I am sure all the traders out there will agree with me that you should measure your portfolio growth in BTC and not Dollar, but is this starting to change with the recent run we are experiencing on Bitcoin?

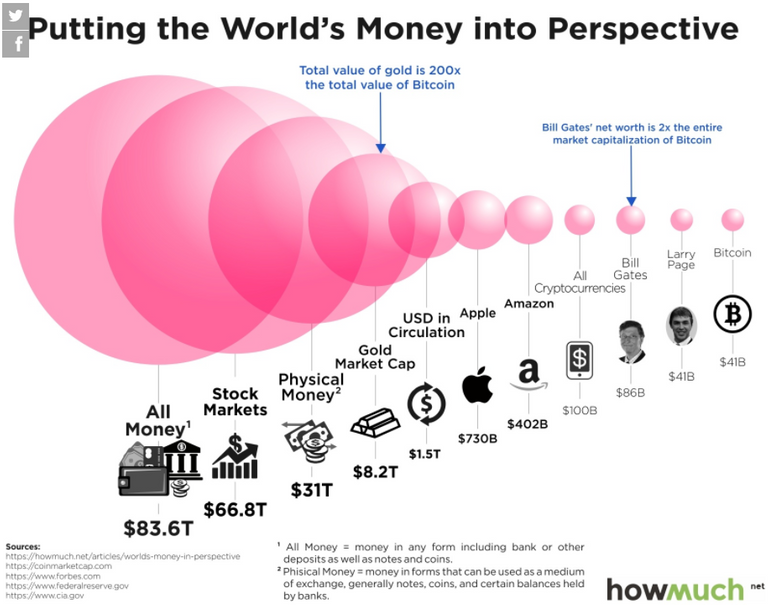

Although the image below is fairly old, we can still see how small the Crypto industry is in relation to the rest of the world.

I have not been trading a long time, but if there is two things that I have learnt from the experienced traders out there:

- Never sell a coin for lower than you have purchased it at.

- Always measure your Blockfolio growth in BTC and not USD

Why measure in Bitcoin and not USD?

I think it is obvious to most, but I am still going to mention it. In my opinion, 1 Bitcoin will become worth more than any of us can guess at this point in time. When we look at the size of the global economy, there are many answers out there, but I found this great explanation in the form of an infographic:

The market cap of the whole Crypto Industry is still so small in the bigger scheme of things, that there is still an incredible opportunity for growth over the next few years. WHen more and more FIAT money will move into Crypto it should keep on growing. Please note that this is just a personal opinion, and not financial advice of any means.

Happy Steeming

The question of course is, if BTC will keep being the reference in the future. I like to spread my risk over altcoins too, even if I lose a bit in BTC value.

Absolutely. I know a lot of people disagrees with this, but I find it hard to believe Bitcoin being relevant in five years time, I believe Bitcoin is being slowly strangled by the fee problem, and there is quite a jungle of altcoins out there queuing up to take over the #1 role.

Yup, thats what I am thinking too with bitcoin being irrelevant in 5 years. At the end of the day, it is a software. Considering most softwares don't last 5 years, its already had a good run.

It's not only software, it's also technology and it's a protocol. Anyway, I've seen enough technology, protocols and software blossom just to later fade away into obscurity. Some few sticks for decades, but that's the exception.

Gold has been a store of value for several thousands of years.

I can't say that I entirely disagree. That's one of the reasons that I prefer to consider silver as a more long-term asset to hold onto, while any bitcoin I get from what little mining I can accomplish will be my "speculation."

Taken that way, if I'm right on either one, I can get more of the other a few years down the road.

In theory, of course...it'll be a few years yet before anyone knows which path is the best for the majority of people, and sadly, most people will be choosing neither, either for lack of knowledge, or for simply not caring about reaity...or basic mathematics.

I do the same @frankvvv, thanks for the comment

Totally agree with these... I've seen so many people lose a lot of money to FUD (fear uncertainty and doubt) by selling their coins on the way down rather than waiting for them to go back up, as they always tend to do.

Actually, that's quite the contrary to my trading strategy - and I also disagree that it's appropriate to measure the profit in BTC. I used to think so, but now ... no, I'm back to counting in fiat.

My trading strategy is to be a market maker.

I have scripts running towards some exchanges - should probably grow the list of exchanges I run it at. Quite often the local market price deviates a lot from the average market price, it may be because some bigger player drops more coins, or buys more coins than what the market can support - without thinking what he's doing - or it may be systematic differences because lots of people have moved fiat to some exchange and wants to buy crypto all at once. I'm having scripts for this. I'm mostly using my scripts to aquire crypto for the cheapest possible price, I'm not sure how well it would do if I let it trade on its own on any reasonably big exchange - but for smaller exchanges it really rocks. I was earning quite decent amounts of money running this script on some smaller Norwegian exchange, though the API stopped working for me after a while. Too bad for me that I never bothered checking it up, at the 15th of August someone bought 4.661657 BTC for 1 MNOK, my script would for sure have ensured to have some deep sell-orders stacked up making the loss for this customer a bit lower.

I'm also a relatively big market maker in the domestic markets - selling and buying peer-to-peer, for cash or bank deposits. The typical customer wants to have one go-to-guy for selling or buying crypto, and don't mind paying some percent premium for that.

On a good day I can turn over the same money several times earning some few percents on each trade - then it's profitable, whatever way one looks at it. At the other hand, I often find myself holding bigger amounts of cash for a longer time, spending time sending bank money to the exchanges, and when the money hits the exchanges it's not immediately turned over to crypto ... no, it's waiting for the right prices. In fiat terms I've earned good money on this. In BTC-terms, I would have earned a lot more by simply hodling.

I'm comforting myself with the thought that in fiat terms, I'm running at a much lower risk than the hodlers - and after all, in the end of the day, I need fiat for bread and butter and whatnot. One never knows where the market price will go ... I do believe the boom over the last 14 months or so is quite unsustainable. The current price is probably about right if Bitcoin was ready to supercede both cash and credit cards - but it isn't. It's even less ready today than what it was two years ago. Price is booming because people are buying, people are buying because the price is booming, I believe very few of the newcomers are even aware of the capacity problems.

A lot of times it is hard to trade based on BTC. It takes some getting used to.

@jacor so true the measure should be in satoshi gained the dollar amount is pointless. Do you have more coin after the trade is the only point. I think each of us as we start to explore this space realize this over time. I love that chart with the squares shows really just how big of a space we have to move into... eventually that chart will show bitcoin gobble up all those dots until it is measure in bitcoin vs the other coins. This shows us just how early to the game we really are. I think this next year is going to be one of the biggest years to get as much coin as you can. The cool thing is that every entry point is a good one for the next hundred years. So what we gain now our great great grandchildren are going to for ever thank us.

Thing is, cryptocurrencies are an exponential technology. It's just a software layer. So it can grow in an exponential way. People are not made evolutionary to be able to grap exponential growth. This thing is going to take over incredibly fast.

yes when you understand exponential growth it gives you a better awareness as to the incredible speed at which it can make the move. It is indeed the most exciting time to be alive as we experience the transition I enjoyed seeing the birth of the internet and the growth it has had over the past 20 years. This will not take that long. The internet required physical building of the structure to run it. The adoption of crypto already has that base to work from so it is just software and can move at the speed of light. Buckle up and hodl we are in for one hell of a rocket ride over the next 5 years.

Thanks for a great comment @allowisticartist . Fully agree with everything you mention here.

Your welcome @jacor I enjoy thinking about this things.

Both BTC and dollar growth will still affect your payout, so both are important

Indeed, but when you pay out dollars you have less BTC, which means you have less potential for growth in future. I believe it will become more difficult to get hold of BTC in future as the price will trend upwards.

you will always be able to get BTC just you will get less each time you buy. In January 2017 my girlfriend @unityeagle bought me $50 worth of bitcoin or .05672062 wich is 5,567,062 Satoshi that is worth $932 this year. and right now $50 will buy you .003 or 300,000 satoshi but next year that same $50 will probably only get you .0003 or 30,000 satoshi so forget about the dollar amount and keep your eye on how many satoshi you have.

There are many people who do not believe in this Blockchain technology and predict that this BTC bubble will soon burst.

However, bitcoin’s value will plummet if it’s fees keep on increasing and thus more and more people will then purchase altcoins, thereby, increasing their value.

the way BTC is growing might change that and with the release of BTC futures will mean more people will be interested in it, it market capitalization is increasing thus the interest, some time in the future we shall be talking about world maket in term of BTC

I am watching this closely. Thanks for the comment.

I have to admit that I do measure it in in Dollar and Euro too, but more and more I'm going to be used to BTC. My portfolio is still very small and contains material BTC so i needed a landmark to understand it's value

I think we all start with measuring our growth in our local currency, but in the end it is all about how many BTC you can gather over time.

I'm sure people said the same about tulips ... :-)

This is so true!! The idea of Investing in USD for most crypto enthuasiast is beyond ridiculous. Either you buy bitcoin, or you buy another coin. Placing your investment in FIAT is not really an option, and thus FIAT should be left out of the picture. I think a lot of people are losing out on potential gains because of this. For quite some time I thought of my late Ethereum investment to be paying off handsomely, then I realized how much more I would have made if I had just kept it all in BTC. Thank you for giving people a heads up about this :-)

Ps. I'm new to Steemit and I don't really have a lot of friends and followers yet wink wink. I'm currently working on a piece about CBD oil and crypto security; I'll leave the rest up for the imagination. It will be published in a couple of days. Hopefully it will be worth a read :-)

Hey @partywalrus, consider yourself followed ;) THanks for a great comment.

My pleasure :-) Cheers, bud. Really appreciate the follow!

I'm getting into trading and it's a really important information i need to keep in mind. thank you for sharing. followed

Thanks @ yairdd

amazing post @ jacor

if you can visit to my post

interestingly written, I think everyone will agree with me

Very interesting read. I agree with what your saying, however I don't expect people to stop measuring in terms of USD as it's s the one currency you can buy everything with. Once bitcoin becomes more readily accepted I think we will see a change in mindset. Love the info graphics as well think I will have a good peruse of that website.

Good stuff

haven't looked into that perspective before thanks for explaining the things i was not aware about

The fact that BTC's price rises feverishly implies the ongoing devaluation of USD.

interesting infographics thanks for sharing

thanks for information!!!!!!!!!!! @jacor

I don't think it's as straight forward as this.

If you're intending to hold your coins for a very long time then sure, measure in BTC. If you're scalping and moving money back to fiat then i think measuring against USD is fine as this is what you'll want as an end result: More USDs.

I get that if you're not out performing BTC then you may as well just hold BTC as you're better off but making USD gains on alts could still be a measure of success for some.

Awesome!! :) Very nice infographic!

The funniest part about the money is that it is purely virtual value based on people agreement. :)

Well deserved re-steem. Since this summer I feel we are living in the age of change where fiat money is losing in the long-term.

Interesante leer cosas como estas! Sigue aportando amigo 👍

Yeah that's a really good point! Thanks for the insights!