Hello everyone! Today we have several topics to consider at once because this is a blockchain/crypto monthly review. I do not think that just listing all the events of the month will be useful, so let's capture exactly those that will significantly affect the market in the future (we are almost sure that it will).

All these events are mainly related to regulation, politics, the economy of the whole cryptomarket, and also the technological development of decentralized networks (to a lesser extent). Although there is also something to see here.

"We will definitely end this well"

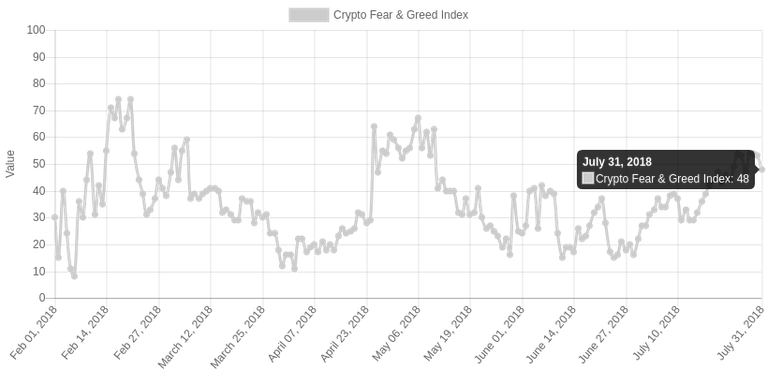

BTC started this month at $ 6,152 point and moved below the last price values of June. Bulls responded to the impulses that could herald the Bitcoin's rising. Thus, during July we could talk about a further test of $ 8,500 and $ 9,000, but, even meaning the positive scenario, these plans can be postponed to August.

The volatility of the Bitcoin's market is an important fact. Even using precise methods of analysis, someone can be easily "bribed" by positive predictions. For example, within the community, when you make an optimistic assumption, you collect more votes.

However, volatility (as well as the concentration of a large volume of the BTC in one's hands, as we can understand) makes its business - this is one of the main conclusions of this month and the period as a whole.

Another interesting observation is connected with the seasonality of markets. Usually, in every summer financial markets suffer a predictable decline. However, Bitcoin seems a little differently going through this rule, even keeping in mind that we met one of the record local minima.

If the cryptocurrency will change the financial system, then the world may eventually abandon the mass of "explained" (archaic) mechanisms, like seasonality. This is my opinion, you can look deeper, of course.

Bitcoin ETF: be patient while hearing this one more time

The regulation and finding the right place for Bitcoin on financial markets (and possibly other crypto assets) is another step towards a clean and open market, as many enthusiasts and experts say. The latest news was related to ETF (the creation of Exchange Traded Funds). It is obvious that the creation of various crypto ETFs will allow promoting crypto-currencies as an investment asset.

Once Satoshi Nakamoto described the most likely cycle for Bitcoin: when the interest in BTC is increasing, the more its price rises, provoking a new wave of interest and so on. This situation is applicable to 2017, and the next rally is also expected in this direction. When players from Wall Street intervened in the Bitcoin economy, they literally "pumped" it with money. However, the criticism (visible) of Bitcoin as a phenomenon is still very high.

What`s happened, exactly:

- SEC postponed decision on 5 BTC ETF applications by Direxion Investment. Based on Leveraged and Inverse ETFs.

- American SEC denied the launching of Bitcoin ETF (by the Winklevoss twins).

Twins faced the first refusal of BTC ETF in 2013 year. In 2015, they managed to launch the Gemini exchange (approved by the New York State Department of Financial Services). This year, Winklevoss won a patent for settling ETPs, exchange-traded products.

- SEC delayed its decision on the CBOE Bitcoin ETF (is pending). The Chicago Board Options Exchange is largest options exchange in US.

Many people already sure that there are many sides where it is possible to develop all cryptocurrencies, not just Bitcoin. For example, Vitalik talks about ETF, paying attention to the availability of crypto as a real payment instrument.

Against the background of these different moods, on the one hand, waiting for the price pump, and on the other, with the distrust of both sides to each other (sometimes there is an opinion - why did we create a cryptocurrency, if now we want to play by the rules of global markets, which are criticized?) we live.

G20 talks about cryptocurrency. «No real danger»

The Group of Twenty, or G20 is an international forum for the governments and central bank governors from the biggest countries. The weekend of July 21-22 was the time when the major representatives met each other in the framework of G20. In Argentina, participants discussed economic risks, among which they also didn't forget to notice cryptocurrencies.

The result of the discussion was that the cryptocurrencies do not pose a threat to the global financial system. Let us recall that earlier, this year, crypto, as a phenomenon, were seriously associated not only with unpleasant volatility but also with real danger.

An important point - at this moment, G20 has promised to develop special measures that would limit money laundering with the virtual assets. While the content of this document has not been published, the task to create it was delegated to FATF (Financial Action Task Force on Money Laundering).

Earlier it was also reported that the cryptocurrency will be considered as a subject of financial risks, which it is possible to integrate into the existing economic system. The news also appeared in July. To do this, established commission will create special metrics and estimates of market volumes.

Secret NASDAQ meeting in Chicago: «seven seals» of cryptocurrency?

Last weekend, NASDAQ started a closed meeting with six another companies to, among other things, discuss the integration of cryptocurrencies into world markets.

The second-largest stock exchange in the world (by market capitalization) is interested in identifying its place on crypto market (at least from the position of a big brother who watching, it's 100%), or even as something more.

Earlier this year, the representatives of the exchange talked about the opening of crypto assets in the future, probably closing the hype wave on this point, and turning to more careful statements.

It is reported that one of the main topics for discussion at NASDAQ closed meeting was the work with cryptocurrencies in a legitimized field.

Crypto: business, financial and global aspects

With the adoption of cryptocurrency, we began to consider Bitcoin as a currency that, in general, is subject to many external economic factors and in many ways behaves "like" ordinary assets. In addition, we also separately consider the market of alternative crypto-currencies (not only Ethereum, forks, and so on).

It seems that almost every coin, regardless of the famous names, initial financing, is ready to become a star on the altcoins market, if the community has enough faith to convert it in real investment. That`s why so many things are important at once.

If we are talking about business, then of course, first of all, it is worth talking about ICO. Here we have several major problems, it tendency persists from year to year, but during July and whole summer, we see that SEC is not a sleepy beast (because not sleepy), and this influence is predominantly positive.

Initial Coin Offering. Back in June, Coindesk informed that the average amount of funds that are attracted through 1 ICO reached the value of $39 million. Moreover, based on personal observation, if the team has the opportunity to work within the framework of American legislation, then investors confidence increases. Otherwise, we see the so-called "restricted areas", including the US. You know, that can possibly happen, if no one can be responsible by regional law.

The education of the average investor is increasing, everyone has at least heard about the SEC;

Fraudulent "hacks" of ICO and serial scams are becoming a bad, but valuable lesson for investors;

We see that ICO and the listing of coins also formed as understandable processes, with its own rules (although there are cases of manipulation are still here).

1) Which of the latest IСO were interested to you? 2) Are you sure that's everything is right in your ICO portfolio, 3) and what new things during this period you have noticed?*

Regional markets. Here it is worth to look not only at start-ups but also notice the interest of large companies and even entire states. Perspective leadership remains to be continued by the area of Asia, the Philippines, Singapore, and Taiwan have done a lot (the latest have already proved themselves as positive regions to the cryptocurrencies).

During this month, some crypto exchanges were created under the framework of legitimate institutions. For example, a regulated exchange and backed-by-bank exchange (here we are talking about the financial expansion of the big players). But, we still see a global test of these markets, alpha or beta, something between it.

Cryptocurrency mining. At the time, when Bitcoin fell to a local minimum, the cryptocurrencies became a little more expensive for miners. On the other hand, regulation has also played a big role in this process. For example, Vietnam prohibits the import of mining equipment, and China will punish for unregistered ("illegal") mining activity.

Well, in the meantime, many companies calculate their half-year profits.

Thanks for noticing!

I think there is much to learn. I also had previous practice in banking, since my education (if it was completed) would be mathematical. Therefore, cryptocurrencies also seemed very interesting to me. But, I mostly look at it from the point of view of writing news to just stay with you, and Steemit community really seems adorable.

I could spend more time to learn the technical reviews, to go deeper in that way more, but you can also use such web-sites, there people do a lot in this direction, especially Bitcoin researchers: I also watch them and sometimes find well-explained theories. Again, the market is very new and it's not always useful to describe it by standard methods, more like that, the future is formed in such moments.

- What do you consider important for this month?

- What do you think the SEC will say about ETF?

- Do you have any forecasts (long-term/short-term)?

Crypto is the subject that should be studied at 21st century (necessary).

🕮 Subscribe: Telegram (ENG), Telegram (RU), (GOLOS.IO)

Congratulations @icotelegraph! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

WARNING - The message you received from @un0e is a CONFIRMED SCAM!

DO NOT FOLLOW any instruction and DO NOT CLICK on any link in the comment!

For more information, read this post:

https://steemit.com/steemit/@arcange/phishing-reported-post-copied-without-your-permission

If you find my work to protect you and the community valuable, please consider to upvote this warning or to vote for my witness.

This Account @un0e is Now Under Quarantine

It is in The Hand of Hackers / Phishers.

Do Not Up Vote !

Warning! Do not interact with @un0e Account.

Do Not Click , on any of the comment.

It will lead to The Phishing Site.

Thanks for quick response

Just doing my job.

This comment leads to the phishing site!!! Be careful!!! DON'T type your keys on that site. There is no real site. IT'S A FAKE!!!

@un0e and @realmeandi are scammers! Be careful! Flag these motherf..s