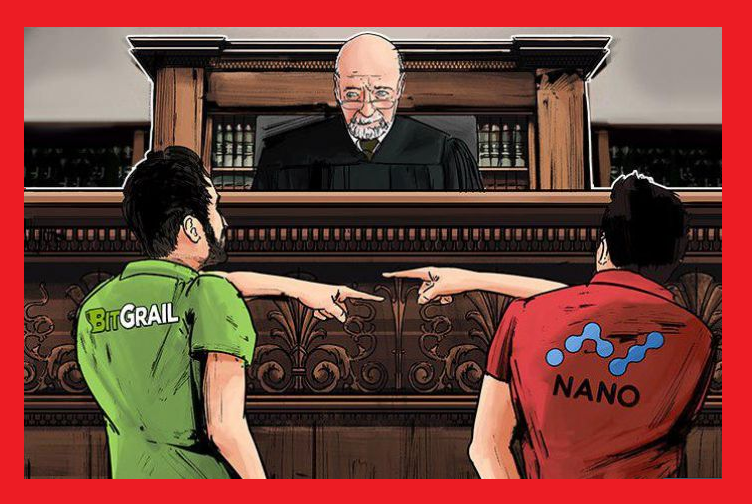

On February 8 2018, 15 million Raiblocks, the previous local money of the Nano organize, were stolen from Italian digital money trade BitGrail. So as to give experiences into claimed security break and the burglary of more than $150 million USD worth of XRB, Cointelegraph led a selective meeting with Francesco Firano, the author and administrator of BitGrail.

This time, Cointelegraph contacted the Nano group and led a meeting with the Nano center group's Troy Retzer, who manages group and advertising at the association, to better comprehend the extensive scale robbery.

Strife with Nano, timestamps

Amid the meeting with Cointelegraph, Firano guaranteed that the Nano center improvement group blamed BitGrail for being bankrupt and careless in overseeing a huge number of dollars worth of assets. Firano included that the issue started from the timestamp innovation of Nano and that the square pioneer of the cryptographic money isn't solid. Firano stated:

"Unmerited and vindictive allegations are finished by the Nano advancement group. The fact of the matter is their piece wayfarer is dated January 19, the date of the burglary. Since RaiBlocks have no timestamps on the chain, we can't generally discover when it really happened other than depend on the square pilgrim, which, as of now appeared by the private discussion they revealed, is absolutely untrustworthy."

Notwithstanding, Troy Retzer clarified that on January 19, the date noted by Firano, the Nano blockchain arrange directed a re-synchronization of its hubs, giving each square or exchange missing before January 19 with a timestamp recorded at the time. This implied all exchanges or squares were recorded precisely, with a timestamp on that date. Retzer told Cointelegraph:

"On January 19, a hub resync was led and in this procedure, it got on pieces not as of now having a timestamp record and recorded them around then, with that timestamp. Furthermore, to the motivation behind why there were holes, amid the change of the site there were passes in the content running, while we took care of the progress of the site from the past administrator to our current administrator. We got a duplicate of the old database and worked for quite a while to make them run accurately on the new server, along these lines numerous pieces never had a timestamp recorded until the point when the full synchronize on January 19."

With respect to Firano's remark that the Nano group has discharged malignant allegations against himself and the BitGrail exchanging stage, Retzer remarked that the center group had not gotten any data from BitGrail and from Firano separated from the information he had discharged freely.

"It is troublesome for us to assist comprehend the circumstance because of an absence of data on the asserted hack," said Retzer, expressing that BitGrail had neglected to elucidate fundamental points of interest, for example, what number of XRB tokens were really stolen from the trade. Beginning reports from BitGrail recommended it was 17 million, yet reports discharged in the not so distant future guaranteed 15 million XRB tokens were stolen.

The Nano group likewise stressed that it has contacted the Italian police keeping in mind the end goal to collaborate in the examination of the robbery and give any help it might require in dissecting the BitGrail rupture.

"Missing exchanges"

On February 15, Firano discharged a Telegram discussion on his Twitter, in which he asserted that exchanges previously January 19 are absent on the square voyager of the Nano arrange. Firano additionally attested that exchanges were some way or another expelled and reinserted in a later date. Be that as it may, in any open Blockchain, it isn't conceivable to expel information put away in past pieces unless the whole Blockchain is traded off and assaulted.

Indeed, even through open assaults, for example, a 51% assault (in which a gathering picks up control over portion of the Blockchain's hash control), it isn't sensibly conceivable to alter information put away in authentic pieces. Because of such claims, Nano designer Mica Busch composed:

"A Blockchain, and the records inside a piece cross section, are one-way structures. Every reference the cryptographic mark of its former square. It is unthinkable for new pieces to be embedded before more current square. Proceeding with this rationale, our square voyager stores timestamps on a best exertion premise. Along these lines if an exchange demonstrates a date later than another exchange that tails, we can demonstrate that this exchange happened before the later date, and view the timestamp as mistaken."

Given that Nano is an open Blockchain system and squares inside a Blockchain can't be changed, a claim that exchanges are absent from the Blockchain is likely not substantial.

Utilization of hot wallet, poor security

On October 23 2017, as the Nano group unveiled in its official explanation, an enormous measure of XRB was suddenly pulled back from the BitGrail digital money trade. 1 million XRB was pulled back, which is worth almost $10 million in view of the present cost of XRB at $9.82.

While the idea of this exchange is yet to be affirmed, it could likewise be conceivable that the robbery of 15 million XRB tokens was started on October 23, beginning with the withdrawal of 1 million XRB.

"In particular, this exchange for a withdrawal of 1 million XRB happened on October 23 2017, at 1:22 AM (GMT) as indicated by BitGrail's database timestamp information. You can see from the Explorer information that there were huge assets pulled back when this exchange to account 'bbjn'. Firano ordered this exchange on Twitter and in our Telegram discussion as 'unapproved'" states Nano's investigate the issue.

As indicated by people in general Blockchain traveler of Nano, Nanode, BitGrail kept on utilizing a hot wallet to store the majority of its assets in XRB, which is unsecure. Hot wallets are overseen on the web, and can be helpless against assaults and security ruptures as a result. For instance, Japan's Coincheck, one of the biggest digital money trades in the nation, endured a $530 million hacking assault because of the trade putting away supports in hot wallets.

Until December 16 2017, the BitGrail Rep 1 wallet was utilized as the main hot wallet of the BitGrail trade to store client reserves, which is to a great degree uncertain and unsafe. Once a hot wallet is traded off, the greater part of the assets inside it can be lost, particularly if there are no multi-signature innovation based security frameworks set up.

On December 16, the BitGrail Rep 1 wallet was changed to a frosty wallet, and BitGrail Rep 2 was changed to a hot wallet, as observed on Nanode.

It isn't conceivable to conclusively express that the BitGrail exchanging stage was broken because of poor safety efforts, unless and until the point that the greater part of the data in regards to the robbery is straightforwardly imparted to the group. Yet, not at all like Coincheck and other vast scale cryptographic money trades like South Korea's Bithumb, BitGrail has not possessed the capacity to discount its financial specialists and as Firano clarified in its meeting with Cointelegraph, the business trusts it is "outlandish" to discount the greater part of its Nano speculators.

Eventually, as an autonomous organization, BitGrail may be considered in charge of the burglary of the assets of its clients on the off chance that it is discovered that the reason for the robbery of the 15 million XRBs on the stage isn't because of an issue of the Nano Blockchain convention.