History of Bitcoin Scalability - All Started From Bitcoin Whitepaper Introduced

History of Bitcoin Scalability. The debate about Bitcoin Scalability , has become fundamental in the bitcoin community ecosystem. Bitcoin's scalability, considered a major problem, also serves as a weak point of bitcoin .

We certainly understand that open ledger bitcoin (better known as Blockchain ), is able to store all the historical transactions that have occurred. All bitcoin transaction records from the beginning to the future are publicly distributed by anyone and run in peer to peer network typology.

With such a character, then of course in the end will require a large enough storage capacity. The Limit of Block Size, becomes the base point that underlies Bitcoin Scalability. Limit of block size, is the benchmark of block-block size of valid bitcoin. All transactions, entered into new valid blocks, with a consensus must be less than 1 megabyte (currently applicable).

The consensus about the block size limit, has been embedded in bitcoin core (core Bitcoin software). Thus, a consensus on a valid new block can be achieved within bitcoin networks. As bitcoins become more popular, then this is where the perceptions to add the size of the block block appear. And the debate about the proposals is becoming more and more discussed in many bitcoin forums.

Christoph Bergmann , wrote the long journey of debate about this scalability quite nicely at btcmanager.com . If we read a lot that the beginning of the debate about bitcoin scalability appeared in 2011, 2013, or 2015, is not the case.

Of the many comments or opinions in bitcoin forums, many are finally referring to the history of bitcoin scalability, starting from Satoshi Nakamoto beginning to introduce Whitepaper Bitcoin first in 2008. Precisely on November 1, 2008, Satoshi Nakamoto publishes a bitcoin paper with the title " " Bitcoin: A Peer-to-Peer Electronic Cash System " , in the cryptographic mailinglist group metzdowd.com .

The History of Scalability Begins From Group Mailinglist 2008

Since the Bitcoin paper was introduced at metzdowd.com (the cryingographic community group Cypherpunks mailinglist ), there are so many criticisms, responses, questions relating to all sorts of things about Bitcoin. Someone named James A. Donald , started the history of bitcoin scalability, by starting criticism of some crucial things to Satoshi Nakamoto. You can see Satoshi Nakamoto's entire conversation in the mailinglist here:

Precisely on November 2, 2008, James A Donald, began to criticize Satoshi's paper, He said:

"We really need this kind of system, but as I understand from your proposal, it does not seem to cover the required size scale. For a proof-of-work token to be transferred it has a value, must have a monetary value. To be able to have monetary value, they must be transferred through a very large network - for example on a trading network file similar to bittorrent. To be able to detect and reject double spending at the right time, one must have the earliest transaction of the current transaction. If hundreds or millions of people make transactions, it will require huge bandwidth - each participant must know all this, or most of them. "

James A Donald's criticism, based on his view, that what he sees in Satoshi's paper on Bitcoin, will require considerable storage sizes in the future. James A Donald sees this as Bitcoin's main problem. If we look at the detail of this mailinglist conversation, Satoshi never gave a detailed statement explaining the limit block.

Satoshi in his response, Satoshi just explained that the amount of bandwidth requirements and storage size to store all block block is not a big problem. Here is Satoshi Nakamoto's answer:

"Long before the network will be as large as mentioned, it will be quite safe for users to use Simplified Payment Verification (section 8) to check for double spending, which requires block headers in the block chain, or about 12Kb per day. Only people who make new coins will need them to run nodes on the network. The first time, most users will run the node. When the network goes beyond a certain developmental point, it will be more, and more will leave it, to a special hardware in a server farm . A server farm only needs one node within the network, the rest can connect to the LAN connection on that node.

Bandwidth is unlikely to be a barrier as you think. A transaction generally ranges around 400byte (ECC has been well compacted). Every transaction must be aired twice. Say 1Kb per transaction. Visas can process 37 billion transactions in FY2008, or an average of 100 million transactions per day. The considerable deal will require 100 GB of bandwidth, or approximately 12 DVDs, or 2 HD quality movies, or approximately $ 18 in current bandwidth.

It takes several years, the new network will be that big. At that time, sending 2 HD movies over the internet is not a big problem later on. "

But specifically Satoshi's answer, he also illustrates that Satoshi himself, as if he had been projecting for a time in the future, Bitcoin can handle quite a dense transaction, as in VISA capable of processing 100 million transactions per day. Satoshi's answer, which was then widely used as a reference source, on various cross-controversy about Bitcoin's scalability.

Meanwhile, in a follow-up response to Satoshi's answer, James A Donald himself is trying to explain and reject the proposed addition of limit block that we have heard so far. James A Donald, based his thoughts on possible possible mining farm dominance. Thus, with such dominance, quite potentially a serious network attack effort.

According to James, a diversified mining entity, will be more immune from potential attacks, unlike the FIAT that monopolizes the creation of currency, or also on other centralized currency creation entities.

Furthermore, James also provides good advice, about how Bitcoin in the future can be able to minimize the size of the data to the amount of bandwidth required in the process of creating new units. According to him, the smaller the size of data and storage needed, then the system is increasingly immune to various attacks , as has happened in many financial networks today.

Related to the comparison of transaction capacity as in VISA, according to James, that alone is not enough. James, seeing that the amount of fast transaction capacity per day, should be able to run with a fairly cheap transaction costs. Furthermore, James also has an ideal method with Bitcoin characters.

James's idea, based on Bitcoin transactions, should be done even for small nominal transactions, and also more based on high privacy. At that time, James tried to compare it to the Bittorrent file exchange medium.

Reflecting from Bittorrent and also the Bitcoin character which he thinks is expected to be able to process many transactions including for small nominal transactions, James judges only with an account layer pattern above the bitcoin that is able to make it happen. Furthermore, what is proposed by James A Donald this, which then today is often known as Channel Payment (Lihgtning Network) . If the transaction handling pattern is done in this way, it will be able to process the transaction with a fantastic amount, even the hundreds of thousands of transactions with a small nominal though. In fact, transactions can be done with a high degree of privacy.

Personally, James sees that potential can be realized. Handling deals with the special channel, previously also based on the idea of Chaum in BitGold since 1915 ago. At that time, James wrote:

" We can build a privacy layer on top of this - account money and chaumian money based on bitgold coins, much as the pre 1915 US banking system layered account money and bank notes on top of gold coins, and indeed we have to build a layer On top to bring the transaction cost down to the level that support agents performing microtransactions, as needed for bandwidth control, file sharing, and charging non-whitelisted people to send us communications . "

What is said by James A Donald that, then we often see included in the various dialogues and comments that discuss about Bitcoin scalability. And the debate over the limit block began to be discussed a few months before Satoshi made Bitcoin's first transaction to Hal Finney . Continuing later, Hal Finney began to argue that Bitcoin is a " currency "

Bitcoin Bank and the Presumption of Bitcoin as Currency By Finney - December 28, 2010

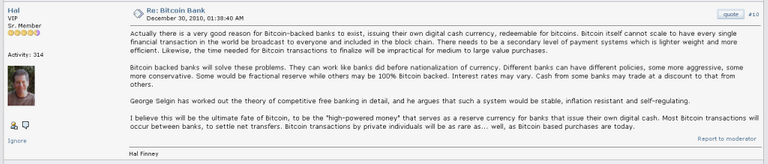

Finney actually started looking at Bitcoin like a currency. This Finney's opinion was put forward on a topic in the Bitcointalk forum, December 28, 2010, entitled " Bitcoin Bank ".

Opinion of bitcoin as currency, will eventually also relate to where effectively the currency unit can easily be transacted, as well as the perception of bitcoin as an electronic payment system. Although at the time, mostly in this forum, it was still unexpected that the debate eventually grew larger as it does today.

On a topic in the forum, someone with a wobber username , argues that there needs to be a Bitcoin Bank himself. He sees that a reasonable economic function with Bitcoin's total supply limit of 21 million will be able to inflate an inflationary effect, and be able to benefit from future price increases.  opic, Hal Finney sees Bitcoin not as an electronic payment system, but rather tends to view bitcoin as a currency. Finney said:

opic, Hal Finney sees Bitcoin not as an electronic payment system, but rather tends to view bitcoin as a currency. Finney said:

"Actually there is a good enough reason to support the establishment of Bank Bitcoin, publish its own digital currency, and can be exchanged with Bitcoin. Bitcoin alone can not consider whether its scalability is capable of handling every transaction worldwide, then broadcast to all people, and put into blockchain. There needs to be a second level in a lighter and more efficient payment system. Likewise, bitcoin will take time to complete large transactions with great value. "

The foundation of Finney Bitcoin as a currency, is to see if Bank Bitcoin will be established later, will solve many problems about the effectiveness of the transaction process, although he also realizes that it will ultimately lead to higher transaction costs if there is a second level of payment system through Bank Bitcoin The.

Meanwhile, when it comes to how bitcoin networks are capable of handling transactions quickly, Hal Finney sees Bank Bitcoin as the answer. Bitcoin transactions, can be a bridge between the two.

Appearance of Proposal to Raise the First Limit Block - January 31, 2013

The history of Bitcoin's scalability continues. Precisely on January 31, 2013, there was someone who started proposing about limit block size changes. The proposal about changing the block's limit, posted also posted in the Bitcointalk forum with the thread title " The Max Block Size Fork ".

The debate, in turn, is increasingly tapered, because the start of the idea of an attempt to change the consensus limit block that has so far remained less than 1 megabyte .

Posting the proposal, began to base his thoughts, that the block size amounting to less than 1mb, became the main problem. Assuming that at that moment, block size has even reached 300kb, while bitcoin itself is also increasing its users from time to time. According to him, block size will soon also touch the limit of 1mb in the near future.

A number of names who participated in the debate over the proposed change block limit, such as Peter Todd, Mike Hearn, Gavin Andresen, and also Gregory Maxwell. In many ways, the debate is tinged with conversations about the benefits as well as the potential weaknesses.

Of course, it would be quite beneficial if there is an increase in block block size, ie the number of transactions that can be processed in seconds. An opinion we often hear lately, that the addition of the limit block, is sufficient if bitcoin is to be regarded as the world's currency. However, the currency must be able to prove itself as a fairly effective means of payment, fast, and cheap.

While on the other hand, opinions that do not agree with the proposal, looking at the change in the size of the block limit, means that it will completely change the bitcoin protocol. In fact, quite potentially also to change the amount of supply of bitcoin that had previously been set at 21 million only.

The effort not to change the basic consensus of Bitcoin, it is indeed the main reference point why this is necessary to avoid. Most people consider bitcoin to be pretty good if the fundamental conception of the protocol is not altered, as it was.

At that time, if most people later hope to try to change that basic consensus, then most others will try to reject it. Gregory Maxwell, at the time, also argued that block block changes were not made.

According to him, the limit block of less than 1mb, will still be a reference incentive to the miners in the long term. He argues, Bitcoin becomes quite valuable, precisely because the regulatory mechanisms that have implications for scarcity. That way, when the total supply becomes quite limited, then the distance between blocks that can be created will also create a market transaction cost as well. With the additional cost of this transaction, the healthier the mining ecosystem. He argues, the debate about the proposed block size change, is not feasible in order to keep Bitcoin decentralized.

Not only that, Maxwell also judge, that the bigger block, will pretty much damage the decentralization of Bitcoin that has been going on at that time. Only blocks of small size, Bitcoin's decentralized character can be maintained, trying to stay away from potential centralization. The smaller blocks alone, which makes decentralization of Bitcoin a deep enough meaning. Gregory Maxwell says:

"With gigabyte blocks bitcoin would not be functionally decentralized in any meaningful way: only a small, self-selecting group of some of the major banks of the world would have the means and the motive to participate in validation."

Meanwhile, Gavin Andresen, began to give his idea about the size of the block that can be tailored to the wishes of the miners. Gavin, supports the existence of a miner that can more freely decide the size of the block is considered valid.

In contrast to Gavin, Peter Todd just saw it as a potential difference in view of consensus achievement in the Bitcoin network. Peter Todd, seeing it will only waste the power of miner computing, because in the end different views of block valid will eventually lead to orphan block .

If it is done continuously, it will be an effort that continually strives to achieve consensus by pressing miners who have limited computing power in the network. This of course can also be categorized as an attempt malicious attack . In this case, what is presented by Peter Todd, happens also as we see in Bitcoin Unlimited .

On the other hand, large miners with larger hash power are potentially in control of the Bitcoin network. If that happens, then the decentralization of Bitcoin disappears. While on the other hand, in response to Peter Todd, Gavin replied that it is not right that Bitcoin strives to be "high power money" , since in reality it is only capable of processing 7 transactions per second.

The history of Bitcoin Scalability continues, demands and always repeats statements, comments, and perceptions that have existed before. Until then began a series of experiments on Tesnet Bitcoin on 26 August 2016.

yes... upvote lagi, versi bahasa Indonesianya mana? :)

ada di http://edukasibitcoin.com/sejarah-skalabilitas-bitcoin/

Kang eb bisa bantu @syarrf ada masalah sama hardisknya, padahal ada walletnya didalamnya hardisknya, apa ada solusi gitu ?

pm ke inboks FB aja om... biar enak