Bitcoin has been the number one investment since its introduction. If you would have bought $100 worth back in July 2010, today you would be sitting on $500 million (at todays price of $15,000). Yes, Bitcoin in general is very volatile and this can scare a lot of investors but looking at its overall history, Bitcoin has shown an overall up trend that shows no sign of stopping. And its doing this uphill sprint while hackers, haters, institutions, governments, and other entities constantly try to attack it in any shape and form. And it just keeps on going!

Now some of you are probably thinking that it may be too late to get into this “game”, but I’m here to inform you that its not! When jotting down these words as of December 2017, I can assure you that we, meaning everyone currently actively trading in the Bitcoin world, or as its better known the cryptospace, belong to the under 1% of the world population.

In the $100 example, two paragraphs above, those few who made millions just sitting on Bitcoin were ridding the first wave. Now its time to strategically place ourselves for the upcoming next wave.

Things to consider

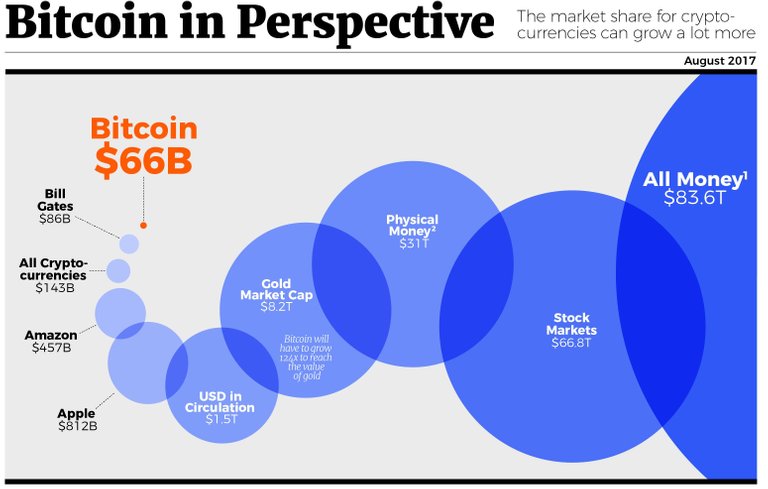

The market cap of Bitcoin makes up but just a tiny fraction of the whole financial system so it has a tonne of room to grow yet. Plus the vast majority of the population is still ignorant of Bitcoin and if you consider only the unbanked population in third world countries who already as i write this are starting to use Bitcoin and other altcoins thru their mobile phones then the future is looking even brighter! Bitcoin and other blockchain based applications are about to change the world as we know it. Its already affecting the world of finance, commerce, information and god knows what else is to come … ie healthcare.

Most experts (eg: Kay Van-Peterson, Max Keiser, Kerim Derhalli, Dave Chapman, Tom Lee) are predicting the price of one Bitcoin to reach $100,000 in the next couple of years. Other experts are predicting a mobile phone market penetration of 25% within the next 18 months. From my research so far, i personally believe that who ever acts now can smartly position himself for the next wave and transform his life for ever!

What are the options

To be part of this technological and financial revolution i have identified 5 possible options with varying degrees of risk. Risk here is based on the “belief” by all who participate, that Bitcoin’s value will continue its overall up trend in the future. Though even if its price plateaus for even a couple of years, everyone involved will still come out in front. My 5 options are what I have personally identified as viable, if you have any other options to add, please leave a comment below.

1) Buy & Forget

The first option offers the lowest risk and most probaly the lowest return, though you never know. It all depends on how Bitcoin performs over the next 12 or 24 months. Since we are all believers in Bitcoin, then most of us would probably agree that if you buy a couple of thousand worth of Bitcoin today, in 24 months from now it should be worth anything from x2 to x10 its current price. No one knows for sure how the price will play out, but pretty much everyone agrees that it will be going up.

2) Mining Bitcoin

Mining, which could once be done on the average home computer is now only done profitably by specialized mining pools. These are usualy located in parts of the world where electricity is cheap and are warehouses filled with ASIC miners and GPU’s built for the sole purpose of mining Bitcoin or other cryptocurrencies. This option raises the risk a little but offers some passive daily income but it wont necesseraly get you more bitcoin when compared to option1. Instead of buying Bitcoin you put your money into buying mining shares or Hash power that can offer a daily payout in BTC. The risk here is picking a trustworthy company that will still be around in the future.

3) Trading alt coins

Unlike with option 1 where you buy once and just continue with your life and only get back at your funds a couple of years later, with trading you buy and are nearly always aware of market price fluctuations making for a lot of sleepless nights. You can trade short term or long term with the long term being anything from a few days to a few months. There are a lot of ways and styles and different schools of thought on how to trade, but for this discussion suffice to say, short term is riskier than long term, with the later offering much more sleep and a safer way to invest as long as you learn to “HODL” and sell only in the green. Most traders try to follow the rule of buying on the dip, and selling half of their coins at x2 the price. If successfully accomplished this offers a return of the initial investment plus a bonus of half the coins they originally purchased for free. This option is much riskier than the previous two by a large degree, but offers much higher rewards in a much smaller time frame!

4) Initial Coin Offerings

ICO’s offer investors the chance to buy into a token/coin at their supposedly lowest price possible. Unfortunately this is not often the case. The problem is most ideas dont come to fruition soon enough or at all, hence their market value drops radically or in some other rare cases, the people behind the project decide to just take the money and run! But then again, if you did your own research and are “lucky” as well, your chosen ICO may go to the moon as soon as it hits the exchange making you very rich! Again, a very high risk but with potentialy very high gains.

5) All of the above

This option combines all of the above by splitting your investment based on risk factor. The common equation is to have 50% of your portfolio invested in the less risky option, so this would be just buying Bitcoin. Then 25% into your next less riskiest investment, which would be minning, then 12,5% into trading and 12,5% into ICO’s. This is not a bad strategy for someone with an initial capital of around $10,000 but can be a bit unrealistic if you are starting with only $1,000. Most people I know who started with smaller amounts, usually just eliminate the first 50% Bitcoin part from the pie chart. Which would mean, you put 50% into mining and 25% each for trading and ICO’s. Once your trades become fruitful, then you can start accumulating Bitcoin for longer holds.

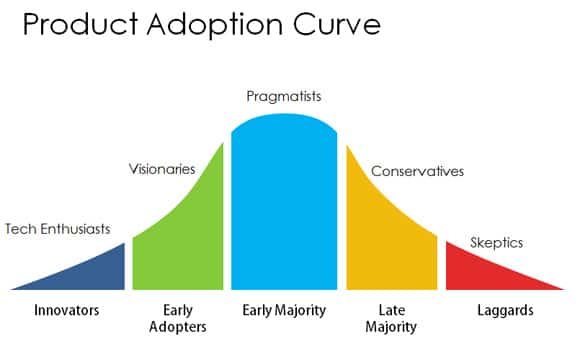

We are somewhere between the innovators and the early adopters.

Last words

Experienced users should try and spread their eggs into as many different baskets as possible so they should be opting for option 5. And i say this with an emphasis because I know a lot of you are taking huge risks with largs sums only on short term trading. If you are new to the cryptospace, I would recommend you stick with options 1 and 2 for the low risk attributes until such time that you feel you can venture into the other options.

Remember, whenever you try something new, whether its a new walllet, a new account, a new trade method, or whatever for the first time do a trial run using a small amount. When you have successfully accomplished your target, then repeat with higher amounts. Also make sure you have gone through my Staying safe with Bitcoin article before moving on. Also keep an eye out for my upcoming “How to” series on some of the options mentioned above.

UPVOTE & SHARE

If you enjoyed this article I would really appreciate an upvote ;-) You could also help me by resteeming my article for others to find and read, thanks!

Resteemed by @resteembot! Good Luck!

The resteem was paid by @greetbot

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.

Butcoin hasnt seen any price hikes recently. Hope that changes soon

Hi. I am @greetbot - a bot that uses AI to look for newbies who write good content!

Your post was approved by me. As reward it will be resteemed by a resteeming service.