In the recent months, I've seen an increasing adoption of the word HODL and its association with positive connotations in almost all crypto currencies. However, the problem lies within the behavior of self-rationalisation. Many individuals and investors attempt to rationalize their losses through the HODLing strategy. Sure, we're both aware that the crypto world is very resilient and are quick to recover from big damages. But, let me ask you one thing. What is your opportunity cost for HODLing?

Two days ago, I moved all of my cryptos into FIAT at $2.8k/BTC. And yesterday, I wrote an article detailing my short strategy for the coming week. Needless to say, My shorts have already netted me more than $300 per BTC, and this does not include my opportunity to buy those sold Bitcoins at a much lower price.

So, if you are a HODLer and didn't take any action in times of these opportunities. Tell me. How much did you REALLY lose?

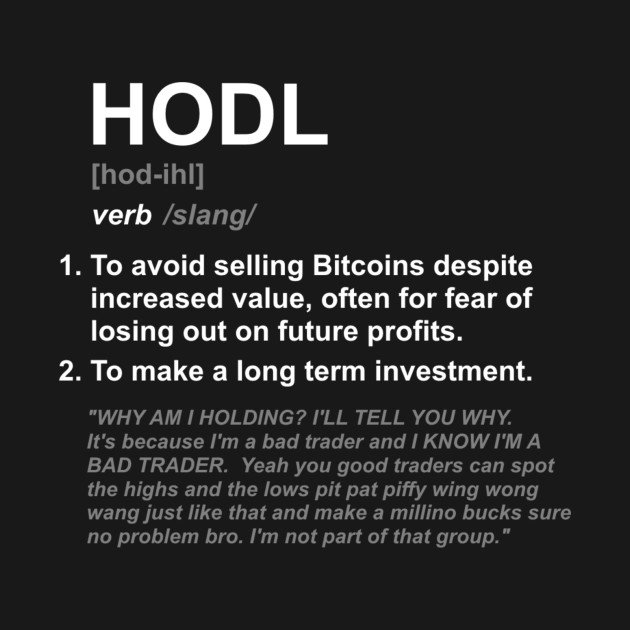

Don't get me wrong, I believe that HODLing is a great strategy in most cases. In a highly volatile market where the price movements are unpredictable and frequent, it is often wise to ignore micro-volatility, and HODL the coin. However, do not fall into the trap of self-rationalisation bias, and understand the significance of the opportunity costs in your HODL strategy.

The problem with getting in and out of crypto-currencies is that the door way is really small. So HODL has an advantage there too.

Since we know we are at the beginning of block-chain adoption.

And we believe that it will be the future.

Then the trend is very bullish.

So, sitting and holding is just a good safe bet.

At any time in the near future, a number of shocks to the ancient financial system could happen sending billions to try to get through the tiny door into cryptos. At that time, HODL will be the only winners.

If your circumstance is such that you aren't able to freely exchange your funds in and out of BTC, HODLing would indeed be much efficient. However, using any of the major exchanges would solve your problem with ease. You should check out Bitfinex. This is the exchange that I use, and I'm loving it!

I also believe that the long term trend is very bullish. However in times of uncertainty like the past 2 weeks, and the upcoming week, there are lots of volatility that give rise to multiple opportunities. Please do not forget that you're losing heaps on opportunity costs!

If you're a new investor, HODLing would indeed be the best strategy, and even as an experienced trader I am a HODLer too! But I make sure to take opportunities in times of volatility. There are so much money to be made, that would be lost if appropriate actions aren't taken.