Bitcoin price

Bitcoin and other crypto coins are moving sharply down this week.

Potential reasons are the upcoming Bitcoin hard fork in November; the ICO ban in China; rumours about a possible Bitcoin ban in China; and generally a price that has been increasing too much too fast.

As can be seen on the 3-day grouping chart, Bitcoin has been making a large move up previous months.

3-day grouping chart. One candle is 3 days. The yellow line is the moving average.

A healthy correction was to be expected.

Going by the moving average (yellow line) it could lower all the way to the $3500 region.

On the 1-day grouping chart (one candle is one day) the price just dipped below the moving average, indicating the price is likely to move down further in the coming week. We might see a small uptick in the coming days.

1 day grouping chart. One candle is one day. Yellow line is the moving average.

Bubble popping?

The Bitcoin price has been ascending to great new heights. From $220 in May 2015 to almost $5000 recently. That's an amazing rally.

Is it in bubble territory? Looking at the long term Bitcoin chart on a percentage basis (with a logarithmic chart), we see the percentage run-up has not been as spectacular as the previous two run-ups:

Long term Bitcoin chart using a logarithmic y-axis.

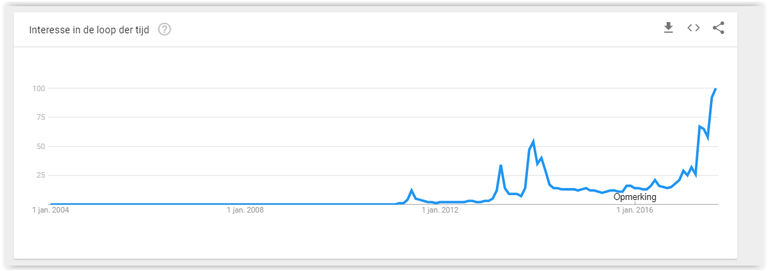

The Google search volume is showing all time heights for keywords Bitcoin, bitcoin price and BTC USD:

I'm giving this a 60% chance of this being a healthy normal correction, and a 40% chance we're seeing a full-blown bubble popping.

With the Bitcoin price moving down, the general trend is that other cryptocurrencies are moving down too - and harder than bitcoin.

If you own Bitcoin, you might consider investing in several altcoins in the coming weeks, as they have become much more affordable relative to Bitcoin.

If you own Ethereum or any other cryptocurrency and expect the full bubble to burst, you might also consider selling it when the price rebounds.

The news is subjective

Yes it is. Its a blog.