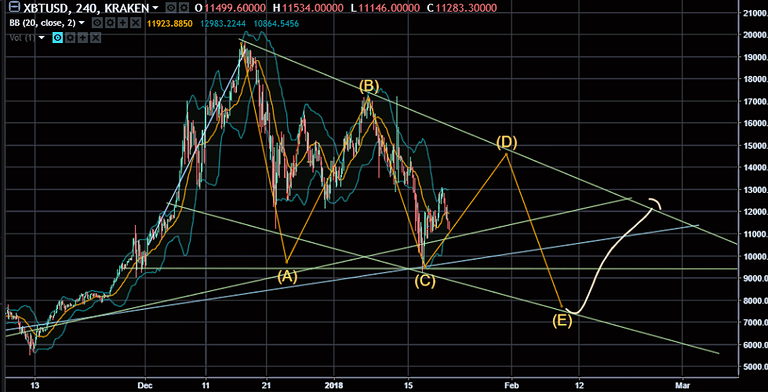

I've been thinking about this once again and tried a grander approach, that would see the entire wedge on a larger scale, lead us down to 7000+ and give us time to regroup and grow by early March.

That would mean we can have 2.5 months of an actual bear market, lower lows, the works - and only then, what with capital influx etc, start growing rapidly again... we'd have had our crash, everybody would be relaxed and happy. BTC would have fallen from about 19k to almost 7k, two thirds, who could ask for more.

Fresh bull market, all paranoia gone till... end of he year ?

The blue/greenish lower lines coming from the left to cut the upper triangle border near the possible breakout point have their origins at lows from July onwards through November... till mid February however, only day trading looks profitable.

It's getting hard to tell where to keep your money right now, and I don't like spending a quarter of my day staring at binance.

On a lighter note: I just bought some ELF for a potential jump... Take a look at her 4 hour chart and tell me what you see/think.

Not much - you should have bought on the 17th ;)

This is a month-old coin. It's hard to see how it could go down a lot, though...

I hate it when there's no fiat to compare, just crypto, and that crypto's future is unforeseeable.

It's at 14 now with the MA going downwards, cannot see it fall below 9.

Compared to ETH, it looks like a better buy, with the MA seemingly going up... only slightly so far, and maybe that's just because ETH is going down more than BTC at the moment, for six hours or so.

If you have insider info that there's a irrefutable reason this must go up soon (a cloud to host other blockchains sounds grande with an e, but will they take the offer).

Website's a bit intransparent, but they all are.

It does look like a bit of a gamble, but it will probably shoot if it receives some good marketing hype, once the market is out of the boondocks - marketing is everything in this business.

Pressing thumbs ;)

well you do your homework, I'll give you that.

I liked the perfect cup it just formed during the recent correction. At the very least it shows shr has some real support and vigor, which is more than coins like xvg and xlm are offering.

I figure that's due to ELF being new and interesting and that it isn't coming off a 10x run like most.

Stupid name, but promising for at least a short-term pop. Maybe.

And no I do not have inside info. I wish.

Hate it when I don't have info... the cups and handles are everywhere these days... if they play out and when is all dependent on the general mood, have to wait for that to get better. Then again, with small coins you often have a surprising pump that will make the coin look better and lure a few people in... not so hard to do. I would either be constantly on the lookout for that or place a stop order that would guarantee you a nice profit in case it unexpectedly jumps to 25 or so.

well, would you look at today's action!

If you missed that one, watch the bollinger bands and the stochastic... buy when it breaks through the low and then watch it, ride the first elliott wave up and the second to half, then get out. Always works except when there's a drastic downtrend, I don't see that here. Just touched the lower band and climbs while I'm writing this...

My guess is that it's being pumped by a private group. I would wager that they're buttering up new members with some profits to gain their trust....the price action is too weird to be a normal upswing.

Very viable perspective, not a bad thing for switching gears and buying up or swinging on the way down.

I think so - it leaves room for everything to play out... no experienced traders saying, "I don't know, this doesn't look deep enough - makes me feel uneasy..."

I've been looking at the 2015 and 16 end of year scenarios and the 2017 dips, and it's really as if, simplified, you get this bigger crash about once a year and lesser ones about every 5-6 weeks, these may last a week or two, while the bigger dip, lets call it a crash, creates a bear market of a few months - it's not necessarily always the end of year dip that's biggest.

Or rather, that's what happened before, when the market cap was low.

But that has changed... and so we may be done with 2 months of a bear market this time and all set to cash out from then onwards, because most of us have been learning a lot lately.

I also think day trading can be good practice, just don't risk everything - take it easy ;)

No day trading for me maestra.

But your few months bearish market seems very reasonable. 17K was the real dead cat bounce.

@CI is waiting for 8300 and I'm beginning to suspect he's right, while I suspect we may slowly trend down to it rather than spike down.

There have been some fearsome down spikes but no capitualtion low that I see, yet.

I'm fat BTC, nearly 50%, and only about 15% cash (unless I decide to scrape a little more out of the stock market). So I'm in hodl and nibble mode. Almost added some ETH at 911 today but it only went down to 917 and I have to remind myself never chase a stock.

Who'da thunk cryptos could become so boring...

Be well,

Rick

I understand, but it's a matter of how much time you have - if you work online, it's feasible and you only need to conquer your initial aversion. I the end, day-trading will be more profitable than hodling and waiting for months that something finishes a "healthy correction" and investors get back their frail nerve to actually bet money on it. Or so I think ;)

You may be right about the profitability of day trading cryptos. And if anyone can do it well I think you may be one the rare few. IMHO, the importance of avoiding emotional involvement in the trade is crucial and in the fast pace required for day trading it is probably impossible for most.

Plan the trade and trade the plan! How the hell can anyone do that rapidly? Not me.

In my dwindling spare time I've been thinking about getting a trading bot running. My cousin is considering writing his own (he has the writing skillset but his practical trading experience is nearly nil). I actually reached out to Haas at one point, but they are too millennial for me and I won't pay anyone if I can't talk to someone on the phone first.

More later, my wife just hijacked my agenda for the rest of this morning.

Ciao,

Rick

Back now, honey-do list temporarily caught up.

Well that sucked.

Stock market opened strong this morning, my whole portfolio up 2%. For me that's a good day in the market, much better than average, but everything turned around while I'm working on more important things and I'm down 2% at the end of the day.

Oh well, stuff happens, and this market has been so strong that only a complete idiot could fail to make money in the past year. By that measurement standard I'm not a complete idiot 8-)

GDAX doesn't provide any notification about executed trades, no email or text notification option and I'm too easily bored to watch it continuously. Does your exchange notify you when an order executes?

Ciao again,

Rick

They only notify when you add and withdraw and such, I would think that sending people mails because of such things would both eat resource and present hackers with valuable information - even geniuses like Hillary used insecure email servers ;)

I never got on GDAX because they wanted some ID info I had already given Coinbase, and something between the two didn't work out, so I grew bored and went somewhere else, but the basic setup should be the same mostly...

I heard that limit orders don't always execute when the markets are tight, anyway - that can be fatal, best to watch what's going on.

They limited my ability to correspond to one uttering a day, so I have no idea if I can post this comment as I already answered @wk93 above...