Bitcoin has remained below a very significant resistance in the $10,500 and $14,000 price marks but this has not affected price speculation from investors around the world.

Speculations from a prominent player in the space are that a price of $300,000 is very possible within a five-year spell. Let us look at his reasons.

In an interview with Bloomberg, as at 2 days back, Blockstream CEO Adam Back made mention that bitcoin might top $300,000 by 2025. In percentage, it implies that the people’s coin, might rake in a 3000% rise in value.

Adam believes that this is going to happen and hinges his prediction on the current influx of investors who are taking positions and hedging with bitcoin. Just in case you didn’t know, Paul Tudor Jones as well as petty retailers like me and you, are the ones he believes will take the price to that value.

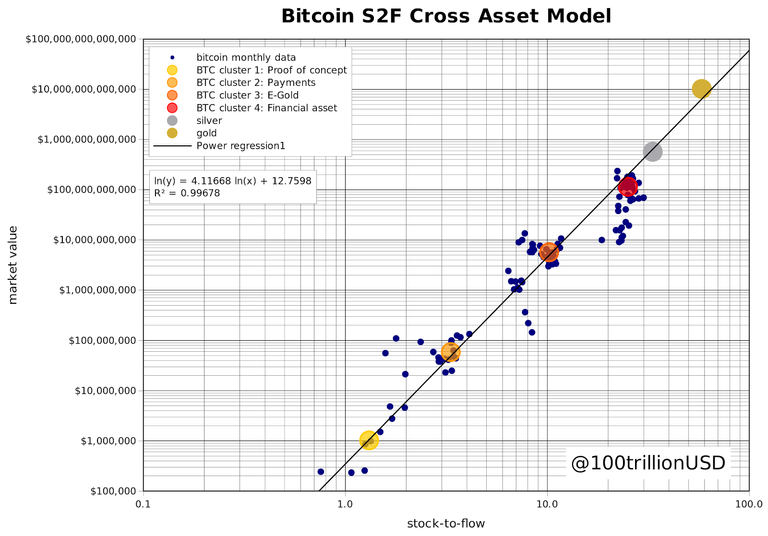

In support of this prediction is the famous Stock to Flow Model from the analyst “PlanB”. PlanB is a pseudonymous quantitative analyst that works as an institutional investor in europe.

Bitcoin Value is Tied to Asset Scarcity

The analysts found that bitcoin value is someoworth tied to its level of scarcity. The more scarce it is, the more valuable it becomes.

In my opinion, this theory is very valid for any commodity when we factor in the principles of scarcity in relation to demand and supply. If only 21 million Bitcoins are evermineable, and with the reduced number of bitcoin per block from recent bitcoin halving, coupled with the increasing push for adoption and massive growing awareness, it is only fair to see the positive sides of the prediction. As btc will literally become a scarce commodity.

PlanB plotted this relationship and found that by abstracting time from the model, he can fit a regression that has an R squared value of over 99%. The regression suggests that Bitcoin will reach a price of $288,000 within the next five or so years.

Stock to Flow Model from analyst PlanB.

Macro Trends Support This Rise

There are analysts seriously considering that the leading cryptocurrency will reach well past $300,000 in the coming years due to macro trends.

Raoul Pal is one of these analysts. The former head of Goldman Sachs’ hedge fund sales division and a noted macro analyst recently went on the “Keiser Report” on RT to discuss this.

When asked if bitcoin can make sure historic All Time High, he had this to say

“If it becomes an ecosystem, and we believe it will be and it will take the whole ecosystem with it as well, then yes, I think a $10 trillion number is easily achievable within that process,” the current CEO of Real Vision said. Read more about his predictions here.

Would Recession Prompt Bitcoin’s Rise?

Bitcoin is likely to erupt higher in the coming years because due to the ongoing recession, there is a risk “of the failure of our very system of money” or at least a collapse of the “current financial architecture.”

To him, cryptocurrencies such as Bitcoin are a way out of that system and may act as the predicate on which the next system is built upon. Pal said on Bitcoin in particular:

“It is an entire trusted, verified, secure, financial and accounting system of digital value. It is nothing short of the future of our entire medium of exchange system, and of money itself and the platform on which it operates.”

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered fraud and violate the intellectual property rights of the original creator.

Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.

I'd love it if Bitcoin went to $300,000 but I'm not sure if it ever will to be honest. One thing that is for sure though is that crypto is definitely a long-term hold!