TL:DR The recent boom and bust of the crypto-market shows how heavily correlated all the different coins are, despite the variety of concepts behind them. I examine the idea of a “diversified portfolio” critically and comment on the actual relevance of altcoins as crypto assets.

Let’s start with a personal investment story. A friend of mine put substantial amounts of money into crypto-coins just last year. He didn’t just buy Bitcoins but instead lectured me on how “it’s all about diversification”. Thus he bought Bitcoin, Ether, Dash, Monero, and probably some more.

I, on the other hand, mostly own Bitcoins and Ether. You could call me a Bitcoin conservative. I’m skeptical towards the success of what I still call altcoins.

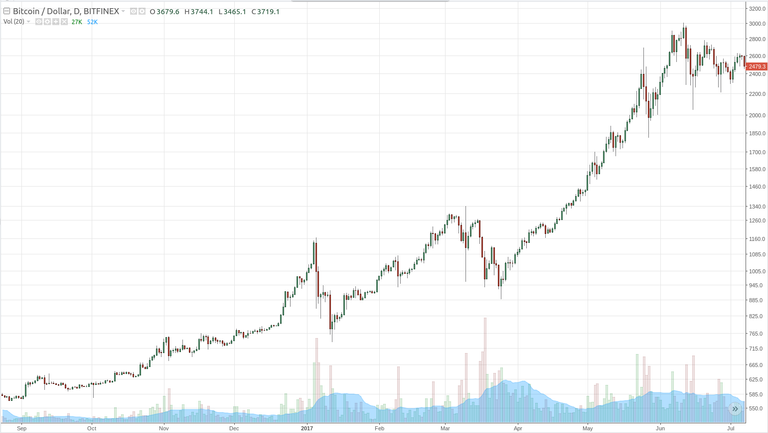

What has happened since then? Above you see the recent boom period from September 2016 to July 2017. While the Bitcoin price roughly quadrupled (BTC/USD, Bitfinex), the price of some altcoins increased even more. The price of Dash, for example, increased more than tenfold in the same period (DSH/USD, Poloniex) as shown below. And that means that, … well, my friend’s diversified portfolio easily outperformed mine.

You might want to conclude now: I paid the price for being so lazy. And, it is indeed all about diversification. Or is there more to the story?

Let’s talk about diversification shortly and then take a closer look on the recent price drop of September 2017 that came after the boom. Our special focus will be on the performance of a set of altcoins.

The basics of diversification

Imagine you have some money to spare and you think Bitcoin is an interesting asset. But instead of simply buying bitcoins, you spread out your buy orders, e.g. you also invest in Ether and IOTA.

You would do the same, when investing in the stock market, where you typically invest into a whole industry (at minimum) rather than just betting on the financial success of just one company.

There are roughly two consequences: You avoid risk. The price decline of a single asset won’t affect your overall profits as much. However, this comes at a price. The expected profit of such a diversified portfolio is also lower. For example, there might be a Bitcoin boom, while the prices of Ether and IOTA remain flat. The Bitcoin-only strategy would have resulted in higher profits.

So far, so simple. But in the long run, diversification becomes critical. In the stock markets, you can often observe the rise and fall of individual companies. Single companies go bankrupt, even in successful industries. What you really want, usually: Bet on the success of an idea (like personalized internet), a technology (like virtual reality), or a market (like the gaming industry). Single companies are more like the unreliable atoms of a greater, promising development. The longer the time frame, the more expendable the single players become.

The price decline of September ‘17

Somewhere on the way to 5000 USD, a correction of the Bitcoin price was expected. It happened when China finally banned ICOs and took a more critical stance against Fiat-Crypto-trading, again. The maximum was reached on September 2nd at about 5000 USD. The minimum since then was reached on September 15th, at 3000 USD.

Now, to my surprise, all of the coins apparently dropped simultaneously in that period. Look at the surprisingly similar shape of the Ether price (ETH/USD, bitfinex).

The effect also became apparent by looking at the thumbnail charts of coinmarketcap.com that I mistakenly took for completely useless before. Let’s look at what happened at a quantitative level. The table below shows for a couple of altcoins: the price in BTC of September 1st (16:00 UTC), September 15th (12:00 UTC), September 17th (12:00 UTC), 2017, together with the relative change to September 1st.

| Altcoin Name | price/btc Sept 1st | price/btc Sept 15th | price/btc Sept 17th | ||

|---|---|---|---|---|---|

| ether | 0.081312 | 0.06741 | -17.1% | 0.068687 | -15.5% |

| bitcoin cash | 0.12967 | 0.10528 | -18.8% | 0.11883 | -8.4% |

| litecoin | 0.016571 | 0.01219 | -26.4% | 0.013878 | -16.3% |

| dash | 0.081072 | 0.073281 | -9.6% | 0.081477 | +0.5% |

| monero | 0.03035 | 0.024655 | -18.8% | 0.025788 | -15.0% |

| iota | 0.000173 | 0.00012479 | -27.9% | 0.00013244 | -23.4% |

| nxt | 0.00002459 | 0.00001546 | -37.1% | 0.0000174 | -29.2% |

Please note that all of the prices are in Bitcoin. This means, not only all of the selected coins declined in value, they also consistently underperformed Bitcoin in the first half of September. The best performance, DASH, is at -10% compared to Bitcoin. And all the coins except DASH remain worse off than Bitcoin even now.

In conclusion, we see how all the coins are heavily correlated, following along Bitcon’s decline. This is despite the different concepts those coins implement. When you look at the ideas behind the coins, there is a group of similar coins: Bitcoin, Bitcoin Cash, Litecoin, Dash, Monero. And there are the more distinct ones: IOTA (tangle instead of blocks), NXT (purely proof-of-stake), Ether (smart contract platform).

The assumption that similar coins behave similarly, while exotic coins are more independent in terms of their exchange rates is not borne out by the facts. The whole idea seems overly idealistic.

Lessons learned for diversification

Let’s look at the question of a diversified portfolio from yet another angle. Imagine you are back in 2004 and Facebook just came into existence. Let’s also pretend you could, back then, simply buy Facebook’s stocks. You believe in the idea of a Facebook-style social network.

Now you apply the common knowledge of diversification to your investment. There are also a number of Facebook copycats. So you should buy their stocks, too, no? The challenge here is the network effect. There’s likely only one prevailing social network in the end - the one that connects the most users.

Today we know, the russian version of Facebook is still around. Kontakt is one of the few Facebook competitors that found a viable niche. Those that didn’t went out of business. A distinct user experience usually was not enough to compete with the much bigger, more aggressive Facebook.

Back to Bitcoin and the Altcoins: The important questions when investing into crypto probably are:

Will there be a Bitcoin successor?

Which Altcoin is in a good position to conquer a niche?

All the investors that pulled out during September 2017, causing the price decline, were largely divesting indifferently. Apparently no-one dares to bet on a single altcoin. A price dynamic independent of Bitcoin’s was nowhere to be found.

When we accept the narrative that China’s regulatory restrictions caused the decline, one might also assume that restrictive regulation will apply to all coins sooner or later. In that case, there is an additional external cause to the price correlation.

How to build a reasonable crypto portfolio

It is a basic economic assumption that the volatility of an asset decreases when the liquidity increases. Bitcoin leads the ranking by market capitalization and has proved to be the least volatile coin of them all. Imagine a whip where small movements on the one end are amplified on the other end. Altcoins are on the volatile end, promising bigger gains at the expense of sharper drops. Following this logic, the investment in altcoins increases the volatility of a portfolio. This assumption is by and large compatible with the recent developments.

Following the two questions from above, it still makes sense to diversify. A coin index based on market capitalization would contain about 50% Bitcoins, 20% Ether, 5% Bitcoin Cash and so on. Look how tiny the percentage of altcoins turns out here. A portfolio like this might be the best bet you can make. Obviously, it does not protect from the volatility of the crypto market as a whole. And that might be the most important lesson: If you want to mitigate the volatility of your Bitcoin investment, you have to look outside of crypto. Buy commodities, stocks, and real estate.

Dear reader

This is my first english article on steemit. Any kind of feedback is highly appreciated. What does your portfolio look like? How do you interpret the recent decline? I look forward to your comments!

Deutschsprachige Artikel aus der Serie Kryptogeld verstehen

- Kevin lernt Bitcoin - Die Grundlagen

- Bitcoins kaufen - Über Bitcoin-Börsen

- Bitcoins sicher aufbewahren - Über Bitcoin-Wallets

- Kryptogeld wirklich verstehen - Von privaten Schlüsseln, Unterschriften und Adressen

- Kevin macht Krypto-Trading - Vermeide die typischen Fehler eines Anfängers

Congratulations @gustave! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP