One of Japan’s largest cryptocurrency exchanges has halted all withdrawals amidst rumors of a large-scale hack. Ripple worth $123 million was withdrawn from its wallet on Friday January 26 along with a single withdrawal of 500 million NEM, with the altcoin’s foundation president Lon Wong then tweeting “It’s unfortunate that coincheck got hacked. But we are doing everything we can to help.” Upon news of the alleged hack surfacing, the price of NEM dipped sharply, leaving it down 19% in the past 24 hours.

Media Gather at Coincheck HQ

As media gather outside Coincheck’s Tokyo HQ, onlookers are trying to work out what’s happened to the exchange. The first signs that something was amiss emerged after $123 million of ripple was withdrawn as well as a transaction of 500 million NEM (XEM) worth around $600 million at the time. Shortly afterwards, the Japanese exchange announced that it had halted all withdrawals. The ripple receiving address already held a large XRP balance, and so the withdrawal may have been Ripple protecting its assets.

It has yet to be confirmed that the exchange has been hacked, despite a tweet from NEM’s president affirming as much. He later added that he didn’t think NEM should hard fork to freeze the stolen funds. In a blogpost today, Coincheck wrote: “Depositing NEM on Coincheck is currently being restricted. Deposits made to your account will not be reflected in your balance, and we advise all users to refrain from making deposits until the restriction has been lifted. We sincerely apologize for the inconvenience this has caused everyone.”

Japan’s Flagship Exchange Is on Lockdown

Coincheck later updated its blog post multiple times to announce firstly that it had halted the purchase and sale of NEM, then withdrawals of NEM, then all cryptocurrency purchases, and finally all payments by credit card and other fiat currencies. If it transpires that the NEM withdrawal was unauthorized, it would mean that around 5% of the total supply has been stolen. As a percentage of total supply – as well as in dollar terms – that would make the hack larger than that which befell Mt Gox in 2014, though the repercussions of today’s events will be more localized.

Since Coincheck started shutting down its operations early on Friday morning, 101 million XRP worth $123 million were moved followed by rumors of $600 million in NEM following suit. Given the subsequent tweet from NEM’s president Lon Wong, there would appear to be substance to these rumors. Founded in 2014, the same year that Mt Gox went bankrupt, Coincheck is one of Japan’s largest exchanges, with $631 million of cryptocurrency traded in the past 24 hours. In addition to facilitating the buying and selling of crypto, Coincheck encourages customers to use its online wallet to store their assets. This story will be updated as further details emerge.

UPDATE: Japanese news site Nikkei.com is claiming that Coincheck has reported $532 million of NEM to the Financial Services Authority and the police as having been stolen. There is no mention of the Ripple, which would appear to confirm that the XRP was withdrawn as a precautionary measure.

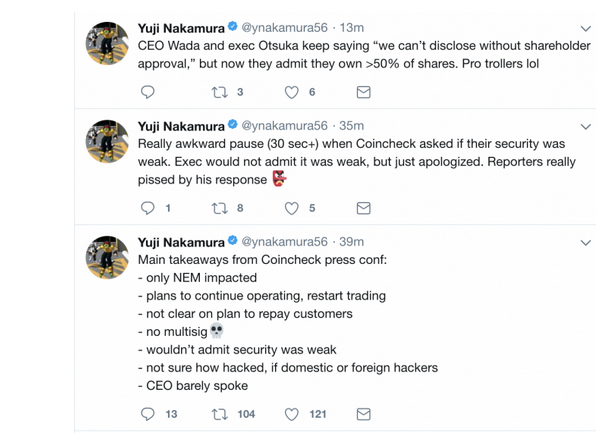

The NEM team have also released a statement saying “We will not hard fork to restore funds. The NEM blockchain is a transparent immutable ledger. We’re helping with tagging the stolen XEM and we’re relaying the affected addresses to exchanges.” The summary of a tech reporter who attended Coincheck’s press conference today is shown below.

Do you think NEM should perform a hard fork to freeze the stolen funds? Let us know in the comments section below.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin.com/coincheck-halts-operations-amidst-hacking-rumors-after-723-million-withdrawn/