itcoin futures just became a reality on Wall Street, but Sweden has been offering derivatives on the cryptocurrency for years. That gentrification has driven bitcoin trading in Scandinavia’s biggest economy to alarming levels, according to an online brokerage that facilitates the transactions.

“The euphoria is about to get totally out of hand,” said Claes Hemberg, who works as a savings adviser at Avanza AB. The firm provides a digital platform for Swedes to trade everything from shares in some of the biggest Nordic companies to more exotic products such as bitcoin exchange-traded notes.

Bitcoin Futures Start With a Bang as 26% Rally Triggers Halts

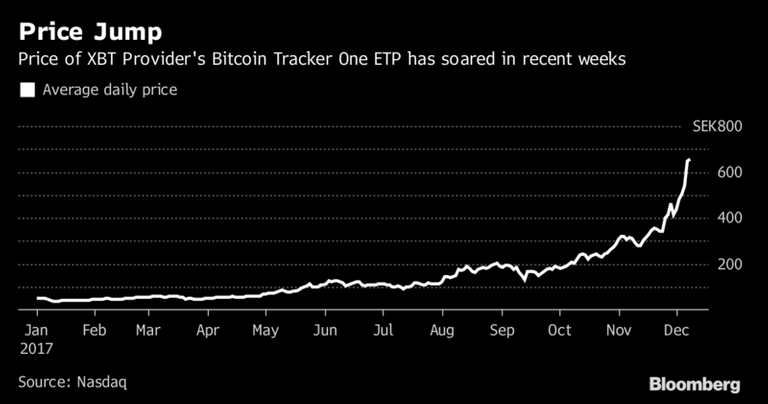

Avanza estimates that about 30,000 Swedes have become bitcoin converts after investing via XBT Provider’s Bitcoin trackers, which are traded on Nasdaq Nordic. That’s a 50-fold increase from a year ago. In total, Swedes have invested 2.2 billion kronor ($260 million) in bitcoin, with trading on some days even supplanting household names like Hennes & Mauritz AB and Volvo AB.

Opening the door to bitcoin derivatives, as Sweden did in 2015, changed everything.

“In the past 3-4 years, you were only able to speculate in bitcoin if you were a bit of a geek, as a certain degree of digital competence was needed,” Hemberg said by phone. “But today, you can trade using your fund account.”

Nordea CEO Calls Bitcoin ‘Absurd’ Construction That Defies Logic

Like many other places, Sweden has seen investor demand for bitcoin explode in recent weeks, as the cryptocurrency moves closer to the mainstream of financial markets. At Avanza, a key worry is that its 15,000 clients speculating in bitcoin aren’t spreading their risk adequately, given the extreme volatility in pricing.

Understanding Bitcoin’s Rise: QuickTake Q&A

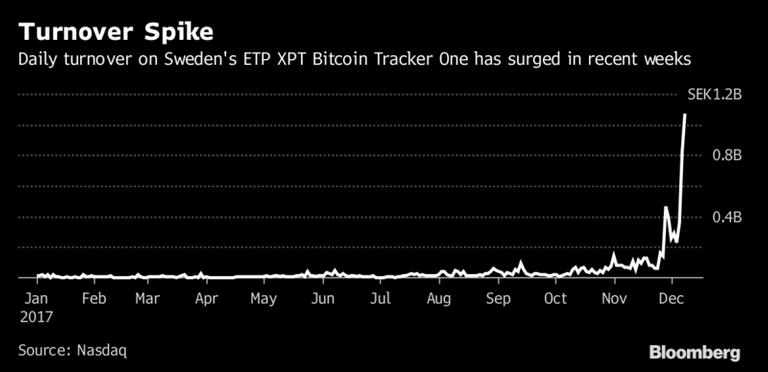

At XBT Provider by CoinShares, a Stockholm-based platform that enables trade in bitcoin and notes based on the cryptocurrency, Managing Director Laurent Kssis says “the last 30 days have been exceptional.” Trading records have been repeatedly broken “as the mainstream interest in bitcoin has been increasing.” Ryan Radloff, a principal at CoinShares, says he thinks “the next evolution of finance is just beginning and the recent rally in price reflects this.” What’s more, he expects prices to continue rising because there’s “a large number of investors” racing to get a piece of “this scarce asset.”

Eric Balchunas, an ETF analyst at Bloomberg Intelligence, says what’s going on in Sweden “shows two things. It shows the incredible demand to trade bitcoins in an ETN, exchange-traded note. The second thing it does, is it shows why the ETF structure rules.”

He also says “there’s no way this is all money from Sweden.”

JPMorgan’s CEO Would Fire Traders Who Bet on ‘Fraud’ Bitcoin

The average Avanza customer has 82,000 kronor of bitcoin, which on its own doesn’t threaten an individual’s financial health, Hemberg says. But every sixth bitcoin owner holds nothing else, and that’s a risk. He draws parallels to trading in biometric-sensor maker Fingerprint Cards AB, which soared more than 1,500 percent in 2015 but has slumped almost 90 percent since then.

“It’s a bit like being part of a sect, where everyone believes in the same instrument and where no one is saying ’no,”’ Hemberg said. “They’re trading 23 times more in bitcoin than in H&M shares today and I’m getting despondent. As a savings adviser, I want people to save, not speculate.”

Bitcoin Futures Trading Tumbles 93% as Day Two Begins: Chart

Total turnover in the Bitcoin Tracker One exchange-traded note was 2.73 billion kronor in November, up from about 177 million kronor in January, according to data from Nasdaq. It has surged further in December, with the average daily turnover at 504 million kronor compared with 124 million in November.

Hemberg says the craze is “absolutely” a bubble. That’s because bitcoin’s price doesn’t reflect the limited application, with only 17 stores in Stockholm actually accepting it as payment.

“I refuse to call this a currency,” Hemberg said. “That would make it sound serious, and it’s not, it’s just an instrument. You could just as well have people shopping with peanuts.”

@resteemator is a new bot casting votes for its followers. Follow @resteemator and vote this comment to increase your chance to be voted in the future!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.bloomberg.com/news/articles/2017-12-11/bitcoin-sect-stuns-online-broker-in-sweden-with-50-fold-jump