeeze soon :)

Posted using Partiko Android

Congratulations @jrcornel! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

This game of shorting will get interesting now big investors know how to play this in style

their wallet are ready. their skill is proven. the result is expected.

We know why!

Yes we do... despicable!

Pleawe check my post out https://steemit.com/religious/@eurekatraps/why-are-people-religious

Please stop spamming this comment on every blog!!!I love you, but don't be a rotten log.@eurekatraps