Bitcoin started in 2009. An unknown person using the alias Satoshi Nakamoto wrote a whitepaper about his decentralized token. That has two meanings. First, Bitcoin doesn't need a bank (Automated Clearing House [ACH]) to process transactions. Instead, processing happens across a lot of devices in a variety of places around the world. The other, Bitcoin is not an official currency of any country, thus has no central bank. It worked out for him, whoever.

The first sale using Bitcoin was by a man from Florida 2010, who bought two large Papa John's pizzas for 10,000 BTC through a post on a forum where Bitcoin was discussed. Not long after, the price reached $1. Bitcoin's rise was smooth sailing from there.

2013 was a breakout year. The price crossed the $100 mark in June and the $1000 mark in November. The price was up and down during 2014. In 2015, it began to taper off and people thought the party was over. That is until December of that year.

In the last week of December 2015, the $230 BTC more than tripled to $720. That was the week I started Bitcoin. My third and fourth Bitcoins tripled while I was sleeping. I was hooked from then on out.

2016 saw stability. The price grew to $950, but more importantly, it didn't drop. The fact that it didn't lose value brought thousands upon thousands on board. When it would originally take me 3 hours to sell a Bitcoin over the counter, I could now sell a higher priced Bitcoin in a little under 2 hours. 'Hog Heaven' is the best way I could describe this. There was no way this could ever get any better. Then the forks came.

2017 was an astronomical year for the now pop culture phenomenon. The 'forks' were duplications of the token system, and they actually let you keep the duplicates with value in the tokens. I almost fainted every single time that it happened. It happened four times that year. I was giving Bitcoin away in a drunken frenzy. I did sober up.

On December 15, 2017, the price of a Bitcoin reached $19,700 .Cex.io had the price at $20,200 that day. (Cex.io has a higher cash out price for Bitcoin most of the time.) And then the 16th came. The price dropped a couple of thousand dollars. Then more the next day, and the day after that. You get what I am getting at. Panic set in and people began to wonder why.

The truth is, on the 15th, the Chicago Mercantile Exchange (CME) began trading Bitcoin futures. CME is a known futures market where a lot of stocks show up healthy, and never make it out. Futures are simple, and ingenious. The seller sells a Bitcoin on the promise of delivery in the future, say six months later. The seller then buys a Bitcoin after the sale date, but before the delivery date, at a lower price. A Bitcoin is delivered when promised, no matter what the price is.

That is why the price of a Bitcoin has faltered even though the altcoin industry has taken off the way that it has. The CME is hitting people over the head with a spiked baseball bat with barbed wire wrapped around it.

Not to fear, Bitcoin will be back and the CME will be why. There're two reasons why this is going to happen. The first, is the CME didn't foresee President Trump's trade policy. The second, is that digital tech is not something you can put a tariff on. If it wasn't for this, Bitcoin would be doomed. Yet, Bitcoin is going to be the saving grace of the world's economy.

President Trump's trade policy is his response to intellectual property theft by China. In his belief, China was 'punking' American thinkers out of their money by stealing ideas from inventors who would use China's massive third-party manufacturer market. He applied tariffs on Chinese and Russian imports, and they responded with the same.

A war of words ensued and created more tariffs and hit the American farmer hard. Traders are now stuck with futures they purchased months ago. Should they go to China, the world's largest country and economy, with their goods, they will have to pay higher tariffs upfront. America suffered a 40% trade deficit because of the trade policy with China alone.

Then came Trump's opinion of NAFTA. He doesn't like it. In fact, when the numbers from his trade policy with Asia showed up, he decided to shift the burden to Mexico and Canada. He even added tariffs to European nations which made feathers ruffled. National leaders voiced their displeasure with the President over having to pay for his folly with China.

Trump's trade policy is not going to hurt the U.S. alone, internationally countries will not be purchasing from the U.S. as well. There will be shortages there while here, there will be food going to waste. Some farmers have said it's a shame to see all their hard work go for nothing.

How will traders make money in all this? Time will tell. Cutting off what was once the world's strongest economy from both imports and exports is going to slow economies down. The way for nations to meet their needs is to pay higher prices to everyone.

Enter Bitcoin to the picture. The CME can't afford to lose everything they made months ago. They will have to deliver. Low Bitcoin prices can give them an edge they need to stay afloat if the market gets as bad as it looks. Buying at low prices will give the CME a large stock of Bitcoin, and higher prices are right around the corner. Possibly higher than last December. If the price of Bitcoin goes higher, the CME can then sell their large supply of Bitcoin for making large profits.

CME can certainly buy a lot of Bitcoin, and then take them off of trade exchanges to create demand and bring the price up. More importantly, make up for the losses Trump's trade policy is inevitably going to cause. This is not up to the CME alone, but hypothetically, they caused the price problem and it's up to them to fix it.

The altcoin market has grown to well over 5000 different types of tokens. They live and die with the price of Bitcoin and spread the value of Bitcoin around. This has brought the price of Bitcoin higher and higher before, and it will do it again.

The Bitcoin network is also faster and stronger than ever. A year-and-a-half-ago, the Bitcoin network could process 2 TH/s. That number has grown to 60 TH/s thanks to the new 'Lightning Network.' It's a network meant to compete with the speed of the Ethereum and Litecoin networks which have transactions take place in 30 seconds. Last year, a Bitcoin transaction would take 45 minutes.

This is my theory. I don't speak for the CME, Bitcoin, or anybody actually. But the logic is there for you to think about. Bitcoin will rise again, not go away. Whether it's through another currency, or the flagship, it's going to happen. The question is when. But, as it stands, it's a good time to get on board.

✅ @jakedavis224, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Thank you in advance!

From 2 TH/s to 60 TH/s in 2 years is fanominal growth. But is it real money?

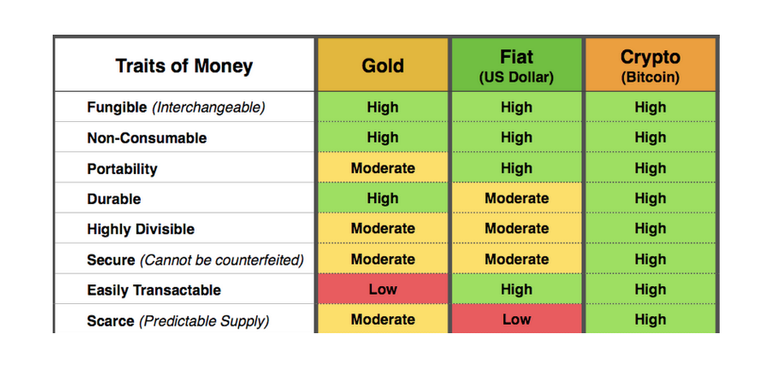

Yes, Bitcoin is real money. The definition of money is: A medium of exchange used to get access to goods or services. Bitcoin can be used to get goods and services.

Many people are often skeptical of new things, and believe everything they read about it. Banks were the same way when it came to bitcoin in the beginning. Now many banks are building Bitcoin projects.

One, BBVA, would warn their employees about the dangers of bitcoin, while at the same time they had a bitcoin development center.

So to sum up, Bitcoin is money. The only problem with adaption is the lack of education.

P.S. You would probably like this article on my Medium publication.