)

SUMMARY

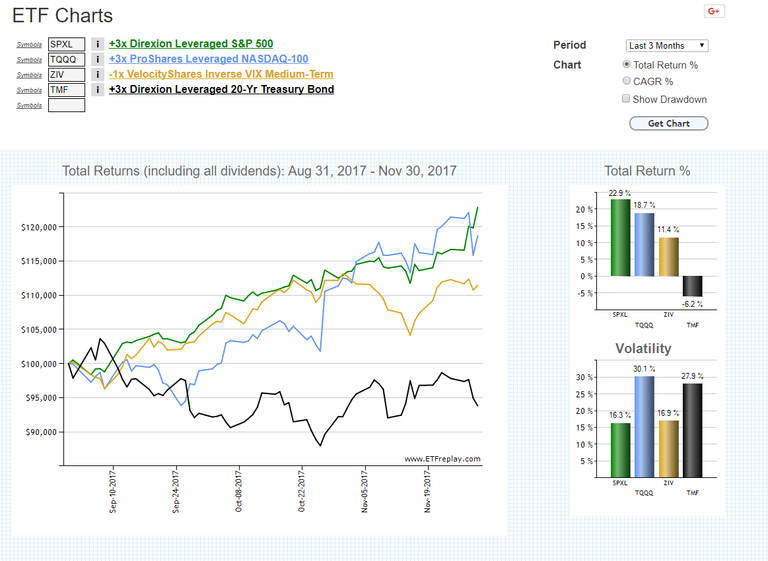

It's FRIDAY and it's that time of the week to check which ETF is winning! The chart below shows that SPXL at 22.9% beats out TQQQ's three week winning streak!

This is the easiest portofolio to self manage! Every Friday, you simply run a rolling 3 month chart for the four ETFs and see which one has the highest gains. The whole rationale to this portfolio on how it keeps you in the best performing trend is explained here. In short, it is a very simple trend following portfolio.

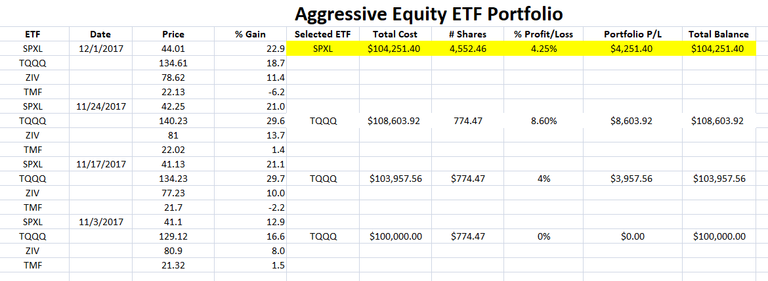

The below is the performance update of my porftolio. I have solld all of the TQQQ holdings and moved the funds to purchase 4,552 shares of SPXL. The porfolio currently stands at 4.25% profit from prior week's 8.6% profit.

Am I alarmed or panicked by the decrease in % profit from last week? Not in the least! I shall follow this portfolio with discipline and select the winning ETF each Friday.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

These Technical Analysis Books: Elliott Wave Priniciple & Technical Analysis of Stock Trends are highly recommended

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

--

If this blog post has entertained or helped you to profit, please follow, upvote, resteem and/or consider buying me a beer:

BTS Wallet - haejin1970

BTC Wallet - 1HMFpq4tC7a2acpjD45hCT4WqPNHXcqpof

ETH Wallet - 0x1Ab87962dD59BBfFe33819772C950F0B38554030

LTC Wallet - LecCNCzkt4vjVq2i3bgYiebmr9GbYo6FQf

Legal Mumbo Jumbo: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.**

Bitcoin Heads to Wall Street Whether Regulators Are Ready or Not.

New high coming soon, best way to trade long #bitcoin with high leverage on BitMEX: https://www.bitmex.com/register/HJfZyC

Users who have signed up with my affiliate link will receive a 10% fee discount.

Any chance of a spread coin analysis haejin, please. Sell or hold

@cryptohustlin has voted on behalf of @minnowpond.

If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.

To receive an BiggerUpvote send 0.5 SBD to @minnowpond with your posts url as the memo To receive an BiggerUpvote and a reSteem send 1.25SBD to @minnowpond with your posts url as the memo To receive an upvote send 0.25 SBD to @minnowpond with your posts url as the memo To receive an reSteem send 0.75 SBD to @minnowpond with your posts url as the memo To receive an upvote and a reSteem send 1.00SBD to @minnowpond with your posts url as the memoWhere do I set up a portfolio like this? What platform?

Would interest me also.

You can use Etrade, TDAmeritrdae, Fidelity online borkerages.

You need to open up a margin account so as to buy/sell these leveraged ETFs.

BUT, DO NOT USE the MARGIN to buy these, of course.

Is it doable for people outside of US without huge fees? Anyone has experience in investing in american instruments from Europe? Cheers

Excellent, Haejin. Is your spread sheet available on the internet or did you make it yourself. Thanks

self made

Thanks. SPXL here we come.

Thank you for the 'open book' on your portfolio. I also want to thank you for directing me to these ETFs. I am also profitable...however, I do swing trade in and out of my positions to avoid the turn cycles.