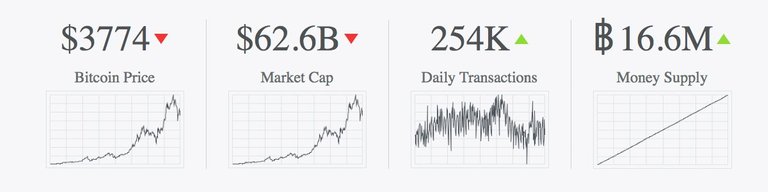

The cost of bitcoin has been swinging forward and backward in esteem since our last market refresh report. By and large, bitcoin advocates appear to be hopeful about the cost as China's administrative crackdown is gradually transforming into ancient history. In the wake of plunging underneath the $3K zone, the value figured out how to move back to the $3,800-4,000 territory all through the majority of the week. On Friday, September 22, bitcoin's value dependability in that domain traveled south – prompting a 5 percent misfortune in esteem and a couple of sub-$3,600 lows. After some combination in the course of recent hours, purchasers have ventured once more into the exchanging field and pushed the cost up to $3,798 amid the early morning hours.

Specialized Analysis

Specialized pointers and request books from prominent trades demonstrate some solid protection past the $3,800-3,900 zones at squeeze time. Bitcoin markets look more advantageous than a couple of days earlier as the cost is holding high over the 125-day moving normal. The week after week outline demonstrates the transient 100 Simple Moving Average (SMA) is well underneath the long haul 200 SMA, which shows the bearish pattern may not be finished yet. Relative Strength Index (RSI) levels appear to be generally steady, however the Stochastic oscillator recommends that the little uptrend happening at the present time will probably fail out. Markers demonstrate it's additionally likely the cost will see some more union throughout the following 12-hours inside the present value an area.

Interesting issues in Bitcoin-Land

In the course of recent weeks, news of China closing down trades has been an amazingly hotly debated issue. Right now the market impacts from the Chinese trade crackdown is by all accounts winding down, and bitcoin advocates are concentrating in on different subjects. One of them is the announcements made by JP Morgan's CEO Jamie Dimon calling bitcoin a "fake." Dimon was accounted for to the Swedish budgetary experts with respect to his current attestations and may confront legitimate examination. Further, Dimon has not quit speaking adversely about bitcoin, as the broker condemned the advanced money again in a meeting on CNBC-TV18 Friday morning.

"At this moment these crypto things are somewhat of a curiosity," Dimon tells the communicate. "Individuals believe they're somewhat flawless. Yet, the greater they get, the more governments will shut them down — It's making something out of nothing that to me merits nothing — It will end severely."

The Verdict

Right now the cost has kicked up, however volume is generally low with just $1.1B worth of bitcoins exchanged in the course of recent hours. Digital money showcase volumes in all cases are low as the end of the week exchanging hush starts. Close by this, the rise in cost has pushed up the main twenty cryptographic forms of money too, as altcoins are seeing 5-10 percent picks up. Almost every altcoin has moved simultaneously with bitcoins value swings in the course of recent weeks.

Bear Scenario: Bitcoin's cost could dip under the $3,500 territory again and into some lower value zones. Some cynical supposition from brokers hasn't completely worn off presently, and some negative news could goad more auction soon. Dealers wagering against the cost are trusting and imploring BTC's esteem will fall beneath the $3K zone once more. Right now, under $3K is not likely to work out but rather we may see some lower value focuses on this week.

Bull Scenario: Right now bitcoin markets demonstrate purchasers are in charge, yet they could wind up plainly depleted in the blink of an eye as volumes are generally feeble. Bulls need to push past the $3,800-4,000 territory once more, to increase some genuine energy towards higher cost focuses. On the off chance that they do, despite everything they have a few fights to battle as far as possible up to the $5K territory. It's imaginable for the time being the current bullish notion will keep merging.

Where do you see the cost of bitcoin heading from here? Tell us in the remarks beneath.

Disclaimer: Bitcoin value articles and markets refreshes are planned for educational purposes just and ought not to be considered as exchanging guidance. Neither Bitcoin.com nor the writer is in charge of any misfortunes or additions, as a definitive choice to lead an exchange is made by the peruser. Keep in mind forget that lone those possessing the private keys are responsible for the "cash."