Greetings to all blockchain fans, wherever you are.

this time I want to give an explanation about the platform for the loan, consider the following explanation.

An entrepreneur must have many bright ideas. These ideas are the beginning of the business development that is being run.

However, business development, of course, is not enough just to rely on ideas. Because various other components are not important for business support. One of them is venture capital, which will be used later.

To get business capital, of course not an easy job. With this capital, you may need it in sufficient quantities. It will be more difficult if you can not qualify for a loan to the bank.

This is one of the obstacles for business people, not to mention who started the business for the first time. Not easy to get a loan, right?

Peer-to-Peer (P2P) and Crowdfunding. Both of these systems seem to have an equation between one and the other. If you look deeper, then they have a significant difference.

Peer-to-peer (P2P) loans

Peer-to-peer (P2P) is a system (platform) that unites lenders (creditor) with the borrower (debtor). In P2P, loan money also sets a set percentage of a month to compete with the interests of Unsecured Loans (KTA).

In practice, borrowing and lending operations in P2P are done online. Lenders and borrowers do not meet each other. In addition, you can get a loan without having to pawn anything (unsecured). Once the loan is approved, you will be bound by the agreement on the obligations to the creditors.

Crowdfunding

Unlike other credit systems, when you collect or raise funds, you actually earn some money in the form of donations. Like P2P, crowdfunding covers three sides: project owners, sponsors, and platform providers.

You just need to tell your business idea and your business opportunity up front. If someone is interested, the sponsor will explore or jointly provide funds for your business. On the other hand, crowdfunding is also used as a fundraising event for social purposes.

So, in Crowdfunding, you should at least tell the story about your project. Peer-to-peer (P2P) equals debt, and Crowdfunding is a donation. Equally, funds are earned through online platform providers. Another difference between Peer-to-Peer (P2P) and Crowdfunding:

At P2P, you will be subject to a written agreement on the amount of funds you collect from the investor and the obligation of repayment. It also requires that you provide detailed business-related information, as approved. Although Crowdfunding does not require a written agreement because of its voluntary nature.

Crowdfunding requires your ability to truly represent the project through the platform provider, so many are interested in providing funds.

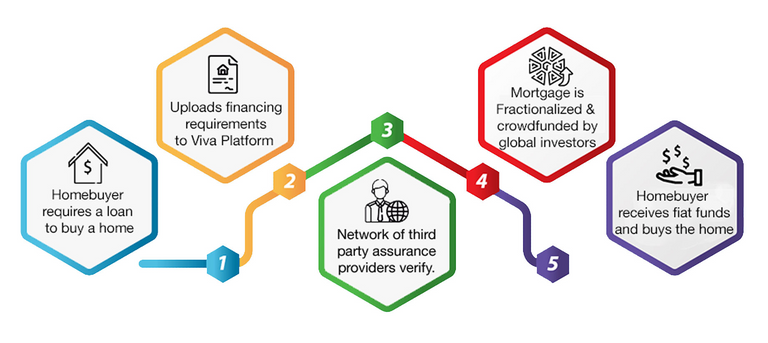

Now it's all been answered with the existence of a platform that can simplify it all that is VIVA Introducing peer to peer Mortgage Crowdlending.

VIVA is a fixed supply cryptocurrency that drives P2P Fractional Mortgage Shares technology, which is the backbone of the Viva Network's crowdfunding mortgage platform. VIVA will be trading on several major cryptocurrency exchanges and we expect an ever-increasing demand for VIVA as this revolutionary financing system gains traction among institutional investors globally.

Exchange Viva FMS app

Once the mortgage has successfully performed crowdfunding using the Fractionalized Mortgage Shares, it will become available for sale on the exclusive Viva FMS Application Exchange located at Viva Network Peron. The application will operate similar to a typical online cryptocurrency exchange, and FMS will trade in a manner similar to any revised earnings guarantee. Investors will be able to use this platform to buy (bid) and sell (ask) FMS investment.

These applications include data analytics tools, graphs and functionality that categorize all FMS securities based on risk rating, yield, duration, IRR, etc. with customized portfolio recommendations and automation available to the average investor. In the Viva FMS Exchange application, the investor will be able to simply click on the FMS and the individual view full details of:

Exchange Viva FMS app

1 Credit rating of the borrower;

2 The borrower's creditworthiness details include: Age, employment status, payment history, credit score, income, other relevant financial liabilities, ability to repay debt (interest coverage ratio);

3 Two standard, ranking-based risk algorithms (Grading System 1 & 2);

4 All asset details include Value, address/location, size, age and quality of physical structure, homeowner level of insurance, etc.;

5 Standard Viva Recommendation Terms;

6 All terms of the mortgage contract include duration, yield, interest rate (and date of VIVA / USD FX rate at that date), loan-to-value at the underlying facility, etc.

Token Generation Event Details

Hard Cap Generation Token Generation: 3,000,000,000 VIVA tokens

Pre-Sales

Hard-cap ETH: 6,870 ETH

Pre-Sales 1

Bonus token: 40%

ETH lifted hard-cap: 500 ETH

Pre-Sales 2

Bonus token: 35%

ETH lifted hard-cap: 2,570 ETH

Pre-Sales 3

Bonus token: 30%

ETH Hard-cap Lift: 6,870 ETH

Distribution Token

Total number of tokens: 4 billion VIVA

75% - Token Generation Event

7.5% - Team Allocation

3.75% - Advisory Allocation

10% - Fund Reserve Allocation

3.75% - Allocation of Marketing Contribution, Bounty, and Private

FOR INFORMATION DETAIL:

WEB SITE: http://www.vivanetwork.org/

WHITE PAPER: http://www.vivanetwork.org/pdf/whitepaper.pdf

TELEGRAM: http://t.me/Wearethevivanetwork

TWITTER: https://twitter.com/TheVivaNetwork

MEDIUM: https://medium.com/@VivaNetwork

FACEBOOK: https://www.facebook.com/VivaNetworkOfficial/

GITHUB: https://github.com/viva-network/viva-tge

Author: alex789

Profile: https://bitcointalk.org/index.php?action=profile;u=1653045

Eth: 0x5f5f506A001A179b8eE67214a7754Bfe04ffadE0