The Honeybadger’s Value Climbs Relentlessly as Traditional Global Assets Falter

As the global economy has been rattled by a sinking U.S. stock market and the cold war-style quarreling with North Korea, the digital currency bitcoin has risen exponentially in value. Wall Street’s DOW average dropped 200 points, and Asian markets slumped considerably due to the global tensions with North Korea. Even rising tech stocks like Nvidia and Alibaba shares plunged in value on Thursday.

Markets Update: Bitcoin Rallies While Traditional Assets Tumble Worldwide

Asian markets, Nasdaq, and the DOW slump big time on Thursday.

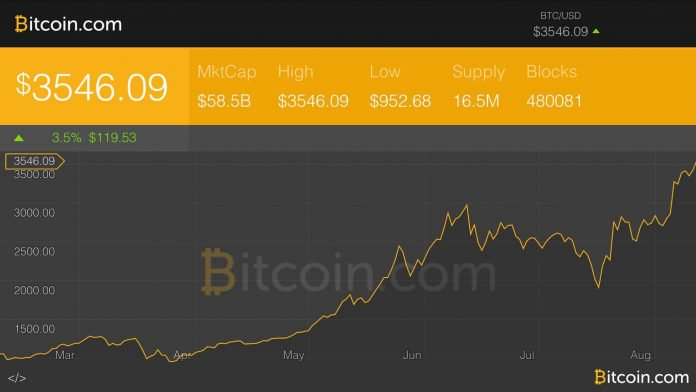

Throughout all of the economic uncertainty, the honey badger of money couldn’t care less. At the time of writing, one bitcoin is averaging $3,530 across global exchanges like Bitstamp, Huobi, Korbit, and Bitflyer. The cryptocurrency commands a significant trade volume of over $1.7B worth of BTC over the past 24-hours and currently captures a $58B market capitalization. A majority of BTC trade volume stems from countries like Japan, the U.S., China, South Korea, and India.

Markets Update: Bitcoin Rallies While Traditional Assets Tumble Worldwide

Bitcoin price August 11, 2017, at 11:30 EDT.

Technical Indicators

Bitcoin markets already climbed to a high of $3,490 across global exchanges on during the overnight on Tuesday, August 8. Bulls started showing some exhaustion while intra-range strategists and day traders took some profits throughout August 10-11. The reversal saw bitcoin hit a low of $3,180 but subsequently, the price jumped back to $3,300 an hour later. At press time, the 100 Simple Moving Average (SMA) and the long term 200 SMA are crossed in unison. The 100 SMA still hovers slightly above, indicating the bull run might continue on the upside.

Markets Update: Bitcoin Rallies While Traditional Assets Tumble Worldwide

100 and 200 SMAs are crossed meanwhile Bitstamp order books show heavy resistance in the $3,600 range.

Stochastic is back heading north as the indicator was showing strong sell-offs on Wednesday and Thursday. Now both the Relative Strength Index (RSI) and Stochastic are flat proving right now the cards could be in anyone’s hands. Order books show a lot of placed orders in the $3,600 range, so there will be some resistance in this territory. Most traders are betting ‘long’ at the moment, and Fibonacci extensions show a target of $3,740.

Bitcoin In the News

Bitcoin has been in mainstream media headlines quite a bit over the past two weeks, with stories about the spiking price and the currency’s recent hard fork. Mainstream journalists from Bloomberg, the Wall Street Journal, CNBC, and the New York Times have been extremely positive about bitcoin as multiple reports are published daily. The news outlet CNBC, in particular, has favored bitcoin in editorials and the station’s financial video segments. This week on CNBC’s ‘Fast Money’ financial investor, Thomas Lee of Fundstrat Global Advisors, said he believes bitcoin could outperform gold and U.S. stocks. Lee stated that if bitcoin commands roughly five percent of alternative asset markets, then one BTC could easily be $25,000 to $50,000 in the future.

Markets Update: Bitcoin Rallies While Traditional Assets Tumble Worldwide

When Lee was asked by the ‘Fast Money’ panel if he had to choose between U.S. stocks or bitcoin this year, Lee said bitcoin was a clear choice stating;

“I think Bitcoin is an under-owned asset and the potential for huge institutional sponsorship is coming — Between now and year end, it’s easily bitcoin.”

The Verdict

Bitcoin has done considerably well since the chain bifurcated into two on August 1 creating the token called Bitcoin Cash (BCH). At the moment the bitcoin cash market shows one BCH is roughly $340 indicating both markets seem to have little correlation right now. In approximately two weeks Segregated Witness (Segwit) will activate on the network and bitcoiners will once again prepare for another possible hard fork this November. However, bitcoin markets are on a tear, and don’t seem to be shaken by the fear, uncertainty, and doubt (FUD) being spread across social forums.

Bear Scenario: Currently there’s a strong floor within the $3,200 range so if a reversal happens bears will aim to test this key zone again. The price has only been above the $3K territory for a short period, but could quickly drop below if panic selling ensues. Both SMAs are still crossed, and a downside could be in the cards if bulls get exhausted.

Bull Scenario: If bulls manage to break the $3600 resistance then the price could easily command a $3,650-3,700 value in the next couple of weeks. There’s a lot of active elements happening within the bitcoin economy and countries like India, and South Korea may be on the verge of legalizing the cryptocurrency as a form of payment. Many traders, analysts, and experts think that a price of $4K and above per BTC could easily happen by year end 2017.

What do you think about the price of bitcoin? Do you see a dip coming or do you see the bull run continuing higher? Let us know your thoughts in the comments below.

Images via Bitcoin.com, Yahoo Finance, CNBC, and Bitstamp.

Congratulations @gl4dos! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @gl4dos! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP