During the Tech Boom era there was great volatility among technology stock as the standard asset valuation models were not directly applicable to the new business models being developed by what eventually become the successful FANG Stocks (Facebook,Apple,Netflix,Google).

The successful stocks emerging from the tech boom era eventually came valued using new models based on the success of realizing network effects and in which the capital structure of the firms were comprised of higher percentages of intangible (intellectual) capital.

The valuation of the financial tech (fintech) startups also know as "crypto-currencies" become more rationally valued and less volatile once a new valuation model for fintech startups becomes more widely known and disseminated.

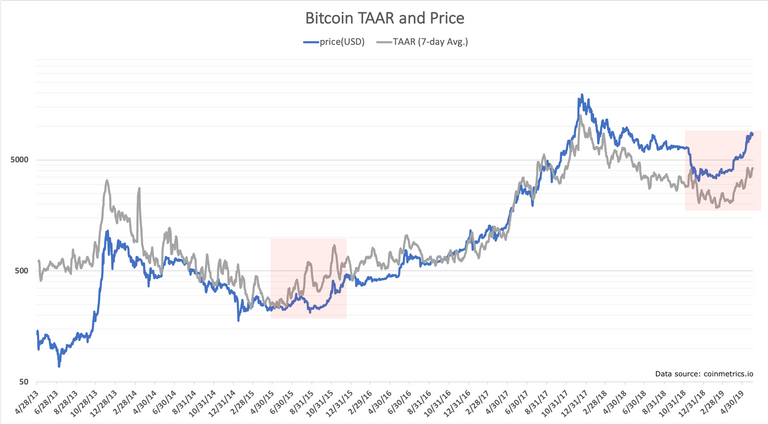

One of the components of a new valuation model is a sort of normalized gross transaction volume which measures the absolute volume of coin denominated transactions over time. A picture of this relationship for Bitcoin is shown here:

In conjunction with the imminent halving of new Bitcoin mining supplies the picture for Bitcoin now becomes very bullish as is explained here and here:

https://steemit.com/bitcoin/@jondoe/even-grayscale-says-to-buy-bitcoin

https://www.ccn.com/bitcoin-halving-massive-price-boom-likely/

Volatility in market pricing is a proxy for uncertainty but this state of affairs represents a buying opportunity for those prepared to interpret and use the emerging valuation model for crypto-currencies/fintech startups.

Hello ggekko, welcome to Partiko, an amazing community for crypto lovers! Here, you will find cool people to connect with, and interesting articles to read!

You can also earn Partiko Points by engaging with people and bringing new people in. And you can convert them into crypto! How cool is that!

Hopefully you will have a lot of fun using Partiko! And never hesitate to reach out to me when you have questions!

Cheers,

crypto.talk

Creator of Partiko

Thank you. I look foward to our interaction.

Posted using Partiko Android