The world of crypto-currencies is still the most convulsive, but is that the constant appearance of new tokens are added the news that come to us about the next changes that will affect bitcoin, and that will make new versions of the best-known cryptocurrencies and popular in the world.

We have already seen the first great schism of the bitcoin world with the appearance of Bitcoin Cash, but soon there will be two more movements. The first will be the appearance of Bitcoin Gold (BTG), but it is the second, the so-called SegWit2x, which poses a much deeper change of the entire platform

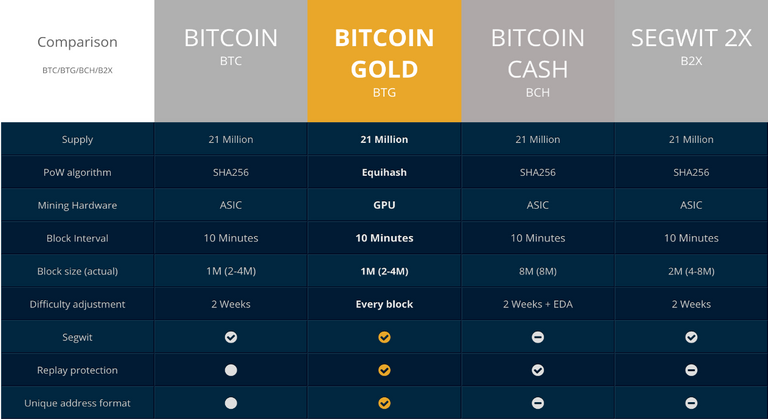

Bitcoin Gold has appeared in the crypto-currency market a few hours ago, and it has done so with a notable difference: it will be a bitcoin version "resistant to ASICs", or what is the same, that can not be mined as traditionally you are mining bitcoin.

Large "cooperatives" and bitcoin mining companies make use of thousands of ASICs, circuits specifically designed for this purpose.

Bitcoin Gold will not be able to "extract" itself in this way, since it will implement a new PoW algorithm ("proof of work ").

That bitcoin's dependence on ASICs is problematic because many of the miners are in China, where ICOs were recently banned and crypto currency exchange markets, the so-called exchanges, were closed. China is also the country where ASICs are manufactured, making mining and mining machines too "centralized".

That's precisely what BTG seeks to solve, a crypto-divy dedicated to "making bitcoin mining decentralize again". Bitcoin Gold will be able to be mined with GPUs, the method that for example they use all those dedicated to the mining of Ether, the criptomoneda of the platform Ethereum.

It also changes the way in which the mining difficulty is managed: in bitcoin that difficulty is adjusted every 2016 blocks (approximately every 2 weeks), but with BTG the difficulty will be adjusted after the production of each block "to avoid big changes in the total amount of computing power ".

In Bitcoin Gold also appears a remarkable feature, the so-called 'Replay Protection' that makes after the fork BTC transactions are not duplicated with a BTG transaction. As with Bitcoin Cash, if you have 3 BTCs in your portfolio, there will be another 3 BTGs in your portfolio of that criptodivisa, but if you spend a BTC to buy something that will not imply that there will also be a BTG less in that portfolio with the new criptodivisa.

The other big movement in the bitcoin segment could have much more profound consequences, because it is a hard fork, a new version of bitcoin whose idea is not to live with bitcoin, but to completely replace it.

The main idea of this new version is to increase the size limit of bitcoin in November, going from the current 4 Mbytes to 8 Mbytes. The proposal came from the so-called New York Agreement (NYA), and is one of the most controversial and controversial changes among the bitcoin mining community, which are those who are supporting or refusing to adopt that cryptodivisa that has no symbol because it simply pretends to be the new BTC.

The idea of SegWit2x is to solve the problem of bitcoin scalability with that increase in block size, something that was already tried with Bitcoin Cash. With Segiwt2x you change how the data is stored in each block but the compatibility with the bitcoin software is maintained: the idea is to give continuity to this crypto, but replacing the current bitcoin. If that is not achieved because the support of the big "miners" are not enough, that third crypto-divy appears with that hypothetical symbol B2X (which could be another).

In fact in Bitcoin Magazine explain how in fact it is probable that a third coin appears with a third chain of blocks and a different symbol that could be that B2X, but that for example is not protected by the 'Replay Protection' of which we spoke previously . Experts recommend not spending bitcoins after the November fork in case the flies wait for the situation, especially complex, to be resolved between the exchanges and the BTC and B2X network.

Once again, uncertainty surrounds this crypto-currency, and no one knows what can happen once Bitcoin Gold and SegWit2x start up.

This post has been ranked within the top 25 most undervalued posts in the second half of Oct 24. We estimate that this post is undervalued by $51.21 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Oct 24 - Part II. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Este Post ha recibido un Upvote desde la cuenta del King: @dineroconopcion, El cual es un Grupo de Soporte mantenido por 5 personas mas que quieren ayudarte a llegar hacer un Top Autor En Steemit sin tener que invertir en Steem Power. Te Gustaria Ser Parte De Este Projecto?

This Post has been Upvote from the King's Account: @dineroconopcion, It's a Support Group by 5 other people that want to help you be a Top Steemit Author without having to invest into Steem Power. Would You Like To Be Part of this Project?