With its plummeting prices, high transaction rates, growing appeal among competitors and regulatory agencies operating in several countries, Bitcoin is hungry for good news. Today has marked another blow against the dominant cryptocurrency: China is working to get rid of Bitcoin mining companies.

Bloomberg reports:

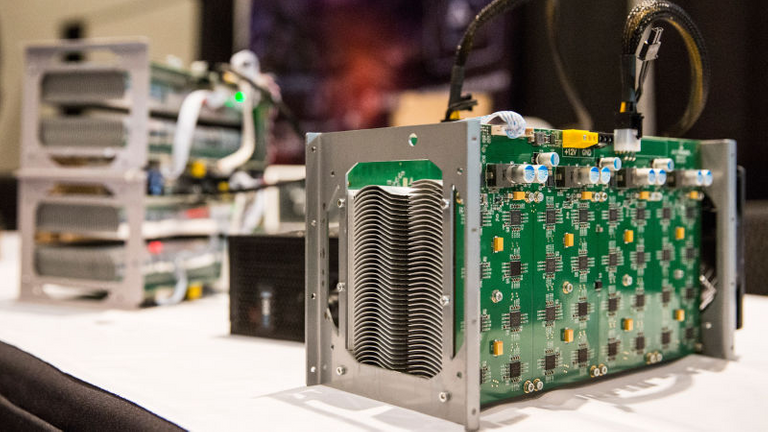

"Mining is the process by which sets of bitcoin transactions—called blocks—are verified and added to the blockchain ledger. That verification relies on having powerful computers solve difficult math problems—with a correctly solved block netting a payout in bitcoin."

Exploration is the process by which bitcoin transaction sets - called blocks - are checked and added to the blockchain. This check depends on powerful computers solving difficult math problems, with a properly resolved block that compensates for a bitcoin payment. The still-active hardware that performs intensive calculations has guided the mining trend over the nine years of Bitcoin from individuals with dedicated laptops and consortia using specialized hardware (called ASIC) in low-cost electricity countries. The confluence of these needs has been largely satisfied in China so far.

There is another problem, and it is related to the operation of Bitcoin. When it debuted for the first time, the reward for extracting a block was 50 BTC. It is now at 12.5, after having halved in November 2012 and again in July 2016. It should fall to 6.25 BTC in June 2020.

This gets even more complicated with another Bitcoin feature: the difficulty of these problems that thousands of ASIC buzz to solve usually increases every block of 2016.

About five years ago, it was no longer financially logical for bitcoin enthusiasts to invest in mining. The probability of successfully resolving a block was the parity passed along with the execution cost of the trap traps team required to play. China is getting rid of the mining industry, the huge amount of electricity consumed by the professional equipment and the reduced return on investment suggest that the margins in which these companies operate will be very rare and will tend to be non-existent.

And without the minors to validate the bitcoin transactions, the "future of money" is dead in the water.