During the last few weeks the global cryptoactive market has experienced a downward movement, due to the different announcements of regulation in the main countries around the world. Today, almost all cryptoactives on the market show percentages of decline of more than two figures.

After the large increase in global market capitalization during the last month of 2017, as well as the increase in the value of the main cryptocurrency, which exceeded 20 thousand dollars per bitcoin on December 17, several regulatory announcements, added to the recent hacking of Coincheck, have negatively affected the price of the main cryptoactives.

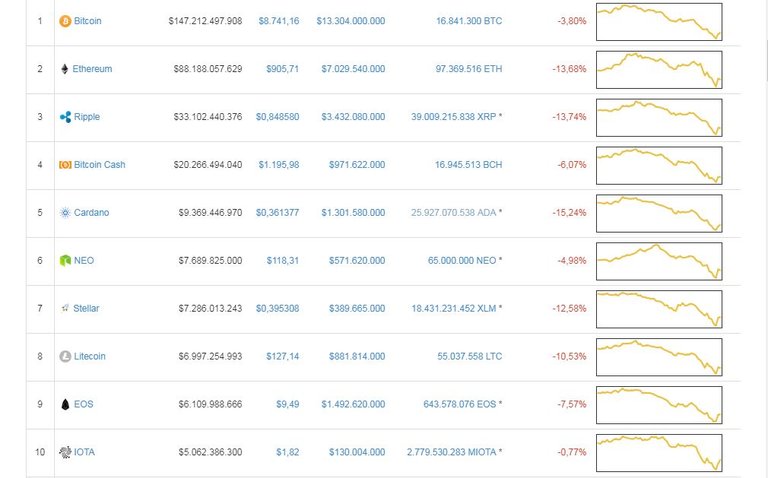

That's what the cryptocurrency market looks like today. Source: coinmarketcap

More and more governments around the world are announcing that they will regulate the operation of exchange bureaus and impose more restrictions on their operation, as well as more Know Your Customer (KYC) requirements, to prevent potential illegal or fraudulent transactions.

These announcements are also made primarily by countries that handle the largest volumes of cryptocurrencies transactions in the world, such as Japan, South Korea or the United States.

EXCHANGE HOUSES IN SIGHT

A few days ago, major U. S. financial authorities, the Securities and Exchange Commission (SEC) and the Futures Trading Commission (CFTC) issued a joint statement warning that they will strengthen their regulations on cryptocurrencies.

In addition to talking about their concerns regarding the Initial Currency Offers (ICO) market, the representatives of these institutions reported that:

"Many of the cryptocurrency exchange platforms that operate over the Internet have been registered as payment services and are not subject to SEC or CFTC oversight. We would support any law that supports the review of these regulatory frameworks and ensures that they are effective and efficient in the digital age."

Jay Clayton and Christopher Giancarlo

Directors, SEC and CFTC

This intention to regulate bureaux de change finds a similar counterpart in Japan, where the Finance Minister and other authorities have expressed their plans to regulate the exchange of cryptoactives in the country, especially after the hacking of the Coincheck bureau de change, in which $530 million was stolen from XEM, the currency of the NEM platform.

The South Korean counterpart also said that it will not ban the exchange of cryptocurrencies, but that it will strongly regulate its functioning. These statements follow the enactment of a law prohibiting exchange house clients from operating anonymous bank accounts, in addition to the comment by the chairman of the Financial Services Commission that they would be considering closing these entities. In response to this, the Minister informed that this was only one of the possibilities studied.

Although the outlook looks negative for the cryptomarket, the director of market analysis at TF Global Markets Naeem Aslam told Bloomberg news agency that these regulations are positive in the long term.

In his opinion, investors are more comfortable knowing that there is a regulatory framework around this market, so these actions increase confidence in blockchain technology.

In addition, the cryptoactives market tends to experience these generalised declines and then, as developers make network improvements and adoption grows, their value reaches higher levels than before they fall.

Source: www.criptonoticias.com

thats fud made this bloody bath but i saw some nice idea in the trading view some users are is last correction for btc and it can start to move up now

crypto is regret:(( may for me!

We are smarter than that, aren’t we?

Go District0 (0x) with their decentralized exchange.

The lockchain technology is proving to be the solution to counter attack the centralized power. So let’s use it and not panic!