Knowing what happens and when it happens will help any trader make a better informed decision. Below, you will see several statistics that wer derived from the Probability Tool Suite by https://traderbotmarketplace.com You can create your own statistics with ease by using this tool.

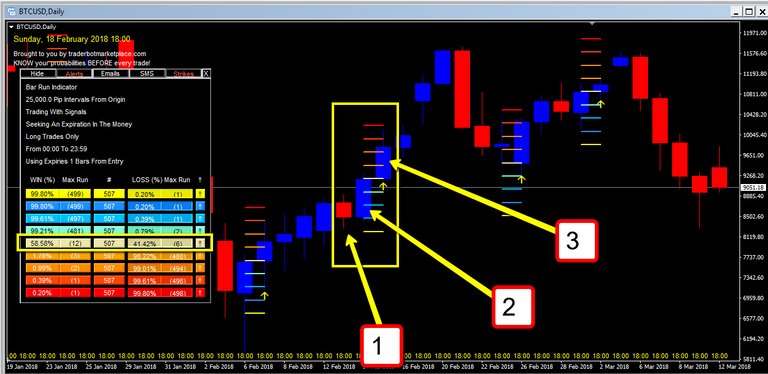

When Bitcoin has a DOWN DAY and then an UP day, the following day finishes UP 58.58% of the time.

1 = Down Day

2 = Up Day

3 = The Following Day (The 3rd Day is the signal Day) The third day is considered a 'WIN' if it finishes HIGHER than it opened.

This is based upon the past 507 signals this pattern has generated since October 2011.

The '3rd day' or the day following a down day then an up day has finished up a maximum of 12 times in a row and has finished down 41.29% of the time for a total of 6 times in a row.

Daily Win Rate

When this pattern occurs on Mondays, it wins 61% of the time.

Tuesdays = 60%

Wednesdays = 59%

Thursdays = 53%

Fridays = 61%

Which Months Were Better? (Since 2011)

January

51 Signals

62% Win Rate

February

39 Signals

64% Win Rate

March

39 Signals

61% Win Rate

April

36 Signals

63% Win Rate

May

44 Signals

50% Win Rate

June

56% Win Rate

46 Signals

July

38% Win Rate ( Big Fat Loser Month!)

49 Signals

With months like July, you can take a vacation then! LOL

August

54% Win Rate

44 Signals

September

34 Signals

58% Win Rate

October

40 Signals

67% Win Rate

October was the best month.

November

46 Signals

63% Win Rate

December

43% Win Rate

62%

By analyzing the data, I now know that I DO NOT want to trade this signal in July.

All of the data was derived from the Probability Tool Suite by https://traderbotmarketplace.com You can create your own statistics with ease by using this tool.

More Random Statistics

After X days in a row, how often is the next day UP?

We call this a '7 Day Bar Run'. It has a win rate of 75% since 2011.

- After 6 DOWN days, the next day is UP 66% of the time. It's happened 12 times since 2011

- After 5 DOWN days, the next day is UP 58% of the time. It's happened 29 times since 2011

- After 4 DOWN days, the next day is UP 40% of the time. It's happened 49 times since 2011

- After 3 DOWN days, the next day is UP 50% of the time. It's happened 101 times since 2011

- After 2 DOWN days, the next day is UP 54% of the time. It's happened 222 times since 2011

- After 1 DOWN days, the next day is UP 55% of the time. It's happened 507 times since 2011

Some Lite Coin Weekly Statistics

A down week is followed by an up week only 45% of the time. This has happened 75 times since 2011.

2 down weeks are followed by an up week only 40% of the time. This has happened 27 times since 2011.

3 down weeks are followed by an up week only 40% of the time. This has happened 15 times since 2011.

4 down weeks are followed by an up week only 33% of the time. This has happened 9 times since 2011.

5 down weeks are followed by an up week only 50% of the time. This has happened 6 times since 2011.

6 down weeks are followed by an up week 66% of the time. This has happened 3 times since 2011.

7 down weeks are followed by an up week only 100% of the time but has only happened once since 2011.

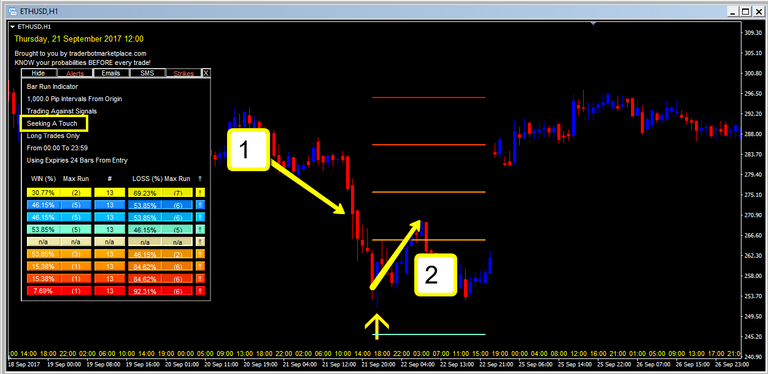

An Ethereum Statistic

7 Bar Run Hourly

Since , whenever price pulled by by 7 hourly bars, price rose by $10 over the next 24 hours 53% of the time. It also fell by $10 about 53% of the time. Price id not remain at the levels because we are looking for a 'touch' instead of an 'expiry'. In theory, a trader could put on a straddle (if there were a contract available).

1 = A 7 bar pullback

2 = Price rose by $10 on Ethereum over the next 24 hours

By the way, this works with Ripple, Dash, Monero, and many others that are available with the MT4 or MT5 trading platform.

AAAAllllrighty Rooo! I have had a blast putting this together for you guys. This article is meant to make you think, " What are statistics?" or " How can I use statistics in my own trading?"

- Would you like more of these types of articles?

- What statistics would you like to see next time?

Happy Trading!

Coins mentioned in post: