Part Three - Bitcoin Scalability: The Year 2015 Becomes a Hopeful Period

Part Three - Bitcoin Scalability. Still in the same year, ie in the Year 2015, seemed to be a year full of hope. This is because there are a number of new innovations that provide enough fresh fresh wind for the development of Bitcoin in the future. Before Blockstream introduced Segregated Witness (Segwit) at the end of 2015, at the end of March 2015, there was a draft whitepaper on Lightning Network.

Lightning Network - February 2015

The Whitepaper, composed by Joseph Poon and Thadeus. It is not known who exactly the person who found the idea of channel micropayment as the main concept in Lightning Network.

Joseph Poon himself, as he said in Coindesk, explained that Lightning Network actually has been around since 2013, as many others have done before. Furthermore, from the idea that has been there for a long time, then make it has the idea to create a paymen channel as a liaison transaction. Followed later, Thaddeus Dryja implements the transaction script to be more concise.

The most interesting part about Lightning Network is that using a special micropayment channel outside Blockchain will make bitcoin transactions much faster, even going beyond the Visa transcription capacity that has successfully processed 45,000 transactions per second during solid transactions.

The only thing that is considered a barrier to transaction capacity Bitcoin is only able to process transactions as much as 7 transactions per second, none other than because there is a limit block that is less than 1 megabyte only.

Transactions with channel micropayment at Lightning Network, using HTLC (Hashed Timelock Contract), which utilizes the Timelock function. While the channel payment is used to prevent malicious attack attempts that may happen to be able to steal funds when the transaction delay is made with the HTLC. Furthermore, with the HTLC, the transaction output can only be executed by the recipient only.

For the sender of the transaction, when Lightning is applied, the sender (sender) first makes the channel payment. The way to do is to use 2-of-2 Multisig Address between sender and receipient. Both parties in the transaction then signed the transaction without having to exchange their digital signatures. After each sign, then the transaction output is also at once with the refund and the last balance position on the transaction.

One major thing about micro payment transactions in Lightning Network, capable of processing transactions fairly quickly, is because the transaction goes beyond blockchain. When the transaction is in full swing, the transaction clearing has also occurred, then the transaction is broadcast inside the blockchain, followed by closing the transaction channel.

Some Core Bitcoin developers like Gavin and Peter Todd, responded to Lightning Network. Both, more attention to the security side that leaves the gap of the attack. The assumption is, when the Timelock function is used, whereas if there are so many transactions at the same time, then the next broadcast transaction will overwhelm the data capacity in the blockchain network. Potential enough to allow later, is the emergence of spamming efforts in large enough quantities at the same time.

In addition, if the transaction context is done outside of blockchain, then surely it will pretty much alter the full Bitcoin that has used Blockchain as its backbone. Blockchain, has been the single most effective defense bastion for various forms of attack.

Peter Todd, also responded, according to him, Ligtning Network is not right to be implemented at this time. He said:

"If Blockchain is used as a horse, this hub-and-spoke channel proposal is trying to suggest replacing the horse with a truck, while those proposers of the Lightning Network are proposing to replace horses with rockets."

Quite realistic is the opinion that doubts this implementation. At the same time, it proves that there are enough things that could actually be done in further Bitcoin development efforts in the future.

The only real effort that has always been noticed is that the Bitcoin economy, which has been imprinted in the current Bitcoin consensus, must be able to adjust to conditions. Mainly, it is the long-term side that can be compatible with the level of technological development. In this case, it would be sufficiently related to the Bitcoin mining ecosystem, about the incentives of miners moving as the driving force of the Bitcoin system, as well as the frontline of the impenetrable security front.

The complexity of Bitcoin, indeed, has become the greatest benefit, but on the other hand, it is potentially also a point of weakness. Changes in block bitcoin limits, carrying impact sequences also on other related protocol changes. The change, it is feared will affect the global aspects that can reduce the attention of mining ecosystems in the long term, if the implementation of new innovations that do not adjust to existing conditions.

While on the other hand, expectations for new innovations, more audible, equally strong opinions of difference still persist. Lightning Network development is also being done.

Developer Lightning Network, in the end also received funding support from Blockstream. Blockstream party, trying to collaborate signature sidechain project. The hope, is to better provide better options as an integeration between Blockchain diusungnya in Sidechain.

Joseph Poon explains that Lightning Network is built on C, Java, Go and Python. For testing the development, also performed on Tesnet3. According to him, Lightning implementation is enough with Soft Fork only.

Lightning Development, has done a lot of advanced development. Efforts are made, is to continue to minimize Transaction malleability. In addition, HTLC also performed improvements, especially adding updates such as CHECKLOCKTIMEVERIFY and CHECKSEQUENCEVERIFY. So in later transactions, the recipient can provide a unique hash to the sender. So the transaction with channel payment, can be more widespread though through untrusted party by staying secure.

Meanwhile, there is another development that is more or less similar to Lightning Network. Is a Duplex payment system, with DMC that is almost the same as Lightning. The DMC, hosted by Christian Decker and Professor Roger Wattenhofer, proposed the DMC in September 2015.

DMC does have the same typical Lightning, which also uses channel micropayment. Decker himself, has made his design into a BIP draft at the time. Not only the DMC alone, ChangeTip with tipping platform, also tries to implement the tip platform with a number of Bitcoin, in order to be done off-chain (outside Blockchain). They use it on a ZapChain social media that has been integrated with BlockCypher for small value transactions.

Even later in September, 21.co launched the Bitcoin Computer platform. This Bitcoin computer, being the first one, is hardware and also software that fully supports bitcoin protocol. In addition, it also supports micropayment transactions. Nevertheless, this debate continues. Bitcoin's scalability debate was getting heated up after two well-known developers made a new bitcoin core branch variant named Bitcoin XT.

Bitcoin XT - August 2015

When the debate is felt there is no common ground, a number of core Bitcoin developers, there are also cross-polls. Two core developers Bitcoin, namely Gavin Andresen and also Mike Hearn, eventually create a new branch of Bitcoin core with the name Bitcoin XT.

Bitcoin forking code core, ultimately tapered debit Bitcoin scalability. Gavin himself, has been a coordinator of Bitcoin core developers since April 2014. But Gavin's efforts at Bitcoin XT, it seems to be a controversial effort amid a crisis of debit Bitcoin scalability. Later, mirrored from this forking core, which membut the emergence of variants of other bitcoin cores.

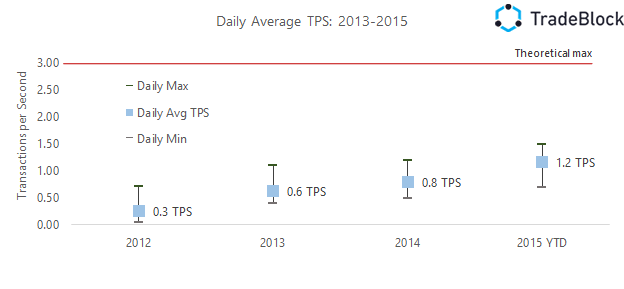

At that time, the runway used was due to an increase in network capacity. From tradeblock monitoring, there is an increase in the average number of transactions occurring from 2013 to 2015. By 2015, there is an increase in transactions of 1.2 transactions per second. Supposedly, on the bitcoin network at that time, the analysis only ranged from an average of 3 transactions per second only.

There is an increase of 1.2 transactions per second by 2015 (Figure: Tradeblock).

In fact, on 29-30 May 2015, there is a considerable transaction surge. That is, it is flooded with transactions totaling approximately 26,000 transactions. The assumption, to process the entire transaction that still exists in the mempool, will require approximately 14 new valid blocks next. The range of time required, approximately 2.5 hours.

On 29-30 May 2015, there was a sharp increase in bitcoin transactions. (Figure - Tradeblock).

Earlier, on May 9, 2015, Mike Hearn also wrote his opinion on Medium. What Mike Hearn has to say, is to be the forerunner of the proposal that bitcoin protocols can accommodate higher transaction fees. According to him, some bad conditions lets happen if mempool big enough, eventually many abandoned transactions, then the node feared suffered a serious problem.

Mike Hearn's view in his article, trying to make Bitcoin able to adjust to market needs. At that time, a number of major wallet, exchange and merchant service providers, have been trying to make the bitcoin protocol will be able to make the miners can more prioritize transactions with greater transaction costs. So with the conditions when the large-size mempool, there are priorities of miners to process transactions with a larger fee. The end, according to Mike Hearn, can reduce the size of the effool effectively.

During that time, bitcoin transaction fee, is said to be quite low, even on some wallet clients, it is still possible to send transactions with no transaction fee included. Meanwhile, the service provider only modifies the transaction, including transaction costs only, but still can not be accommodated by the nodes in the mining ecosystem. In the mining ecosystem, the node only always works to process transactions as far as they have been heard first, without any special option on transaction fees.

The real picture, although for most online wallet providers and others, even though it has included transaction fees, the miners may still prioritize transactions even with lower fees, or no fees. In terms of transaction fees, in fact it becomes the object of a third party, to reap the benefits.

Given the increasing transaction size and size of the board, both Gavin and Mike Hearn decided to make speculation with Bitcoin XT. The result, speculation Bitcoin XT actually received sharp criticism. All discussions in the subreddit forum (r / bitcoin), have been banned by The Theymos. He considers, forking Bitcoin cores as well as Altcoin. At that time, there was already altcoin, Litecoin which appeared as an alternative to cryptocurrency besides Bitcoin. Mike Hearn himself, eventually decided to get out of bitcoin developers in mid-January 2016. He also had made a fairly controversial statement stating that Bitcoin Has Died.

In addition, Garzik also proposed BIP 102 to raise the block limit to 2 megabytes. Then, try to request a pull on the master source code Bitcoin in Github. The request pool on the BIP was not addressed. However, there are a number of intrigues that start dragging the name of Satoshi Nakamoto, who seems to be depicted back to the Bitcoin stage.

In early September 2014, an email frequently used by Satoshi Nakamoto to communicate, reportedly has been hacked. Then on the email, sent an email to the bitcoin core developer mailinglist:

“If two developers can fork bitcoin and succeed in redefining what ‘bitcoin’ is, in the face of widespread technical criticism and through the use of populist tactics, then I will have no choice but to declare bitcoin a failed project. Bitcoin was meant to be both technically and socially robust.”

Because in a number of debates such emails sent as as a legitimacy of Satoshi to change the size of the block limit, so for that reason, a number of discussions about Bitcoin XT banned in many forums. The debate continues throughout 2015. Subsequently, some core developers have made open letters to all bitcoin communities, for holding a grand theme workshop on "Scalling Bitcoin"

Thank you for sharing this post with us, I enjoyed reading it. I did not previously know any of this information. As a more general user of bitcoin I was only familiar with the name lightning that I keep hearing. Worst thing are these terrible transaction fees we have had recently