The crypto bear market is in full force, as predicted. Previous bear markets in crypto were generally accompanied by calls for the death of bitcoin and prices going to 0, as bitcoin was highly dominant in those days. Recently, we have seen these same types of arguments for many crypto projects. In my opinion, crypto most certainly WILL NOT die. The question has now become, will crypto take on a niche role similar to what linux has done in the OS space, or will crypto take over the world, or something in-between? This remains to be seen, but I am fairly confident that the entirety of the crypto market will eventually be valued in the trillions of dollars, minimum. I am personally hoping for another leg down in this bear market to load up on cheap crypto-assets. Whether that happens or not is the trillion-dollar question. It may just be wishful thinking. Of course, the risk here is that the bears are right, and prices do go to 0. The death of the crypto markets as a one-off fad should always be taken into consideration when assessing this risky technology.

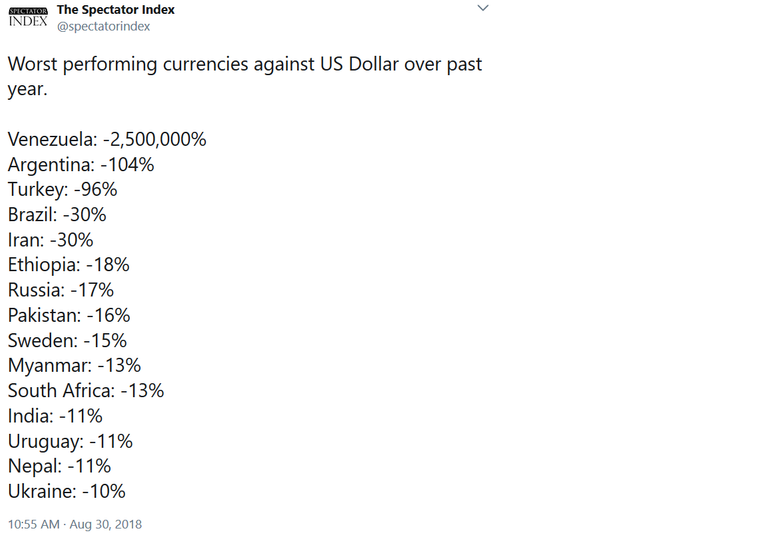

One emerging trend of note is the increasing volatility and destabilization of the legacy fiat currency markets.

https://mobile.twitter.com/spectatorindex/status/1035179147088224257

I attribute at least some of this to the adoption of crypto as some folks in these countries turn to crypto to escape the debasement of their national currencies. This is reminiscent of the burgeoning days of the 2008 financial crisis, when subprime mortgages were thought to be contained, and the effects of the defaults would not spill over into the larger financial system. Eventually, all aspects of the legacy financial system were affected at that time. Today, ‘Subprime’ countries such as Venezuela, Argentina and Turkey are thought to be isolated from the rest of the legacy financial system and pose little threat. I’m betting that this threat is much larger than many people expect, and this threat is coming from where it is least expected; the crypto markets. The migration from fiat to crypto has, and will, take time. The interesting thing that remains to be seen is if one or more crypto assets can succeed at becoming a widely used default currency over the coming decades.

System development in crypto is occurring at a breakneck pace, the fastest I have seen since becoming involved in 2012. Back then and especially during the 2014-2015 bear market, developers were working for free and complaining about not being able to put food in the fridge. Yet somehow the development community overcame these difficulties and pushed forward. Circumstances are much different today. The 2016-2017 bull market has given these development teams war chests of capital to work with… and I’m not talking about the exit scams pulled off by fraudulent ICOs. I’m talking about solid, base-layer projects that have been at work for years – Ethereum, EOS, Cardano, Dfinity, NEO, Vechain, Rchain, Tezos, Steem, ect. With millions, tens of millions, hundreds of millions, and even billions of dollars worth of capital to deploy in building out these systems, I expect we will see highly secure financial networks that operate at blazing speeds and scale to seemingly infinity. This should become a reality over the next 10 years.

I have begun doing some work on valuing crypto-assets as I think early attempts at doing so are lacking. Stay tuned.

Disclaimer. None of this is advice of any kind.

Crypto will not die, for sure... but there will be some cleaning before resuming its development and adoption

Consistent projects will remain

Steem on

yes i agree