Price manipulation in the Bitcoin ecosystem.

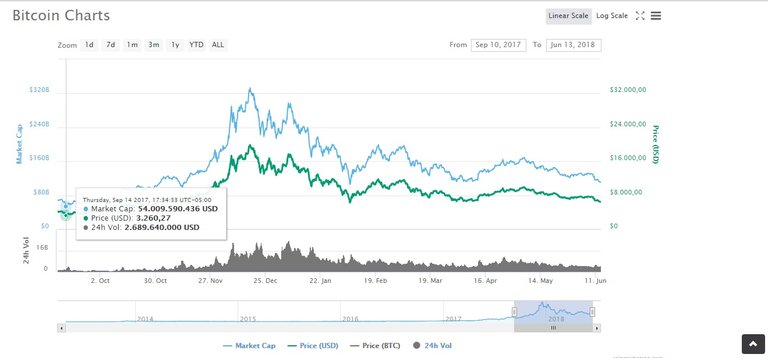

This year 2018 the price of Bitcoin is presenting the same behavior of the year 2014, all year downward trend after reaching record highs, the concern is that these historical prices were in dizzying increases caused by the covert actions of a few large players , instead of the real demand of investors. "That is why, in mid-2017, experts were heard saying that the price of BTC could reach US $ 5,000, because they relied on real demand without manipulation.

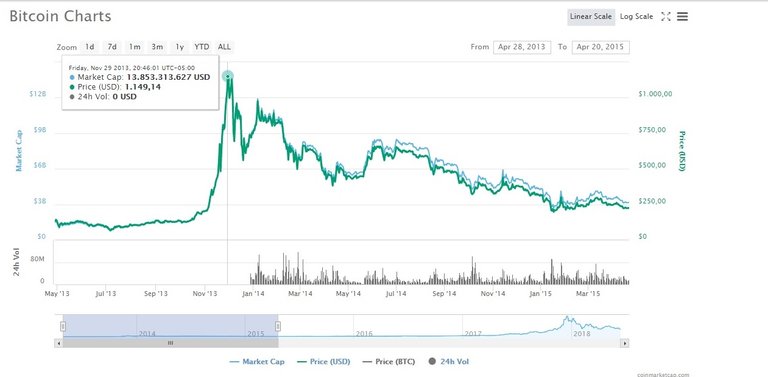

A document written by Neil Gandal, Tyler Moore, JT Hamrick and Tali Oberman, examines the suspicious commercial activity that took place in the now defunct exchange of Mt. Gox cryptocurrencies, and states that it correlates with the sharp increase in the USD exchange rate -BTC at the end of 2013, this means that probably only one actor was responsible for driving the Bitcoin price from $ 150 to $ 1 200 in 2013.

As you can see in the graph, after the manipulation of the market and achieve the historical price, the market always tends to seek its fair price and that was what it did throughout 2014 and even until February 2015.

Now it seems that history repeats itself, According to the New York Times, the vertiginous rise of Bitcoin last year was caused by the covert actions of a few big players, rather than the actual demand of investors. Half of the Bitcoin price increase in December 2017, when the cryptocurrency hit record highs of around $ 20,000, was due explicitly to Tether and the Bitfinex issuer, according to researchers John M. Griffin and Amin Shams of the University of Texas.

In conclusion, the market is looking for a fair price for the BTC and it is not surprising that this price is just under 5,000 usd.

I appreciate your vote if you liked the article.

It's too bad that there can't be a system developed within the cryptocurrencies algorithms to prevent this type of pump and dump manipulation.

@hjlondono you were flagged by a worthless gang of trolls, so, I gave you an upvote to counteract it! Enjoy!!