Eleven months ago, Willy Woo argued that HODL alt-coin indexes wouldn't work and subsequently showed altcoins' poor performance over time. CarpeNoctom felt it was time for an update of Woo's 'shit runs downhill' analysis to see if it still does.

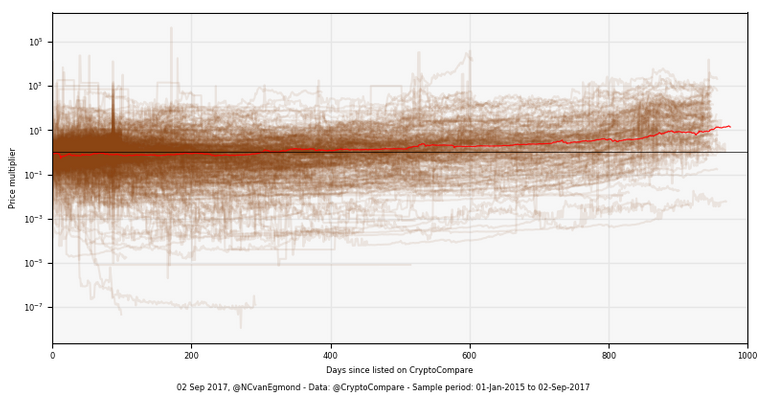

Like Woo, I plotted the price of all coins from the first day of listing, indexing the time series at 1. At first glance, overall performance seems superior to the numbers Woo showed almost a year ago. Interestingly, Bitcoin's performance [red] no longer sets it apart. Many alts have outperformed it since 2015.

Brief note on the dataset: I pulled price data from CryptoCompare. As a result, there are two obvious biases in the data:

- Selection bias: Coins that do not meet CryptoCompare's listing criteria are excluded.

- Survivorship bias: CryptoCompare most likely delisted dead/dying coins. [1]

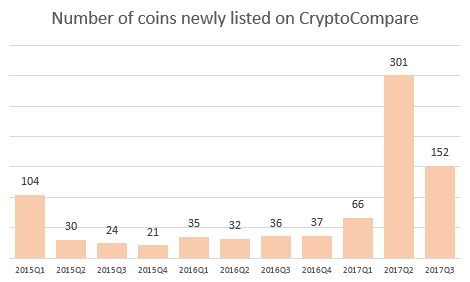

In both cases, this potentially results in much (!) more optimistic results. The data includes 838 coins, much more than the original 118, currently listed on CryptoCompare that were listed after January 1 2015 [2]. The smallest coins have a current market cap of approximately $150,000. Bitcoin, altcoins, shitcoins, scamcoins: The gang is all here. The chart below shows how many coins were listed in each quarter starting in 2015. Unsurprising to all of us, the number of newly listed coins has exploded recently.

Breaking it down by year

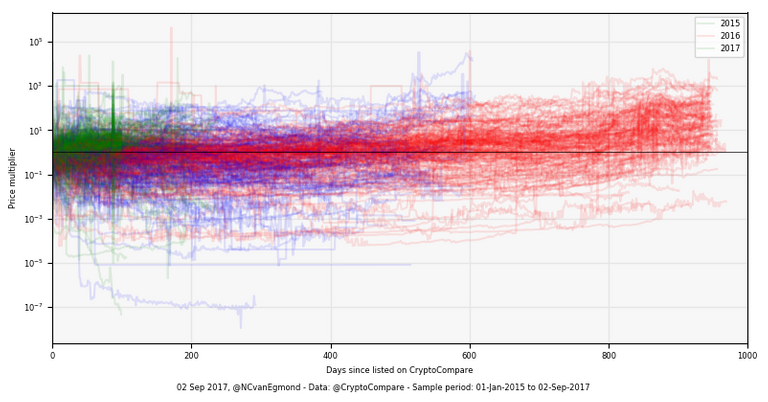

Let's add some color to distinguish by year of listing. We see that there are plenty of coins that dive below their starting price in 2015/2016. In contrast, the majority of coins listed in 2017 seem to have done very well.

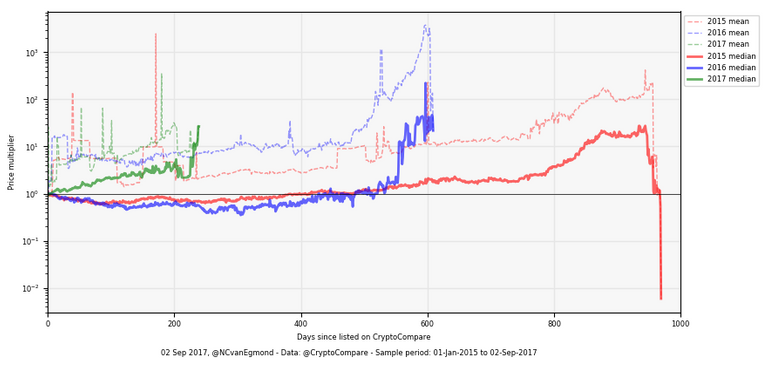

The plot below shows the price performance of the median coin. Here we clearly see the stark increase in overall market cap that happened in the first half of 2017.

Here's the interesting part: The dotted lines show the mean performance of all coins launched in a year, outperforming the median coin by 5-10x. In my opinion, these averages makes a strong case for holding a diversified portfolio of alts. The upside and downside risk is asymmetrical: You can hold 10 coins that dump to 10% of their value, and still break-even if your 11th coin goes 10x. Combine diversification with some semblance of due diligence and risk management, and you have a winning recipe.

Conclusions

Three things are clear: The performance of altcoins, measured their prices, has clearly increased significantly [3]. Bitcoin no longer outperforms all other currencies and assets in the space. The year 2017 has been a good year so far.

However, drawing the conclusion that the quality of altcoins has improved because prices has gone up seems tenuous. It might, but there are more factors at play here. There is more and more money flowing into the sector which also pushes up prices significantly. Time will tell if alts have developed from volatile assets into long-term holds, and if current price levels can be sustained.

For now:

- Diversify

- Do your own research

- Practice risk management

Footnotes:

[1] Let me know on Twitter if you have ideas where to find data free of survivorship bias.

[2] If you want to play around: Data available via Dropbox

[3] Yes, this could - in part - be the result of bias in the sample

woobull.com/data-visualisa…

@cryptodemedici @dangermouse117

Disclaimer: I am just a bot trying to be helpful.