CFTC allows investments after ‘numerous’ employee inquiries

Critics say agency’s move could lead to lax oversight

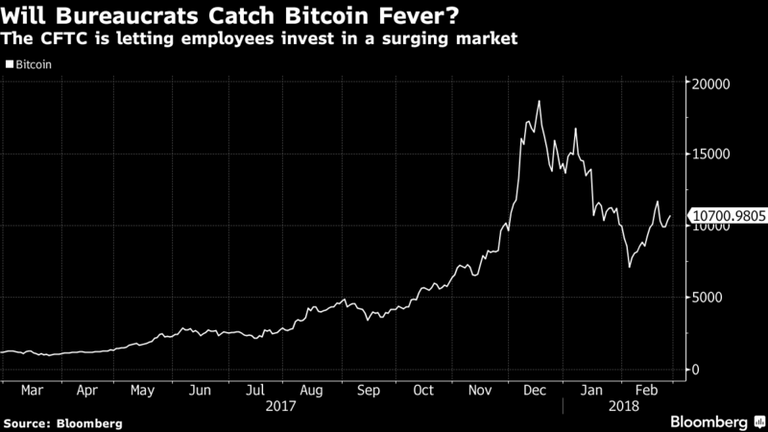

The U.S.’s main commodities regulator recently told its employees that they are allowed to invest in cryptocurrencies, a determination that came weeks after the agency began overseeing Bitcoin futures.

Under the Commodity Futures Trading Commission’s ethics guidance, workers can trade digital tokens as long as they don’t buy them on margin or have inside information gleaned from their jobs. Investing in the Bitcoin futures that the CFTC polices, however, is barred.

While it’s not known how many people at the CFTC are actively trading the products, the agency’s general counsel, Daniel Davis, told employees in a Feb. 5 memo that the guidelines were being issued after the commission’s ethics office had received “numerous inquiries” about whether the investments were permissible.

The CFTC’s ruling comes at a time when federal agencies are debating whether and how to impose rules on the nascent products that have rapidly become a global investment craze. A number of officials have been wary of putting a government stamp of approval on cryptocurrencies, raising concerns about their wild price swings, their use in illicit transactions and the frequency with which they’ve been hacked and stolen.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.bloomberg.com/news/articles/2018-02-28/bitcoin-futures-regulator-clears-employees-to-trade-crypto-coins